As I write (29 April), Jet2 (LSE:JET2) shares are up 8% over 12 months. However, it’s been anything but a steady incline. The stock has come under pressure from several angles including Labour’s autumn Budget and the potential fallout from Donald Trump’s global tariff policy. In fact, the stock is only up over the period after a positive trading report boosted the stock. As such, £10,000 invested in Jet2 shares 12 months ago would now be worth around £10,800 plus, around £100 in dividends.

What’s been going on at Jet2?

As noted above, Jet2 shares surged on some good news this week. The leisure airline announced a £250m share buyback and issued a robust trading update. For the year ending 31 March, Jet2 expects profits between £565m and £570m. That represents a 9% year-on-year increase and is in line with analyst forecasts.

The company ended the period with a strong cash position of £3.2bn, including £1.1bn in “own cash” (excluding customer deposits). Notably, Jet2 also repaid a £387.4m convertible bond early, removing dilution risk for shareholders.

According to management, demand for summer 2025 looks promising, with capacity up 8.3%. That’s helped by new bases at Bournemouth and London Luton. However, the company notes customers are booking later, making future trends harder to predict.

Package holiday and flight-only prices are both up, offsetting higher costs. While Jet2 is well-prepared for peak season, management remains cautious on forward guidance due to ongoing economic and geopolitical uncertainties. The company had previously guided that the firm would take a £25m hit from the autumn Budget.

It’s really, really cheap

Jet2 boasts a strong balance sheet, underpinned by robust cash reserves and prudent financial management. The company still uses debt, but uses it very sparingly, with the company’s net cash position sitting at £2.3bn. That’s huge when we compare it to the market cap of just £3bn.

Earnings forecasts remain positive, with net income expected to rise from £399m in 2024 to £430m in 2025, and further growth projected in subsequent years. Revenue is also forecast to climb steadily, reaching over £7.2bn in 2025. These figures also point to a net cash-adjusted price-to-earnings (P/E) ratio of 1.7.

Margins are set to remain resilient, and return on equity is projected to stay above 27%, underscoring Jet2’s profitability and operational efficiency. This financial strength positions Jet2 well for continued expansion and shareholder returns.

Plenty to unpack

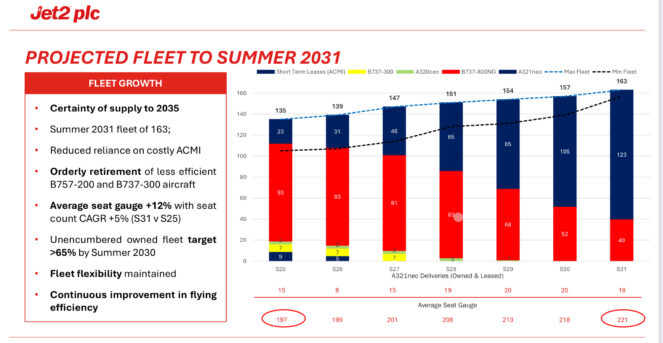

I’ve often wondered why investors are a little shy of Jet2. One reason may be its fleet, which is a little older than some of its peers. It’s also investing in a significant fleet overhaul programme. Of course, such a programme requires a lot of capital. But the plans do seem prudent, with only a small proportion of revenue going towards the purchases.

Personally, I believe Jet2 to be one of my best investments. It’s phenomenally cheap, and it’s operating in a market with plenty of supportive trends, including very robust demand for travel. My concerns? Well, margins are narrower than the likes of IAG and that means it can be more susceptible to demand shocks or even higher duties and taxes. Nonetheless, I’d consider buying more if it wasn’t already one of my biggest holdings.