The FTSE 100‘s constant see-sawing means many quality blue-chip stocks still trade at rock-bottom prices. Here are two I think investors searching for shares to buy in May should seriously consider.

Despite the threat of further turbulence in the weeks and months ahead, I think they could deliver terrific returns over the longer term.

Babcock International

Demand for defence stocks continues surging despite the threat of supply chain and cost issues as trade tariffs go up. According to WisdomTree, its dedicated European defence exchange-traded fund (ETF) launched in March has already surpassed $1bn in assets under management (AUMs). Its constituents like BAE Systems, Rolls-Royce and Rheinmetall have significant scope to grow earnings as continental arms spending ramps up.

Likewise, FTSE 100 industry giant Babcock International (LSE:BAB) has substantial growth potential. But I don’t think this is reflected in the cheapness of its shares.

At 782p, its shares trade on a forward price-to-earnings (P/E) ratio of 14.8 times. This makes it one of the cheapest blue-chip defence companies out there.

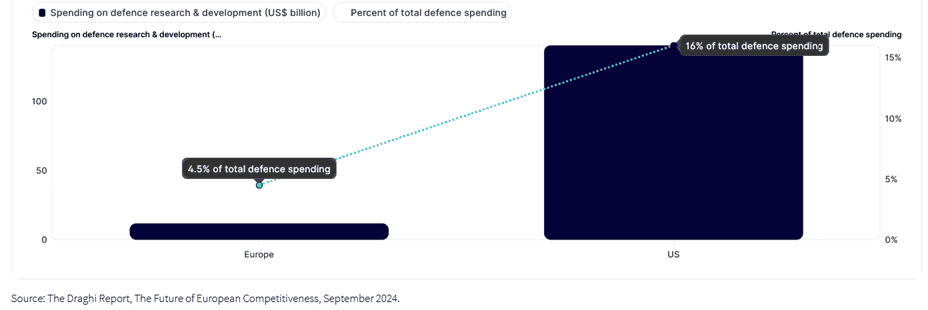

The engineer faces stiff competition from those sector giants I mentioned above. But it still has a once-in-a-generation opportunity increase earnings as European nations vow to narrow the gap between their own spending and that of the US.

As the chart below shows, the gap between these historical allies is vast:

Babcock — which generates around three-quarters of revenues from the UK and also sells to continental neighbours including France and Ireland — is already thriving in this favourable climate. Revenue and underlying profit leapt 11% and 17% respectively in the 12 months to March. I expect it to continue performing strongly.

Scottish Mortgage Investment Trust

Tech stocks have had a rough ride more recently, pushing Scottish Mortgage Investment Trust‘s (LSE:SMT) share price sharply lower.

At 871p per share recently, the tech trust has fallen sharply from its 2025 highs of £11.43 punched in February. As a consequence, it trades at an 8.9% discount to its estimated net asset value (NAV) per share.

Now I’m not saying the storm’s passed for trusts with exposure to US tech like this. This year’s troubles haven’t all been about tariffs. The growing threat of Chinese companies has also been on full display (think Deepseek’s disruptive threat in artificial intelligence (AI), for instance, and electric carmaker BYD‘s sales outstripping those of Tesla).

Yet despite these dangers, I think Scottish Mortgage still has enormous long-term potential. The 96 companies it holds, including Amazon, Meta and Cloudflare, provide myriad ways for investors to capitalise on the booming digital economy. And it’s not overly reliant on any one stock or sector to perform.

I also like Scottish Mortgage because it holds many private companies that I wouldn’t ordinarily be able to invest in. These include Elon Musk’s SpaceX and fintech giant Stripe. In theory, these smaller businesses could have greater growth potential than those better-known tech names.