Searching for the FTSE 100‘s greatest cheap shares to buy right now? Here are two I think could look good as part of a diversified portfolio.

One offers market-beating dividend yields, while the other looks dirt-cheap based on expected earnings.

Coca-Cola Europacific Partners

At first glance, Coca-Cola Europacific Partners (LSE:CCEP) shares might not look like anything to shout about value wise.

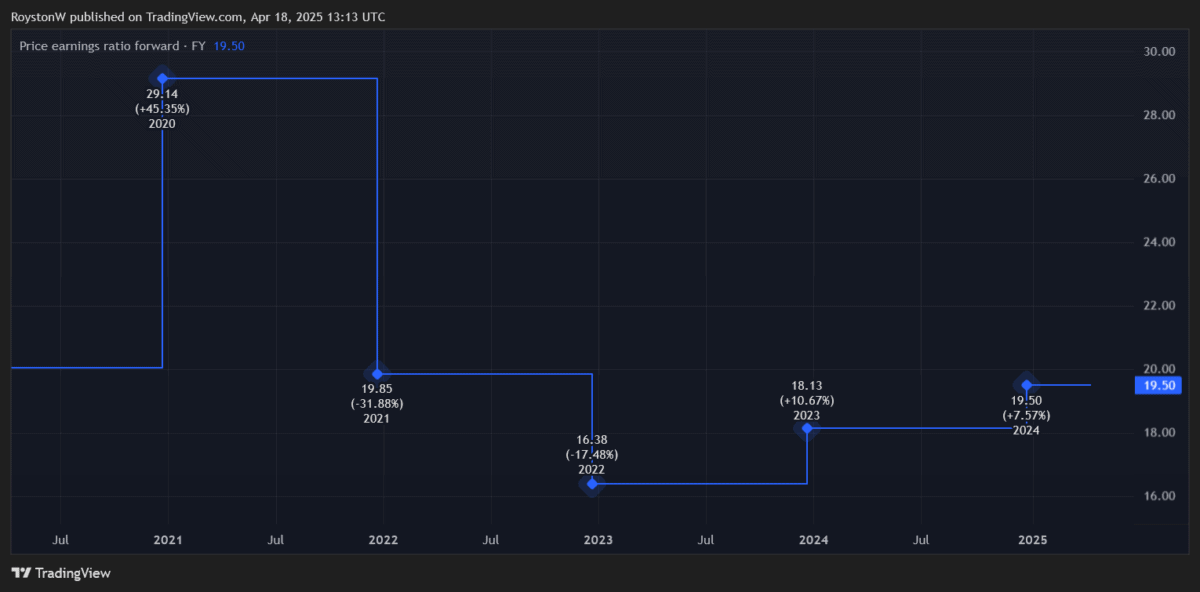

The drinks bottler’s forward dividend yield is 2.1% healthy rather than spectacular. Meanwhile, a corresponding price-to-earnings (P/E) ratio of 19.5 times suggests it’s not especially cheap based on expected profits, either.

Yet Coca-Cola Europacific’s forward P/E-to-growth (PEG) ratio tells another story. At below 1, this suggests the business is actually undervalued relative to anticipated earnings. City analysts expect the bottom line to grow 31% in 2025.

I’m not surprised by their bullish forecasts given the firm’s recent impressive trading. Latest financials showed organic revenue up 13.8% in 2024.

This is not just thanks to the immense pulling power of brands like Coca-Cola, Sprite, and Fanta, though. Sales are also taking off thanks to the FTSE firm’s vast developing and emerging markets exposure (where last year’s sales leapt 12.7% and 23.3%, respectively).

But like any share, Coca-Cola Europacific isn’t without its risks. The bottling giant could face some near-term turbulence if global trade tariffs impact consumer spending in its territories. Fresh exchange rate voliatility is another potential threat to profits.

But I’m optimistic that its packed portfolio of market-leading drinks, its presence in fast-growing regions (and lack of US exposure), and strong track record of innovation across its brands should protect it from the worst of any turbulence.

Taylor Wimpey

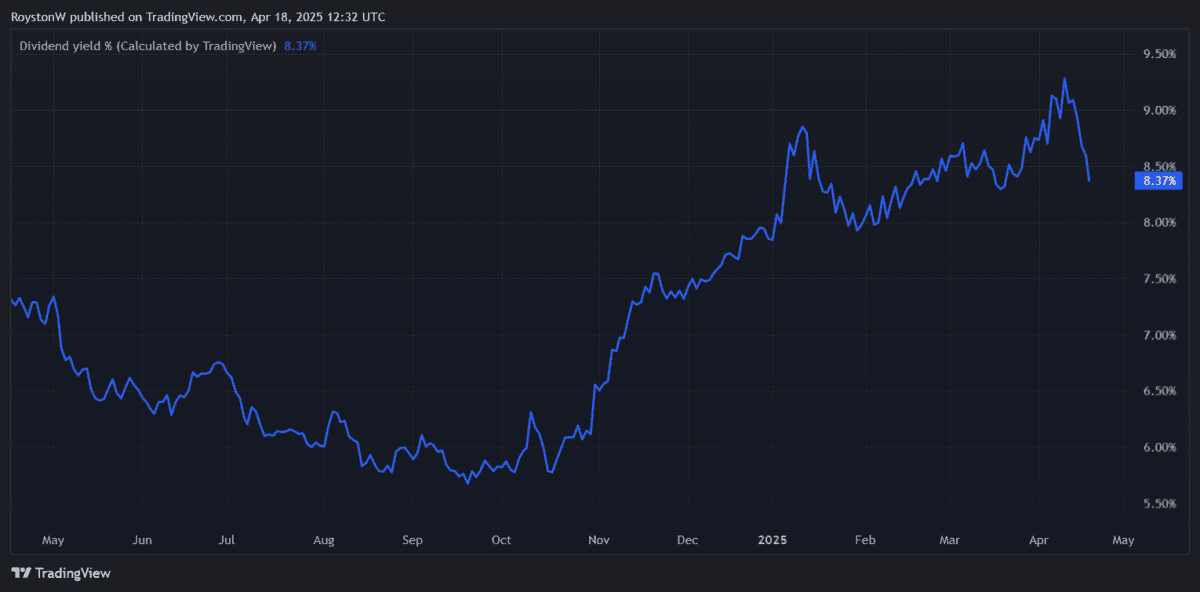

A strong balance sheet has enabled Taylor Wimpey (LSE:TW.) to keep paying market-beating dividends in recent years. And with the UK housing market showing signs of improvement, City analysts are tipping cash rewards to start rising again too following 2024’s dip.

As a result, this year’s dividend yield sits at 8.4%. To put that into context, it’s double the FTSE 100 average of 3.6%.

Falling interest rates have boosted housebuilders’ sales volumes more recently (Taylor Wimpey’s own weekly net private sales rate per outlet between 1 January and 23 February was up 12% year on year, latest financials showed).

Encouragingly, the Bank of England’s tipped to keep slashing rates, too, as consumer price inflation (CPI) drops closer to its target of 2%. Some analysts think interest rates will drop from 4.5% currently to 3.75% by the end of 2025.

Housebuilders are also benefitting from the boost that intense mortgage market competition is giving to borrowers. Barclays, HSBC, and Santander are among big high street banks to cut lending rates below 4% in recent days.

Having said this, a fresh downturn in the housing market isn’t out of the question as the UK economic struggles with low growth. Yet while this could impact Taylor Wimpey’s share price, the firm’s large cash pile — net cash was £564.8m as of December — means that it could still weather a mild downturn and continue paying large dividends.