Investing in a range of FTSE 100 dividend shares can help deliver a more robust passive income over time.

With fresh trade tariffs threatening the global economy, a wide range of UK shares face profit shocks that could substantially impact dividends. Holding a wide range of shares can help investors navigate this uncertain outlook by spreading out the risk.

Bearing this in mind, here’s a collection of FTSE-listed shares that could provide strength through diversification and deliver an index-beating second income.

The magnificent seven

| FTSE 100 stock | Sector | Forward dividend yield |

|---|---|---|

| Legal & General | Financial services | 9.2% |

| GSK | Pharmaceuticals | 4.7% |

| Aviva | Financial services | 7% |

| Segro | Real estate investment trusts | 4.5% |

| Reckitt Benckiser | Household goods | 4.5% |

| Phoenix Group | Financial services | 9.5% |

| BAE Systems | Defence | 2.1% |

Thanks to some truly gigantic dividend yields, the average yield across these seven blue chips is 5.9%. This comfortably beats the Footsie average of 3.7%, and means that someone who invested £20,000 evenly across them today could enjoy a £1,180 passive income this year alone.

As I say, dividends are by no means guaranteed. But this portfolio’s exposure to multiple sectors could help it weather any sector-specific earnings shocks. What’s more, a mix of cyclical and defensive UK shares provides strength as well as the potential to deliver strong long-term income growth.

Financial services businesses Legal & General, Aviva, and Phoenix Group could suffer earnings issues if trade tariffs sap consumer spending power. Yet Solvency II capital ratios above 200% mean provide dividend forecasts with steel.

I think these insurance, wealth management, and retirement services providers will deliver strong dividend growth over the longer term, too. This will be driven by demographic changes and the growing importance of financial planning that boost these companies’ sales.

Strength in depth

I think those other FTSE 100 shares, meanwhile, provide a supreme blend of both stability and dividend growth potential. BAE Systems and GSK both operate in defensive industries that are broadly immune from macroeconomic conditions.

What’s more, both of their markets are primed for impressive long-term growth. I’m expecting them to remain solid dividend payers despite the danger of supply chain issues and testing setbacks at the drug development stages, respectively.

Reckitt Benckiser, meanwhile, faces substantial competition from other fast-moving consumer goods (FMCG) manufacturers. But the star power of many of its labels (like Nurofen and Durex), combined with its broad geographic footprint, provides significant robustness.

A FTSE 100 favourite

Segro is a FTSE 100 dividend share I’m considering adding to my own portfolio today.

As a real estate investment trust (or REIT), it’s required to pay out at least 90% of annual profits from rental operations out in cash. This is in exchange for tax breaks, and can make them reliable passive income stocks over time.

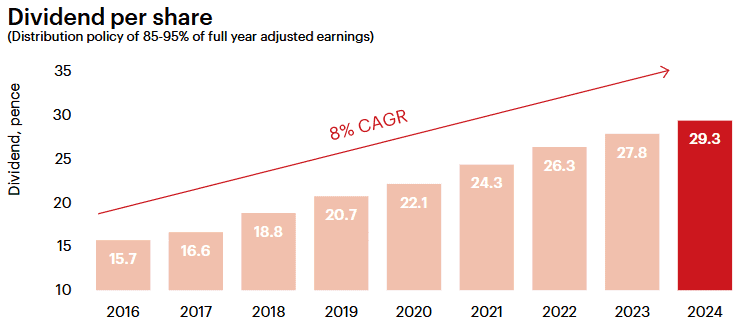

As the chart shows, dividends here have grown sharply each year since the mid-2010s. I’m confident it can continue doing this, supported by its cross-sector exposure, its long tenancy agreements, and a strong balance sheet.

Segro’s loan-to-value (LTV) ratio sits at just 28%, latest financials show.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

It’s true that overall earnings are vulnerable to interest rate increases. Segro’s share price has suffered more recently as borrowing costs have risen and net asset values (NAVs) have dropped.

But on balance, I think it’s a top dividend share to consider in these uncertain times.