Looking for ways to capitalise on gold‘s continued bull run? Here are two top exchange-traded funds (ETFs) I think demand close attention.

The price tracker

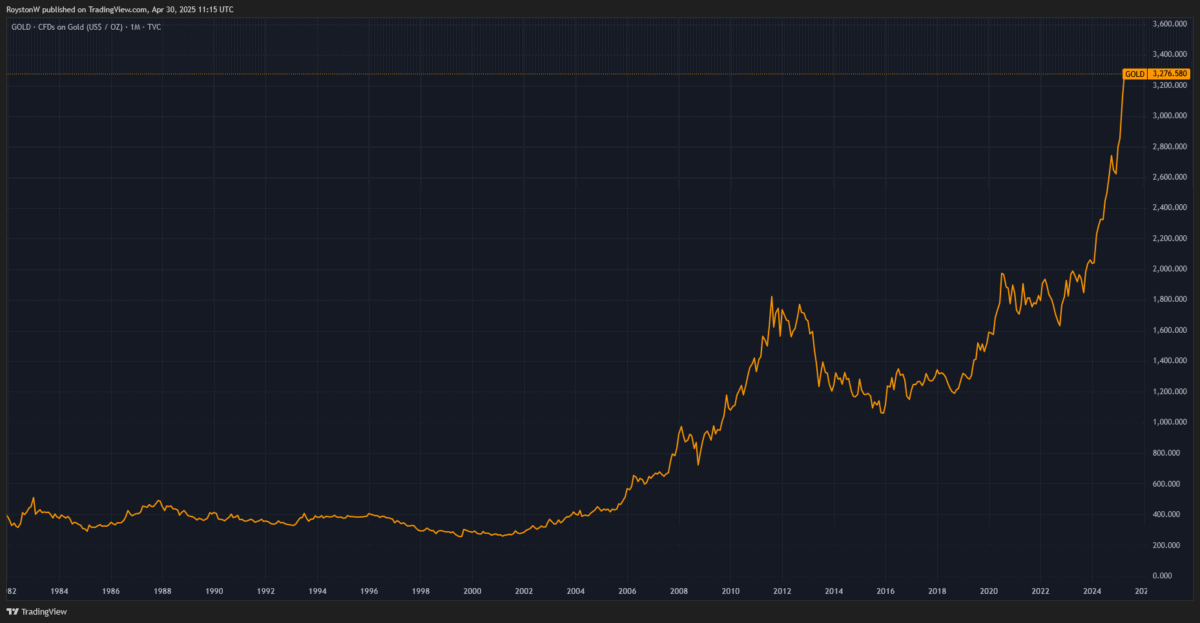

Gold prices reached record peaks above $3,500 per ounce on 22 April, but have since retraced to around $3,276.38. Yet gold is still up around 25% this year, and looks (in my view) in good shape to rise again after recent profit taking.

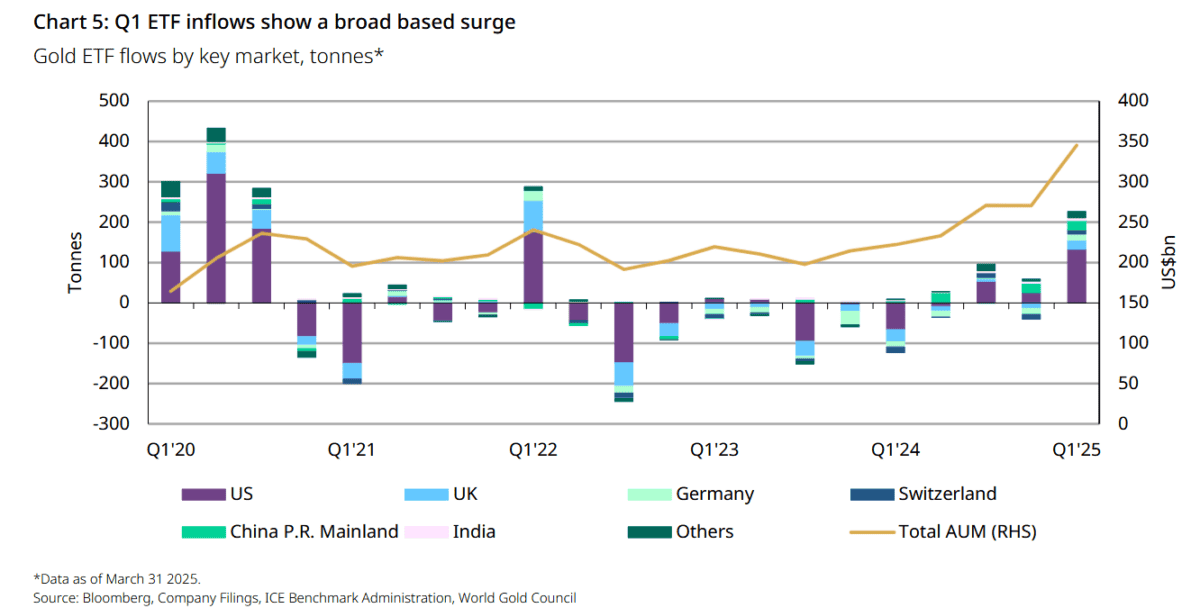

Inflows into gold-backed ETFs like the iShares Physical Gold ETF (LSE:SGLN) have been a key factor behind the bullion’s price jump this year. According to World Gold Council data, global holdings jumped 226 tonnes during the first quarter. This took total ETF holdings to 3,445 tonnes in March — a near-two-year high.

