The stock market‘s a great place to make money, but it can also be a place to lose it. Fortunately, investors can put themselves ahead of the competition by just avoiding one simple mistake.

In general, the worst thing investors can do is sell stocks when prices are low. This seems like a straightforward principle, but it’s surprising how often it seems to happen.

Sell low?

Warren Buffett‘s instruction to be greedy when others are fearful is well known. But – as Buffett also acknowledges – working out when prices are at their lowest is nearly impossible.

Even if buying when prices are at their lowest is difficult, it should at least be possible to avoid selling at those times. But investors seem to have an uncanny knack for doing exactly this.

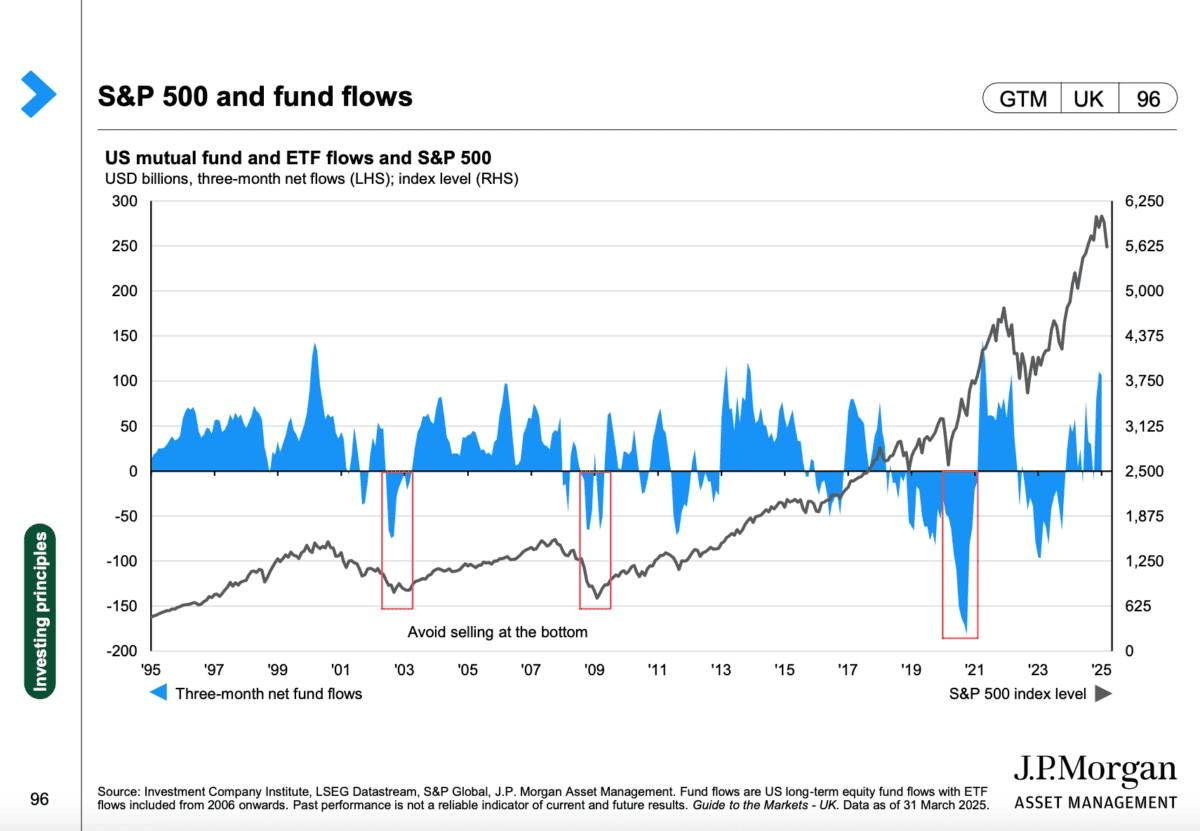

According to JP Morgan, the biggest outflows from US equity funds in the last 30 years have been at times the S&P 500 has been falling. In other words, investors sell when stocks go down.

There are a couple of lessons investors can take from this. One is that following Buffett’s advice is easier said than done, but the other is those who can are at a big advantage.

Exceptions

Like all good rules however, there are exceptions. During the Covid-19 pandemic, Buffett sold Berkshire Hathaway’s stakes in the major US airlines after their share prices had fallen.

There was however, a very good reason for this. Travel restrictions meant the businesses started losing money and had to take on significant amounts of debt to stay afloat.

United Airlines, for example, went from having $13bn in long-term debt at the end of 2019 to $30bn at the end of 2021. And that made the company’s future prospects look very different.

A big change in the underlying business can justify selling a falling stock. But when this isn’t the case, investors should be wary of the temptation to sell when prices are low.

An example from my portfolio

One of the stocks in my portfolio is JD Wetherspoon (LSE:JDW). Since I started buying it at the start of 2024, the share price has fallen 25%, but the business has performed relatively well.

Sales have grown and earnings have more than doubled. And the firm has invested heavily into owning its pubs outright – rather than leasing them – to bring down costs in future.

The stock’s been falling due to concerns over wage inflation. Offsetting these will likely involve raising prices and this brings an inevitable risk of putting customers off.

This is a genuine issue, but I don’t think JD Wetherspoon has ever been in a better position to deal with it. So I’m not looking to sell my investment despite the falling share price.

Staying the course

Avoiding selling when prices are low seems easy, but the market data suggests it’s surprisingly hard to follow. I think that means there’s a big potential advantage here for investors.

JD Wetherspoon is an interesting example. Its key strengths – its scale and its reputation for low prices – are still firmly intact and the business is looking to expand by opening new pubs.

I can understand why there’s fear around, but I think the company’s situation is better than people think. So I think selling with the share price falling would be a mistake I’m hoping to avoid.