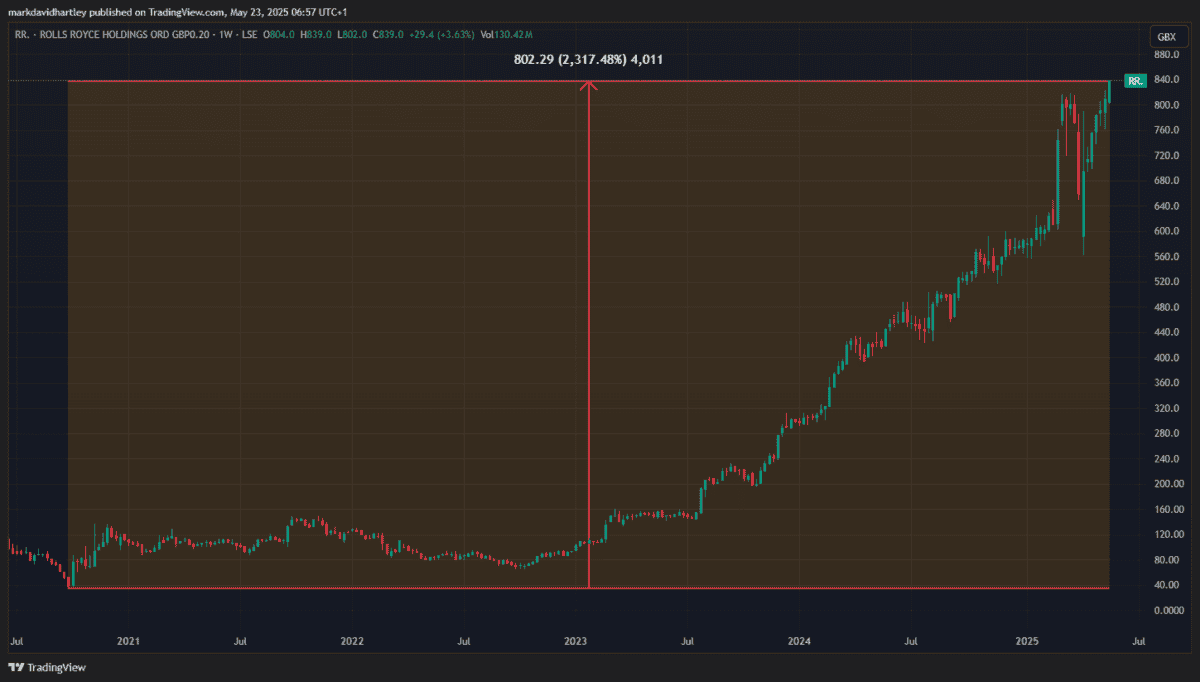

When the pandemic first struck in early 2020, Rolls-Royce shares took a sharp plunge. Like many at the time, the aerospace engineer’s price collapsed — falling from 244p to 35p within a matter of months.

Looking at today’s price, it’s almost unbelievable to think it was that low just five years ago. At the time, airlines were grounded the world over and panicked shareholders were dumping stock by the barrel.

But among them were undoubtedly some savvy investors, the kind who take to heart the advice of legendary investors like Warren Buffett: “Be fearful when others are greedy, and greedy when others are fearful.”

A brave soul who grabbed the opportunity to buy the shares back then would be very happy with their returns today. The stock — now trading at around £837p — is up by over 2,300% since the lowest point during Covid.

As little as £1,000 invested at that level would now be worth an eye-watering £24,170 — equating to an annualised return of approximately 90% per year!

Sadly, I was not one of those investors. So, have I missed out entirely, or will another opportunity arise?

Hunting undervalued stocks

Rolls-Royce has made a spectacular recovery but I don’t expect it to gain another 2,000% by 2030. To capitalise on today’s market, I must find another undervalued stock on the brink of a multi-year long rally.

Here are four core ratios that can help investors identify undervalued stocks with growth potential:

- Price-to-earnings (P/E)

- Price-to-book (P/B)

- Enterprise value to EBITDA (EV/EBITDA)

- Price-to-earnings growth (PEG)

Ideally, the P/E ratio should be below the UK market average — usually about 15. Both the P/B and PEG ratios should be below 1 and the EV/EBITDA below 10. These are not hard and fast rules — and they differ based on which industry the company is in — but it’s a good starting point.

A winning combination

When applying these filters to a stock screener, one FTSE 250 company stands out to me: TP ICAP (LSE: TCAP). This leading UK-based financial services firm specialises in interdealer broking, market infrastructure and data solutions.

With a market cap of £1.98bn, it’s big enough to be considered stable while small enough to still enjoy decades of growth. It has moderate P/E and P/B ratios of 12.25 and 0.98, respectively, and a decent EV/EBITDA ratio of 4.17. Most promisingly, it has a very low PEG ratio of 0.1, suggesting earnings growth far ahead of its price.

But its fortunes could still be derailed. Since Brexit, the UK has become less attractive as a financial hub, leading to a decline in over-the-counter interest rate derivatives trading. Now, TP ICAP lags behind US competitors like BGC in terms of revenue growth and broker productivity. If this trend continues, TPICAP may need to innovate to stay in the game.

To meet this challenge, it has considered listing its data division, Parameta Solutions, in New York. However, mitigating factors have delayed the IPO.

Despite these risks, I still think it shows signs of promising growth potential. With strong fundamentals and a winning combination of ratios, I believe it’s one of the best UK stocks to consider today for long-term growth.