The WGC’s predicted “continued momentum in gold ETF flows” for the rest of 2025 too, “on risks of stagflation and recession, and ongoing geopolitical and trade tension“.

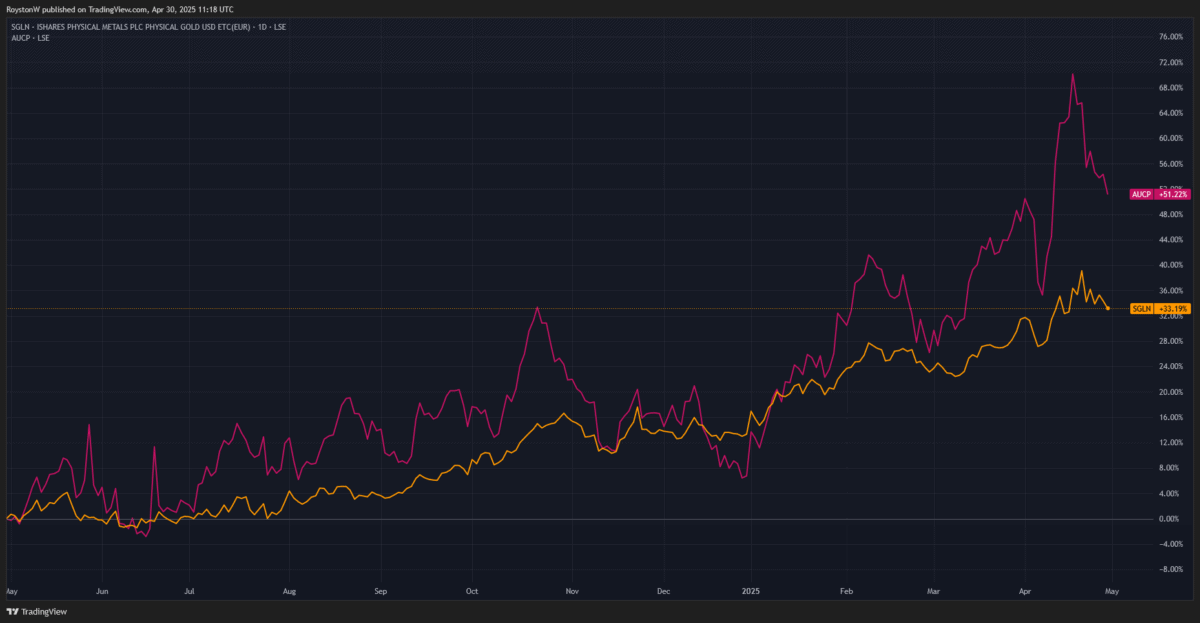

So funds like iShares Physical Gold remain top assets to consider in May. I like this particular fund, the UK’s largest with net assets of £16.9bn, as it also has one of the lowest ongoing expense ratios in the business (at 0.12%).

In the past five years, the fund has delivered an average annual return of 14%. I think this could pick up worries over the economic and political landscape mount, and the US dollar likely weakens still further, making buck-denominated assets more cost effective to buy.

Remember though, that there are no guarantees. For instance, an improvement in investor confidence that spurs rotation into riskier assets (like shares and cryptocurrencies) could weigh on safe-haven gold values.

The gold mining ETF

Investors with a high tolerance for risk may wish to consider a fund that tracks the performance of gold miners instead. This is a route I’ve gone down as I recently added the L&G Gold Mining UCITS ETF (LSE:AUCP) to my Self-Invested Personal Penson (SIPP).

Unlike a basic price-tracking fund, ETFs like these leave holders exposed to the dangers associated with gold mining operations. These include production disruptions, adverse currency fluctuations and political challenges in key mining areas.

Yet while involving greater risk, mining funds can also deliver far better returns, as a small gold price increase can lead to a much greater rise in company profits. Performance is also boosted by miners’ dividends, which are reinvested to achieve further growth.

This particular L&G product has delivered an average annual return of 18.9% during the last five years, beating that iShares gold price tracker described above.

By investing in 34 different miners, the fund reduces the impact of challenges impacting one or two companies on overall returns. It also holds some of the best (in my opinion) bullion producers in the business like Agnico-Eagle, Newmont and AngloGold Ashanti.

The ongoing charge of 0.55% is higher than that of most ETFs that track the gold price. But I believe the potential for more superior returns make this a price worth considering.