I think these UK-listed dividend shares are among to the most interesting passive income stocks at present. As an added bonus to investors, I feel they also offer good value for money.

Here’s why I see them as worth consideration right now.

JPMorgan Claverhouse Investment Trust — for extra security?

It’s important to remember that dividends are never, ever guaranteed. Even the most dependable dividend stock can deliver poor returns from time to time.

The JPMorgan Claverhouse Investment Trust (LSE:JCH) helps reduce some of this risk. By spreading investors’ capital across 60-80 different companies — and with a focus on stable large-cap UK shares too — it can provide a solid second income, even when one or two companies dividend shares disappoint.

Claverhouse has more than proved this robustness over time, with dividends rising every year since the early 1970s.

Today, the investment trust carries a market-beating 4.8% dividend yield. It also trades at a 5.7% discount to its net asset value, meaning it offers tasty all-round value.

However, a focus on British stocks leaves it more vulnerable to regional shocks, but I still think it’s a dividend share to consider.

Legal & General — large yields and consistent growth?

At 9.1%, Legal & General (LSE:LGEN) shares carry one of the largest dividend yields on the FTSE 100 today.

Investing in high-yield shares can sometimes attract trouble for investors. Super-sized dividends can indicate a company that’s doling out unsustainable dividends to mask other problems.

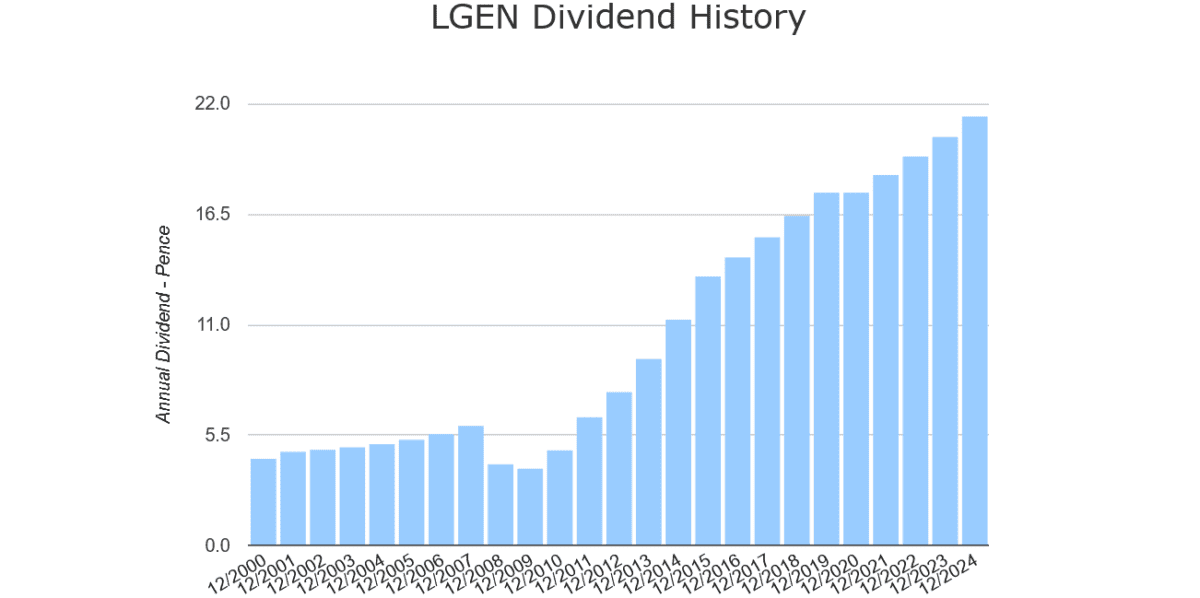

Yet this is far from the case with Legal & General. Dividends have grown every year (bar 2020) since 2009. And they’ve offered market-leading yields since then:

Past performance isn’t a reliable guide to future returns. But I’m expecting the business to remain a top passive income share over the long haul. Despite competitive threats, it has substantial scope to grow earnings as demographic changes drive demand for retirement and wealth products.

The financial services giant also has robust financial foundations to keep paying large and rising dividends. Its Solvency II capital ratio was a stunning 232% as of December.

Legal & General shares currently trade on a price-to-earnings (P/E) ratio of just 10.4 times. Their corresponding price-to-earnings growth (PEG) multiple is at 0.1 too, below the accepted value watermark of 1.

At current prices, I think it’s good and should at least be considered.

Vodafone — value for money?

Across a wide variety of metrics, I also believe Vodafone‘s (LSE:LGEN) one of the FTSE 100’s value shares worth looking at.

A contrarian pick maybe, but like Legal & General, its forward dividend yield sails past the 3.7% average for UK blue-chip shares, at 6.4%.

The telecoms titan also looks like a bargain based on expected profits. Its P/E ratio for 2025’s an undemanding 9.4 times, while its corresponding PEG reading’s 0.8.

Finally, Vodafone’s price-to-book (P/B) ratio, at 0.3, also sits below the value yardstick of 1. This indicates it trades at a discount to the value of its assets.

It’s important to note that Vodafone cut dividends last year to rebuild its balance sheet. And debt levels remain high. But I’m optimistic that payouts can recover over time as restructuring to cut costs and boost earnings rolls on. Surging sales in its African markets should also support rising dividends.