Several investors have been looking to gold recently as a way of protecting their wealth. But I’m still focusing on growth stocks – especially ones trading at unusually cheap prices.

Even in a volatile stock market, there are two reasons I prefer shares in businesses over gold. And that’s especially true with where things are at the moment.

Gold

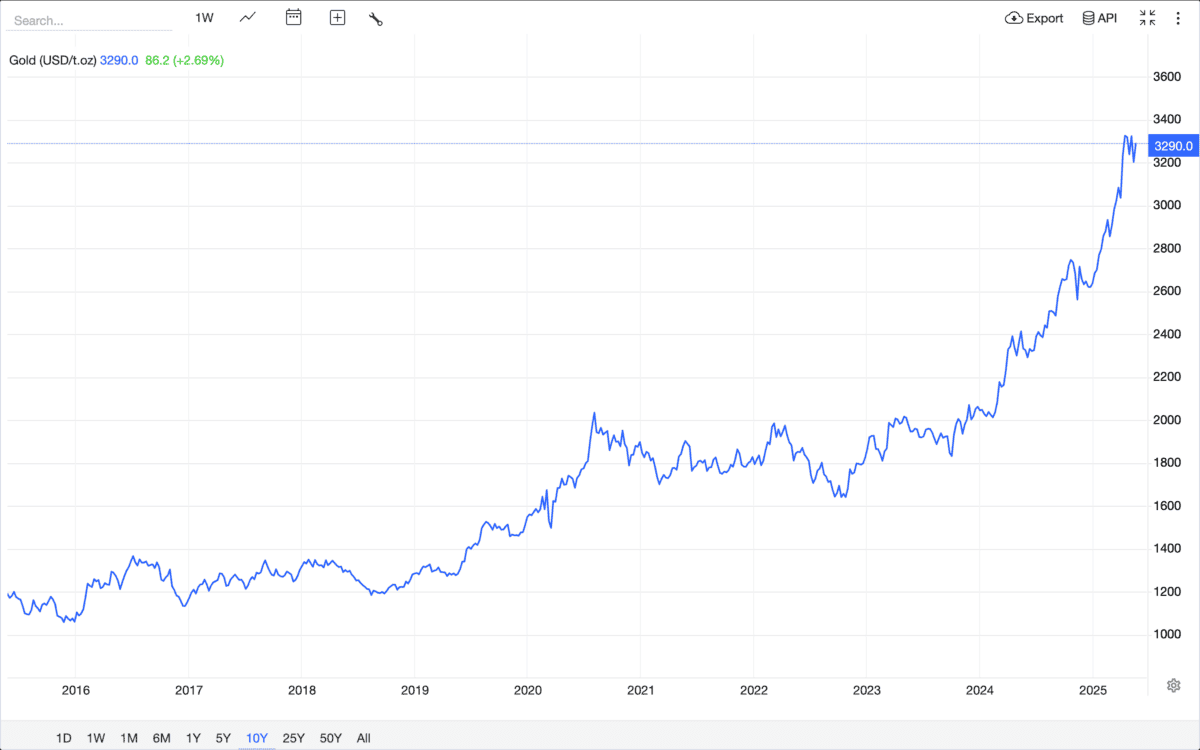

One reason I’m staying away from gold at the moment is that it doesn’t look like the right time to buy it. Prices are at their highest levels in a decade, which isn’t particularly encouraging.

Source: Trading Economics

By itself, that’s not a great reason – the gold price was unusually high last year, yet it’s up almost 37% since then. But it’s not just me who thinks it’s not a great time to be buying what’s undeniably a safe-haven asset.

