The International Consolidated Airlines (LSE:IAG) share price is plummeting as worries over the global economy mount. At 236.9p a share, the British Airways owner is down 21.1% since the start of 2025.

February’s record closing high of 366.3p now seems a very distant memory. Yet for City analysts, a rebound to this level and then beyond is set to happen before too long.

In fact, all forecasters are unanimous in their belief that IAG shares will bounce back. But how realistic are their estimates? And should investors consider buying the FTSE 100 travel giant for their portfolios?

66% rebound?

As of today, some 26 of the City’s finest have ratings on the company. And the average price target for the next 12 months sits substantially above current levels, at 393.5p.

That’s 66.1% higher from the price at which IAG shares are currently changing hands.

The most optimistic forecaster thinks the shares will rocket 112.5% during the next 12 months, to 503.4p. The least bullish estimate sits at 250p, although this is still 5.5% higher than today’s price.

Challenges

Yet despite these confident estimates, IAG faces a series of challenges that could derail any share price recovery.

The first is the state of the global economy, and particularly growing recessionary risks in the key US market. Tellingly, BlackRock chief executive Larry Fink said this week that “most CEOs I talk to would say we are probably in a recession right now.“

Economic downturns tend to be especially cruel for airlines as people and businesses trim non-essential spending. Alarmingly, Fink said that the industry is already showing signs of buckling, noting that “one CEO specifically said the airline industry is a proverbial… canary in the coal mine — and I was told that the canary is sick already.”

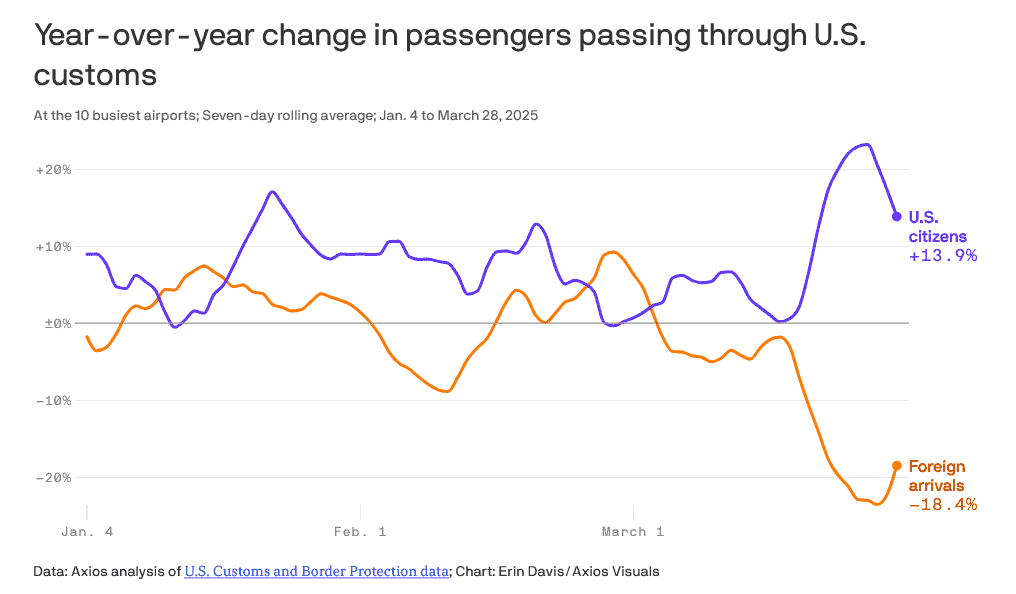

Another obstacle for IAG is a sharp fall in tourism to the US. Transatlantic travel is a huge money-spinner for carriers like British Airways, so news that flights to the States are sinking so early in Donald Trump’s administration is a troubling omen.

Analysis suggests this drop-off reflects a negative reception to Trump’s aggressive geopolitical and economic strategy outside the US. But this isn’t all, with Goldman Sachs suggesting the decline “Is likely attributable to tighter immigration policy” Stateside as well.

The attractiveness of the US as a travel destination could well pick up in the short-to-medium term. But I wouldn’t bet the farm on it right now.

Opportunities

However, it’s also important to say there are opportunities for IAG, as demand for its non-US routes could pick up as travellers shun the US. Its budget carriers like Aer Lingus could also see benefit as cheaper plane tickets become more popular.

Finally, the business could enjoy a big boost to margins if fuel costs continue reversing. Brent crude has dropped to $64.60 a barrel from $76 at the start of 2025. And recent supply and demand news suggests it could keep shuffling lower.

I don’t believe these factors alone are sufficient to spark a rebound in IAG’s share price. And since its shares aren’t particularly undervalued — with a forward price-to-earnings (P/E) ratio of 4.2, just slightly below the industry average — it’s unlikely that bargain hunters will rush in and drive the price up significantly.

On balance, I think investors should consider avoiding IAG shares.