Investing in a mix of US and UK shares with a long-term outlook can be a road to a luxurious retirement. By sticking to a plan and dedicating a sizable amount of income each month, it’s possible to bring in considerable returns — and achieve generational wealth.

I know it’s an overused phrase but it’s worth repeating: the sooner one starts, the better. The miracle of compounding returns means there can be a huge difference between 20 years and 30 years. The snowball effect means the returns grow exponentially, with each extra year resulting in even more rapid growth.

However, that doesn’t mean it’s easy — or guaranteed. There’s a myriad of different geopolitical factors to consider that can send global markets soaring or tanking. At times, it can be a nerve-wracking experience that requires patience and dedication — but the reward may be worth the risk.

Let’s do some calculations.

The road to riches

The S&P 500 has returned 12% on average in the past decade, with dividends included. The FTSE 100 has returned only 6.3%. That suggests investors should focus purely on US stocks but a mix of both is a good way to protect a portfolio against a market downturn in one region.

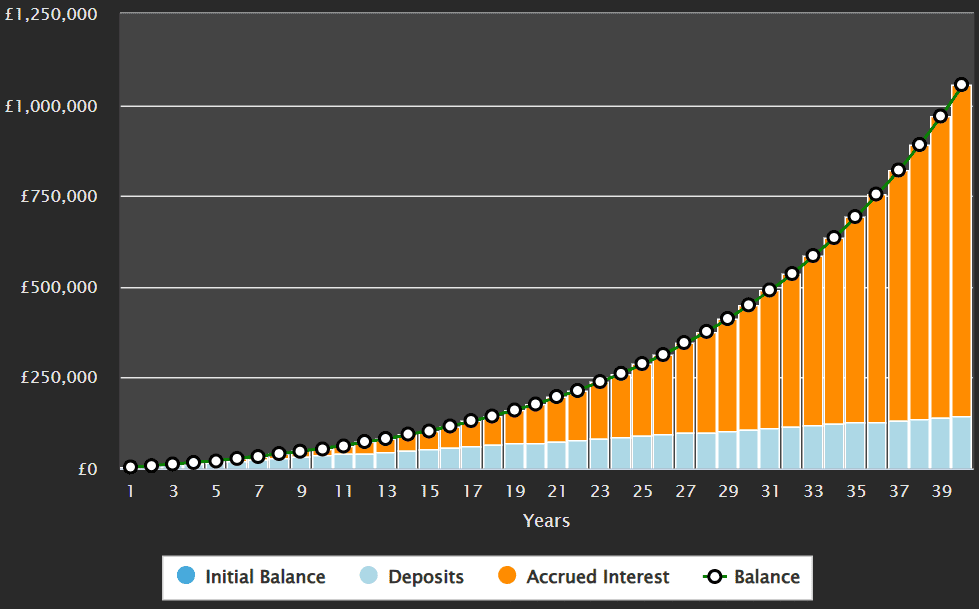

It’s realistic to assume a well-balanced portfolio of UK and US stocks could return 8% on average. A monthly investment of £300 into an 8% portfolio could grow to £177,884 in 20 years. Keep going for another 20 years and the compounding returns would bring the total up to £1,054,284.

That’s a long time but if a dedicated investor started at 30, they could reach it soon after retirement. Even a late starter at 40 could reach almost half a million in 30 years.

Top UK growth stocks

The S&P 500 may have hosted some impressive growth stocks in recent years but the FTSE 100 shouldn’t be ignored. Stocks like Games Workshop and Alpha Group have enjoyed spectacular growth in recent years.

However, I’m more partial to well-established companies with proven track records of long-term growth potential. One that I think UK investors should consider is 3i Group (LSE: III), an international investment company primarily focused on private equity and infrastructure.

Its portfolio includes stable, cash-generating businesses that support consistent dividend payments. Its flagship holding, Action, is a European discount retailer that has delivered exceptional growth.

The stock has steadily increased from 460p per share to 3,874p. That’s a 742% increase, representing an annualised growth of 11.2% per year.

It’s dividend growth is even more impressive, increasing a compound annual rate of 32% over the past 15 years. That shows strong dedication to returning value to shareholders.

However, there are drawbacks to consider. As a private equity firm, 3i’s earnings can be volatile and closely tied to economic cycles. Performance fees and asset valuations fluctuate with market sentiment, which can impact dividend stability. Additionally, its reliance on a few key assets, like Action, introduces concentration risk.

Still, the company has consistently delivered strong performance, reflected in its rising net asset value (NAV) and growing dividends. Its investment in infrastructure, especially, provides reliable income over time, making it appealing to passive income seekers.