Tesla (NASDAQ: TSLA) stock is no stranger to volatility. The electric vehicle (EV) giant’s shares have experienced dramatic swings over the years, with investors oscillating between exuberance and caution.

Recently, Tesla’s stock has declined by around 15% year to date, although it’s been anything but straightforward. But when you dig into the fundamentals, the correction is hardly shocking.

Tesla’s unrelenting valuation

Tesla’s valuation metrics are huge, even by tech and growth stock standards. The company trades at a forward price-to-earnings (P/E) ratio of 179.7 times, which is nearly 1,000% higher than the sector median of 16.8. Its enterprise value-to-EBITDA (earnings before interest, tax, depreciation, and amortisation) ratio stands at 76.3 times, dwarfing the sector median of 9.9 by over 660%. Other multiples, like price-to-sales and price-to-book, are similarly stretched, consistently showing Tesla’s premium valuation relative to its peers.

Such lofty multiples reflect sky-high expectations. Investors are betting on Tesla’s ability to revolutionise transportation, and dominate new markets like robotics, energy storage, and autonomous vehicles. However, at these valuation multiples, if execution undershoots expectation, the stock could collapse.

Tesla’s autonomous driving and robotics arms have seen major developments in 2025. The company’s Full Self-Driving (FSD) ‘Supervised’ system now enables near-complete hands-off driving under human oversight, with regulatory approval for highway autonomy in Europe expected by September. Even the autopilot in my Tesla appears to be fairly competent. Meanwhile, Tesla’s much-anticipated robotaxi service is set to launch in Austin.

On the robotics front, Tesla’s Optimus humanoid robot continues to show progress in advanced agility and is set for mass production, with 5,000 units targeted this year and external sales planned for 2026.

Growth prospects and mixed signals

Tesla’s consensus earnings growth estimates paint a volatile picture. Analysts forecast a 21% earnings decline in 2025, followed by a sharp rebound with growth rates of 51% in 2026, 28% in 2027, and 53% in 2028. This roller-coaster outlook reflects several uncertainties. Sales of its EVs are plunging as the Tesla brand gets dragged into politics. However, autonomous driving really could be the game changer.

While Tesla’s market cap remains above $1trn and it boasts a strong net cash position of $23bn, the path to sustained profitability and margin expansion is far from guaranteed. The company’s ability to innovate and scale efficiently will be critical. But there are other factors at play. These include inflation, interest rates, tariffs, and geopolitics.

Why a correction isn’t surprising

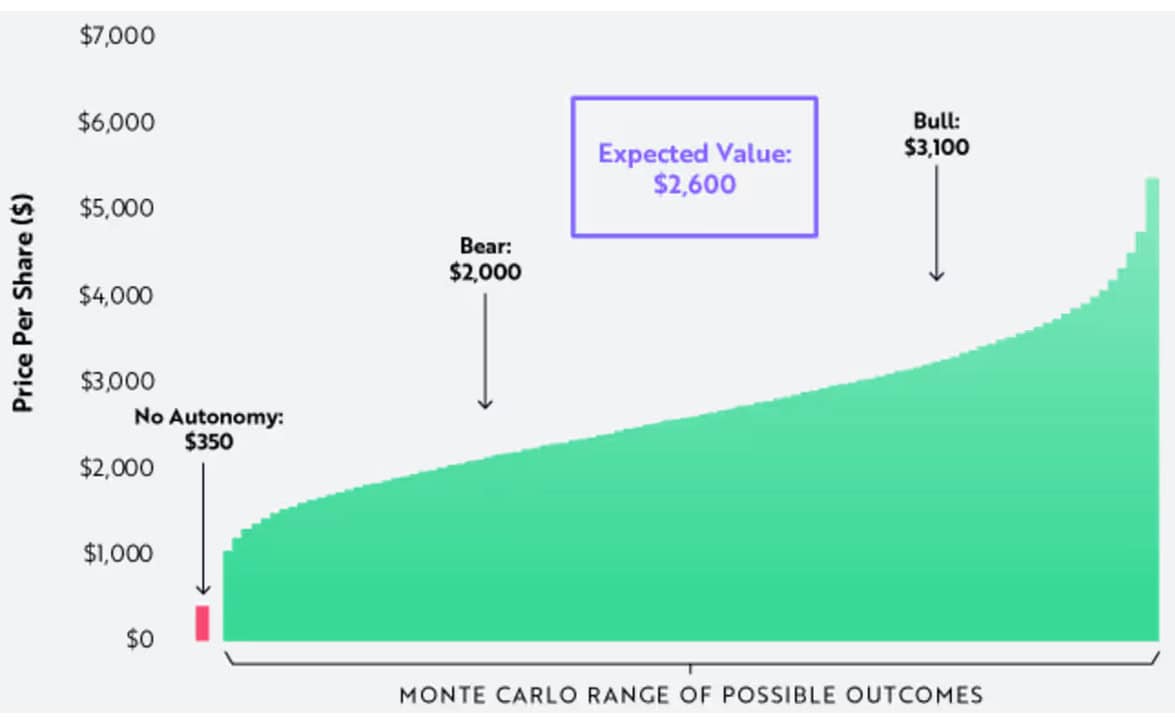

Given Tesla’s astronomical valuation and mixed near-term growth outlook, a correction was arguably overdue. However, a further drop in the current share price is still very likely. I’ve seen forecasts suggesting the stock could plummet by 75% if investors start to lose patience.

For long-term believers who trust in Tesla’s vision and leadership, the stock may look like great value right now. Just ask Cathie Wood. But for those focused on valuation discipline and risk management, patience and caution are warranted.

Personally, Tesla falling again wouldn’t surprise me. I want to see the company succeed, but I’m not investing at the current price.