The Helium One Global (LSE:HE1) share price had an eventful day yesterday (31 March). Before the start of trading, the company announced the news that shareholders have been patiently waiting for. Namely, that the company has formally accepted the terms of the mining licence offered by the government of Tanzania.

The first annual fee has been paid. And the necessary legal work to finalise the various contracts will now follow. A formal assessment of the helium reserves will then be undertaken.

Not surprisingly, the news helped drive the share price 9.5% higher. After all, it represents an important milestone on the road to full commercialisation. But then it started to fall and it was below its opening level by early afternoon.

Shareholders are probably wondering what has to happen for the group’s share price to take off. Despite all the good news that’s been released lately — development drilling at its joint venture site in America is also going to plan — the share price is 53% below its 52-week high.

Be calm

But I don’t think there’s any need to panic.

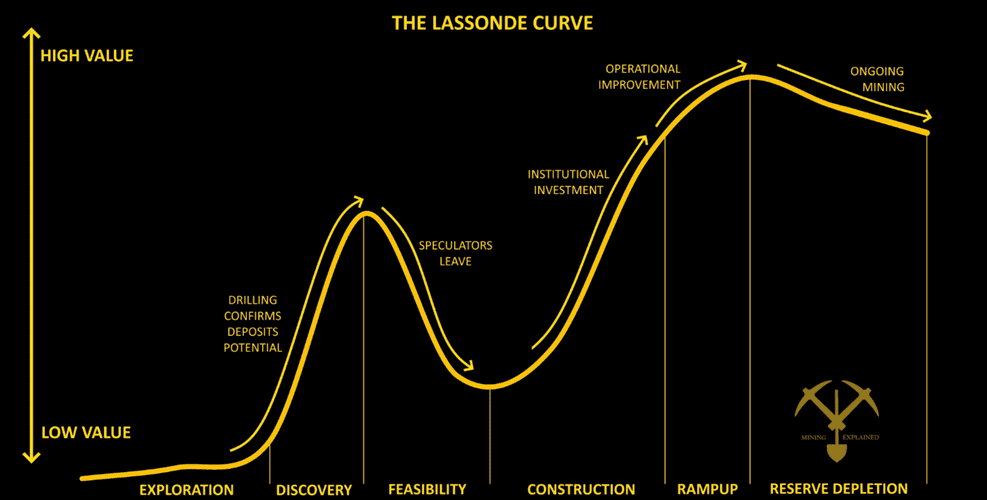

That’s because, over 30 years ago, Pierre Lassonde looked at the life cycle of a typical mining company. Using the ‘Lassonde Curve’ (see below), he put forward the idea that investors will sell up after an initial surge of interest, leading to a pull back in a miner’s stock market valuation. A period of treading water will then follow as the company moves through the feasibility stage and into the construction phase.

I think this is where the Helium One share price is currently at. And I suspect it’s likely to remain in the doldrums until it becomes clearer how the development of its flagship project will be funded. Once clarified, Lassonde predicts that the market cap of the company will start to increase.

Ongoing discussions

In December, at Helium One’s annual general meeting, Graham Jacobs, the company’s finance and commercial director, said “initial – moving on towards detailed – engineering studies” had been completed. Based on these, he believed the cost of developing the mine in Africa is likely to be “somewhere in the region of” $75m-$100m.

He also said that the company was in discussions with banks about providing the necessary finance. Also, Jacobs didn’t rule out entering into offtake financing, where customers pay in advance for gas.

But he also cautioned that there will be an “element of equity” to go along with whatever financing arrangement the company (hopefully) secures.

And that’s a problem for me. At current exchange rates, the funding required is more than the market cap of the company. The amount involved is therefore not trivial. And due to the specialised (and risky) nature of any lending, I think there will be a relatively small pool of debt providers willing to come forward. This means they will be in a position to demand very favourable terms, at the expense of existing shareholders.

There’s also a chance that nobody will want to fund the company. In these circumstances, who knows what will happen.

That’s why I don’t want to invest. Despite the attractive market characteristics for helium – there’s a finite supply and demand is rising – I suspect any investment made now will soon be diluted. It’s just too risky for my liking.