Pacific Horizon Investment Trust (LSE: PHI) is an Asia-focused FTSE 250 investment company that hasn’t been setting the world on fire. In fact, it’s down 5% this year and 42% since late 2021.

But is the stock now worth considering for long-term investors? Let’s explore.

At a glance

Pacific Horizon’s managed by Baillie Gifford and invests in high-growth companies across the Asia Pacific region (excluding Japan). It takes a long-term approach and isn’t afraid to back emerging companies that it thinks could be potential disruptors.

Having said that, the portfolio’s largest holdings today are mainly heavyweights. These include Taiwan Semiconductor (TSMC), Tencent, Samsung Electronics, and TikTok owner ByteDance.

Up to 15% of total assets can be invested in private companies, such as ByteDance. In March, Pacific Horizon held five unlisted firms, which together accounted for 8.5% of the portfolio.

| Top 10 holdings (March 2025) | % of total assets |

|---|---|

| TSMC | 8.4% |

| Tencent | 7.4% |

| Samsung Electronics | 5.3% |

| ByteDance | 4.3% |

| Sea Limited | 3.4% |

| Daily Hunt | 3.3% |

| Zijin Mining | 3.2% |

| PDD Holdings | 2.5% |

| Equinox India Developments | 2.4% |

| Meituan | 2.4% |

Half-year results

Recently, the trust released underwhelming interim results for the six months to 31 January. While its net asset value (NAV) rose 3%, the share price fell 4%, with the NAV discount widening from 7.8% to 14.2%. This meant it underperformed the MSCI Asia ex Japan Index (6.7%).

China performed strongly, as the government moved aggressively to support the economy. However, the trust’s lack of Chinese banks weighed on returns, as did limited exposure to top-performing Chinese tech stocks like Xiaomi, Meituan and Alibaba.

Elsewhere, Taiwan’s semiconductor sector benefitted from surging AI demand, while its holding in Sea Limited (owner of the Shopee app and Free Fire game) surged over 90%. Unfortunately though, losses in South Korea (especially Samsung Electronics) and India hurt performance.

Longer-term horizon

As a long-term investor, I don’t read too much into six-month periods. Chinese banks aren’t the sort of stocks I’d expect to see in the growth-oriented portfolio.

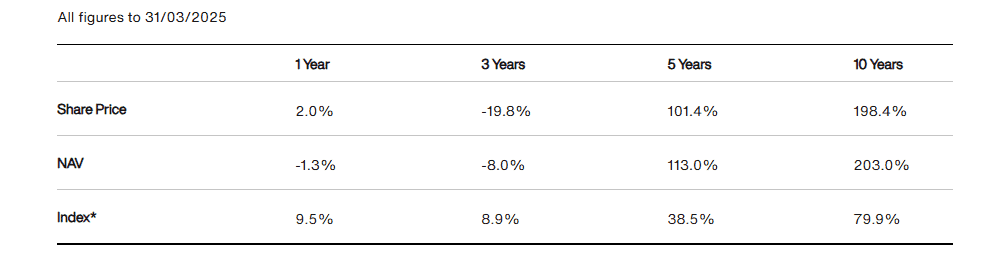

That said, the returns over one and three years are also below the benchmark. So longer-term underperformance looks to be creeping in.

Zooming further out though, the five- and 10-year returns are more than double the index’s (up to 31 March). But a return to form is needed soon before investors start losing faith.

Tariffs uncertainty

Pacific Horizon has nearly 34% of assets in China and around 16% in India. It thinks China has vast long-term potential due to very low valuations and more than $10trn in Chinese household savings accumulated since the pandemic.

It also said that “Vietnam remains the best structural growth story in Asia, driven by its successful export manufacturing base“. The weighting to Vietnam is roughly 10%.

However, a full-blown global trade war would certainly cause pain all round, especially for Vietnam and Pacific Horizon’s portfolio. So there are plenty of near-term risks.

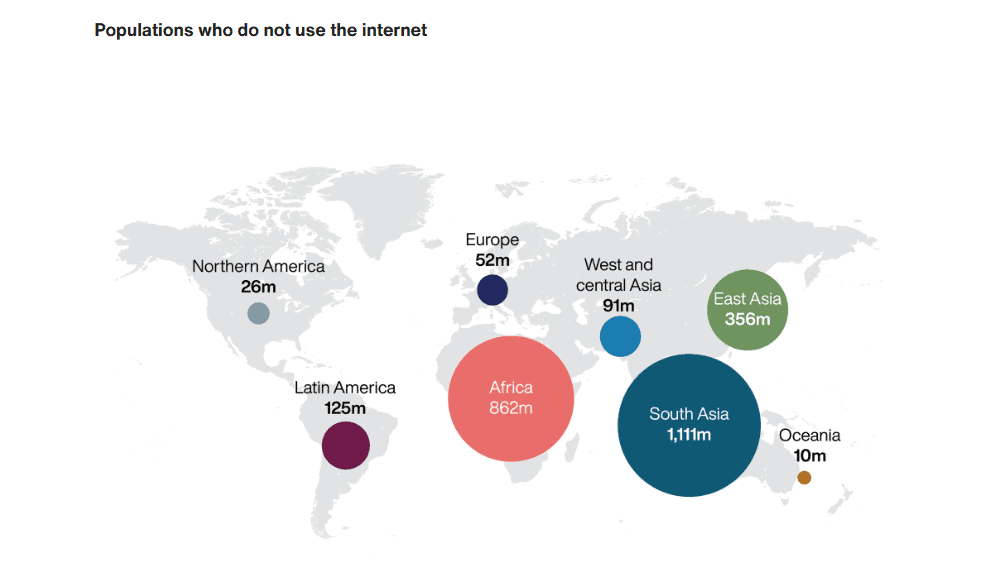

Nevertheless, 1.1bn people in South Asia alone are yet to access the internet! And in just one generation, Asia’s middle class is set to be larger than the entire populations of Europe and the US combined.

Whether it’s TikTok in social media, BYD in electric vehicles, or DeepSeek with AI, Asian companies are gaining in global prominence. I don’t think Trump’s tariffs will stop this trend from continuing long term.

With the stock down 42% since late 2021, and now trading at a 9.5% discount to NAV, I think Pacific Horizon’s worth considering for patient investors.