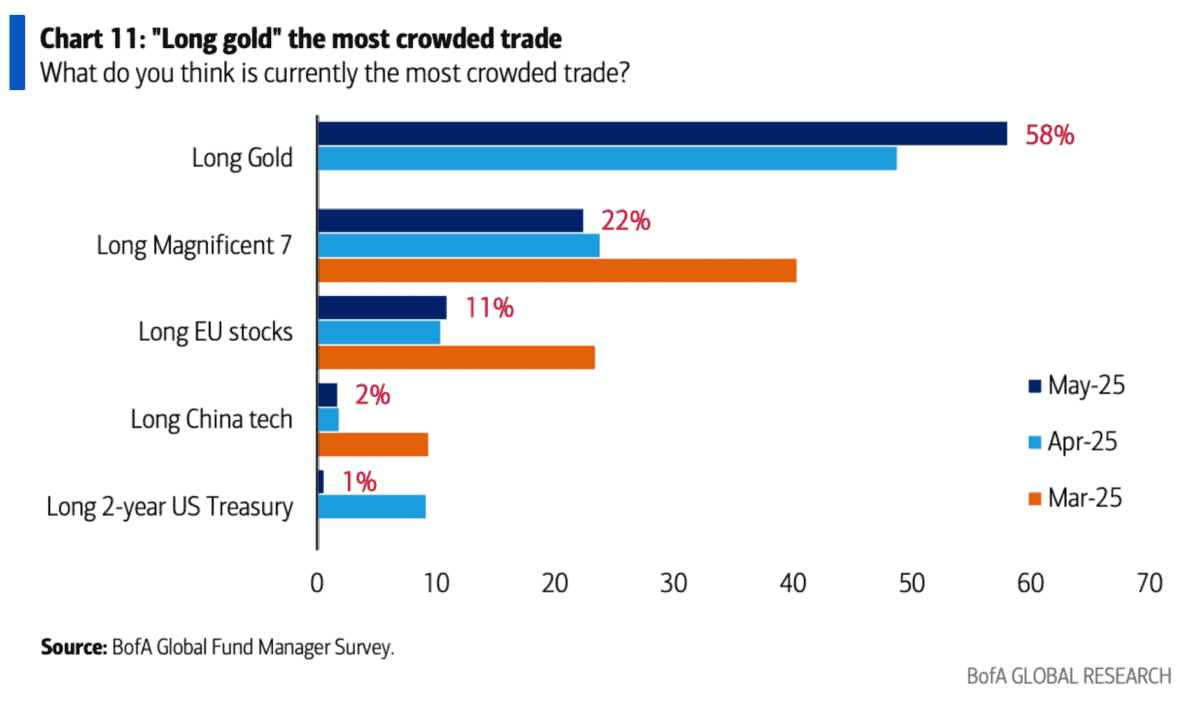

According to the latest Bank of America fund manager survey, ‘long gold’ is the most crowded trade at the moment. In other words, the professionals think there’s too much money already invested.

That wasn’t the case back in May 2024 – the consensus was that ‘long Magnificent Seven’ was the most crowded trade. And this speaks to another reason I tend to stay away from gold.

The only way to make money by investing in gold is by selling it to someone else. But that requires someone else to be willing to buy it – and that’s risky in a trade that already looks crowded.

With shares however, the underlying businesses can return cash to shareholders without them having to sell. And in the case of growth stocks, these distributions can increase over time.

Stocks

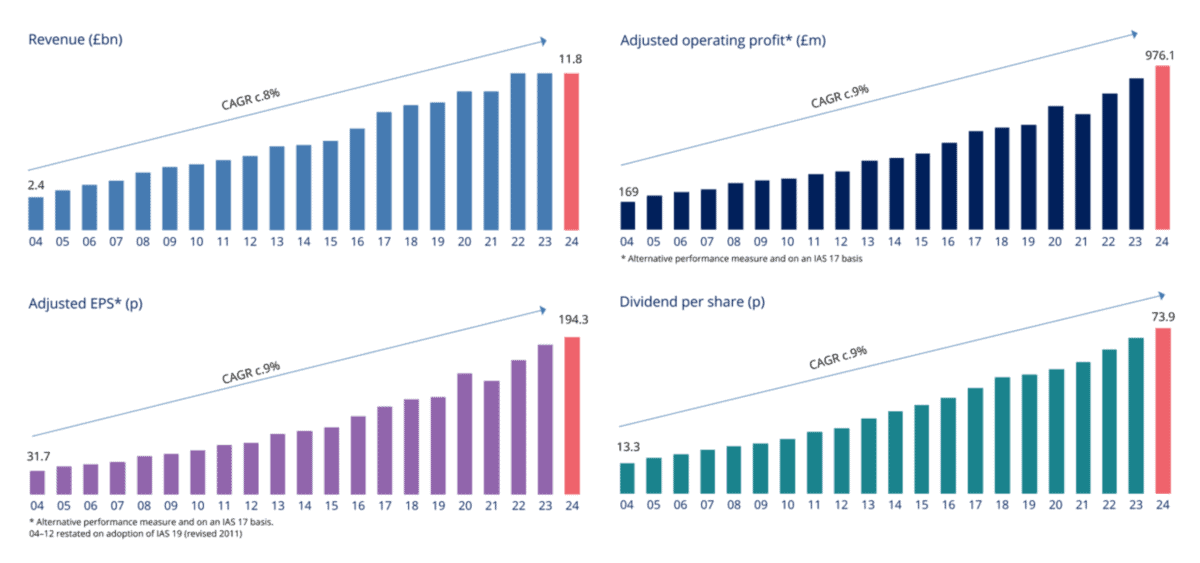

One example that I’ve been buying for my portfolio recently is Bunzl (LSE:BNZL). The company has increased its dividend per share each year for over three decades.

Source: Bunzl Website

A track record like that generally doesn’t go unnoticed and it’s rare to find the stock trading at a bargain price. But I think right now looks like a rare opportunity.

The Bunzl share price has fallen almost 25% since the start of the year. And that’s caused the dividend yield to get close to 3% as a result.

A set of poor Q1 results has caused the share price to fall. Part of this is due to the uncertainty around US trade policy, which is an ongoing risk for a firm that generates most of its sales across the Atlantic.

To some extent, a pessimistic outlook is reflected in the current share price. In its update, Bunzl reduced its revenue and profit guidance for the year and suspended its ongoing share buybacks.

Despite this, the firm did manage to increase its dividend. And it’s worth noting that company insiders and directors have been buying the stock after it fell following the weak Q1 report.

Long-term investing

In the short term, there’s nothing to say the price of gold can’t keep going higher. And it might outperform the stock market again in 2025.

Over the long term though, I think there’s a much better chance with shares. Especially ones that can keep growing while returning cash to shareholders along the way.

Bunzl is just one example – there are plenty of others that are worth considering. But right now, it’s the stock I’m looking to keep buying for my portfolio.