The FTSE 100 is a popular destination for share investors seeking passive income. More than other international indices, the UK blue-chip index is famed for its large collection of dividend shares with high yields and long records of payout growth.

It’s less recognised for its growth prospects however, given its high exposure towards mature industries such as banks, oil and mining. Yet the Footsie index can also be a great place to pick up top growth shares.

Here’s one top FTSE 100 stock I think is great for both capital growth and dividend income. So much so, I recently topped up my existing holdings just last Friday (21 March).

Shooting star

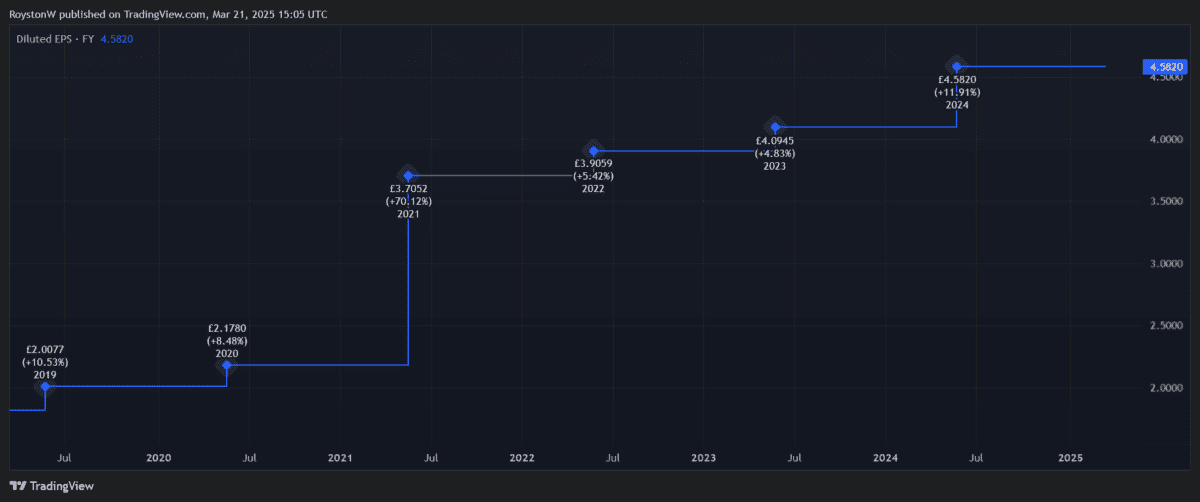

Games Workshop‘s (LSE:GAW) shares have shot through the stratosphere as earnings have ignited. Since 2020 its share price has risen 260%, driven by a sharp bottom-line rise as the tabletop gaming boom has grown.

Soaring earnings have also delivered a splendid rise in dividends per share over the time. The dividend of 145p per share paid in fiscal 2020 is dwarfed (no pun intended) by the 420p reward the business doled out last year.

City analysts are expecting both profits and dividends to continue rising over the short term too. A 15% earnings per share rise is tipped for this financial period, leading to predictions of an 10% hike in the full-year dividend, to 460.3p per share.

This leaves Games Workshop shares with a solid 3.2% dividend yield.

Cash king

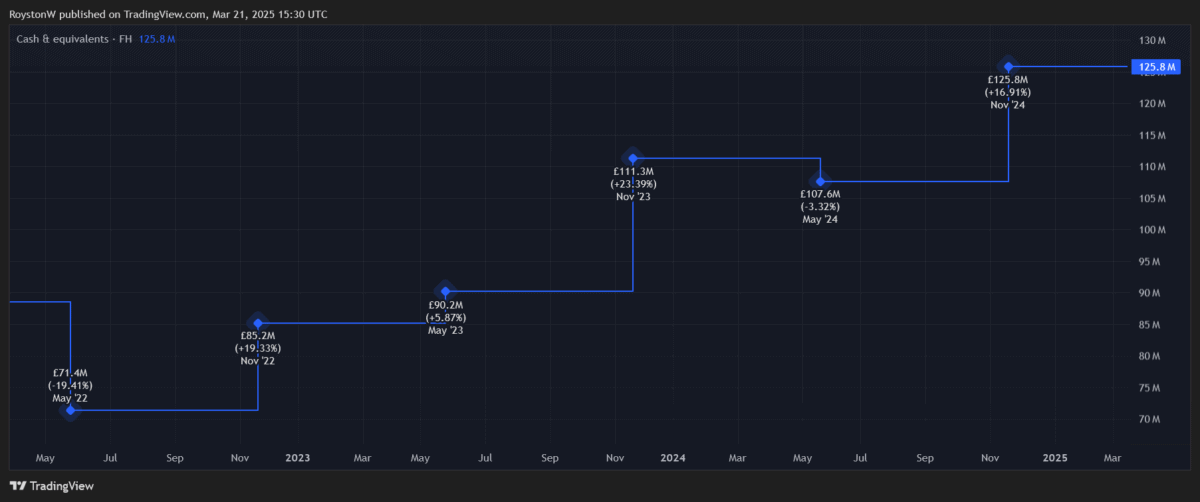

The strong returns it’s delivered is thanks in large part to Games Workshop’s position as a cash-generating machine.

In the six months to December, cash and cash equivalents here rose by more than £18m to almost £126m. This was even after the payment of dividends, tax, and on asset purchases (like land) and product development.

This impressive cash creation is thanks in large part to its huge profit margins, with gross margins tending to range between 65% and 70%. The strong brand power of Warhammer means the company can charge premium prices, and production costs are relatively low.

But past performance is not a guarantee of future returns. And today there are significant risks to future revenues and cash flows, like a potential weakening in consumer spending if economic conditions worsen.

The business could also face higher costs and lower Stateside demand if US trade tariffs are slapped on the UK. Its plastic miniatures roll off conveyor belts in its factory in Nottingham, UK.

Looking good

But on balance, I’m optimistic that earnings and dividends will continue growing at Games Workshop, and certainly over the long term. ith With new manufacturing facilities and ongoing global store expansion, it’s well-positioned to continue capitalising on surging interest in fantasy wargaming.

I’m also encouraged by the company’s steps to supercharge licencing revenues. The blockbuster TV and film deal it’s signed with Amazon alone could take profits to the next level.

Games Workshop shares aren’t cheap on paper. They currently command a price-to-earnings (P/E) ratio of 27.7 times for this financial year. However, I think this is a fair valuation given the company’s proven quality as both a growth and dividend share.