Food retailers can be a reliable source of passive income through good times and bad. Broadly speaking, the stable nature of grocery spending gives companies like Tesco (LSE:TSCO) the means and the confidence to pay healthy dividends on their shares.

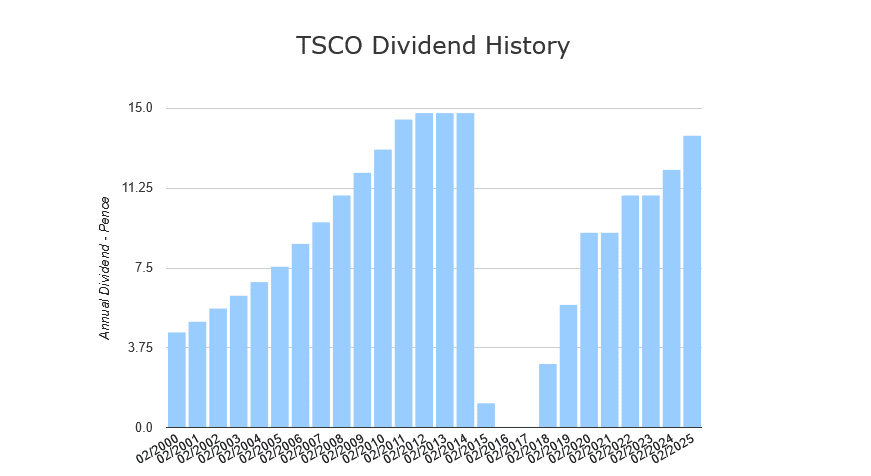

Things haven’t been quite as smooth at the FTSE 100 supermarket over the past decade however. Ordinary dividends were suspended for a couple of years during the mid-2010s as Tesco dealt with heavy restructuring and accounting issues.

But since returning at 3p per share in the financial year to February 2018, cash rewards have risen sharply and totalled 13.7p in fiscal 2025.

With the trading landscape becoming more challenging, can dividends on Tesco shares continue climbing though? And should I consider buying the FTSE company for my portfolio?

Stop-start

While dividends have risen sharply from levels seen six years ago, it’s important to note that payouts haven’t grown each year, as the chart shows:

They were frozen in financial 2021 as Tesco faced uncertainties, and again two years later as the grocer invested heavily to make its prices more competitive.

Annual dividends have risen since then, including last financial year when they were hiked 13.2%. But the stop-start nature of Tesco’s progressive dividend policy is tipped to continue by City analysts:

| Financial year | Dividend per share | Dividend growth | Dividend yield |

|---|---|---|---|

| 2026 | 13.7p | 0% | 3.8% |

| 2027 | 15.1p | 10.2% | 4.1% |

| 2028 | 16.1p | 6.6% | 4.4% |

Solid, if unspectacular

A predicted freeze this year means the dividend yield on Tesco’s shares matches the FTSE 100’s forward average of 3-4%. However, expected dividend growth in fiscals 2027 and 2028 nudges yields above these levels.

In further good news, I believe these forecasts look achievable based on predicted profits. Expected payouts are covered 2 times over by estimated earnings, which is bang on the widely regarded security benchmark.

On top of this, the supermarket’s balance sheet isn’t looking too stretched. This could give it scope to match the City’s dividend projections even if earnings wildly miss their mark.

Net debt fell 2.4% to £9.5bn at the end of February. This gave it a net-debt-to-EBITDA ratio of 2 times, which is reasonable if not outstanding.

Should I buy Tesco shares?

All this being said, I’m not convinced about buyingTesco shares for passive income. While I’m not expecting a dividend cut, I think intensifying price wars in food retail could compromise future dividend growth.

In recent weeks, Asda announced plans to use its “pretty significant war chest” to invest in prices, prompting Tesco and fellow Big Four grocer Sainsbury’s to promise the same. German discounters Aldi and Lidl — which also continue to expand their store estates — are likely to cut their own prices further too in response.

As mentioned, Tesco’s dividends have been frozen before (in financial 2023) as the firm reallocated capital to reduce its price tags. The longer the cost-of-living crisis goes on, the more pressure supermarkets will be under to invest in prices too.

My fear is that the subequent impact on margins and profits could damage Tesco’s share price as well as its dividends.

On the plus side, the company’s ultra-popular Clubcard rewards programme should reduce the threat from competitors. But on balance, I’d rather look for other dividend shares to buy right now.