The minimum holding period I have in mind when I buy FTSE 100 (or any) stocks is at least five years. That doesn’t mean I won’t sell before if something goes wrong (competitive pressures, fraud, adverse regulation, etc).

Conversely, when things go well, I’m willing to hold indefinitely. Here are two Footsie growth stocks I’ve owned for years, but that I currently intend to keep holding till at least 2030.

Footsie newbie

At first glance, Games Workshop (LSE: GAW) might not seem like a growth stock. The company sells tabletop wargames, notably Warhammer, and associated miniatures. It has been doing so for decades.

However, the fact that the stock’s up nearly 200% in five years and now a member of the FTSE 100 index tells its own story.

The company’s fundamentals are elite level. It sports a 40% operating margin, generates an incredibly high return on capital, and possesses a pristine balance sheet. With so much surplus cash sloshing about, dividends are often generous.

In March, Games Workshop said trading had been excellent in January and February, giving it confidence that pre-tax profits for the full year (ending 1 June) would come in higher than expected.

As AJ Bell investment director Russ Mould pointed out at the time: “Games Workshop is showing resilience in the face of a difficult market backdrop and it’s impressive how it has prospered this year.”

Speaking of a tricky backdrop, the company does face the prospect of potential US tariffs. Meanwhile, a recession would pose a risk to growth if customers tighten purse strings.

Looking further out though, I expect Games Workshop to keep growing its global fan base, especially in Asia. And there should be more exploitation of its rich intellectual property, notably through Warhammer TV content in partnership with Amazon Prime Video.

Footsie trust

By contrast to Games Workshop, Scottish Mortgage Investment Trust (LSE: SMT) can be considered a bit of a FTSE 100 stalwart. It hasn’t looked back since joining in 2017, and now has a £10.6bn market-cap after a 150% share price rise.

However, the stock remains 42% below a late-2021 peak. So it certainly hasn’t all been plain sailing (it rarely is with Scottish Mortgage!).

Plus, the managers don’t always make the right calls. They backed NIO instead of BYD, Gucci owner Kering instead of Hermès, and Northvolt instead of anyone else (it went bust).

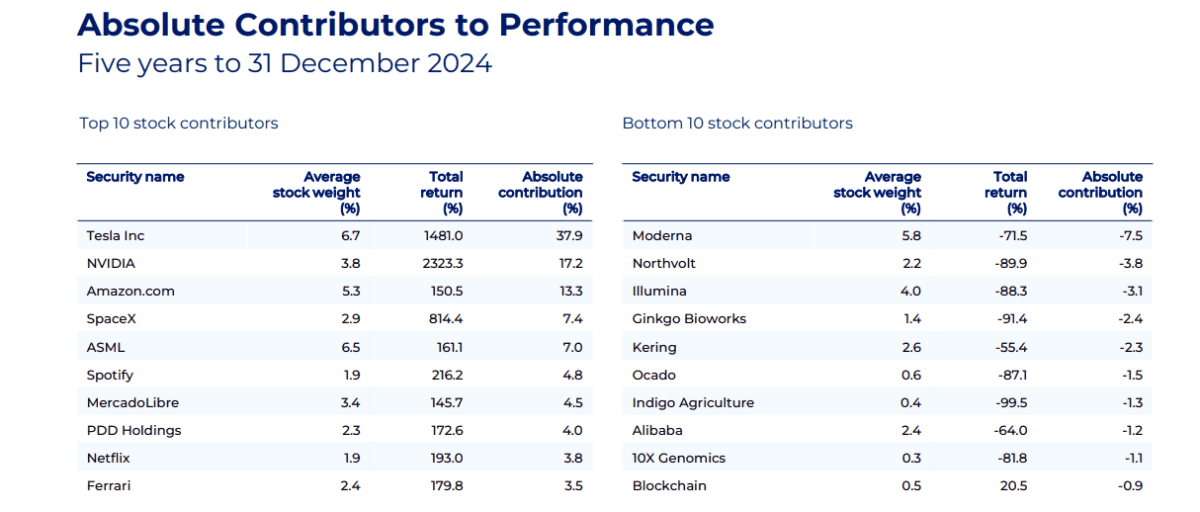

Meanwhile, Scottish Mortgage has a dubious track record with biotechs. In the five years to 31 December, half of the 10 worst-performing stocks were biotechs. Yet the trust just invested in another one called Enveda Therapeutics. So there’s a risk that the managers are venturing beyond their circle of competence, to use a Warren Buffett phrase.

As can also be seen though, the laggards are easily offset by massive winners. For example, Nvidia had gained 2,323% in the five years to the end of 2024. Private holding SpaceX was up more than 800%!

Looking at the portfolio today, I see a few stocks that could generate sizeable future returns and drive the Scottish Mortgage share price higher. These include e-commerce leader MercadoLibre, streaming giant Spotify, and Netflix, which aims to more than double in size and become a $1trn company by 2030.