Successful passive income investing requires more than just picking high-yield stocks. On the London stock market, the FTSE 100 and FTSE 250 provide many opportunities to make a winning second income. But focusing solely on a dividend yield can be risky.

Dividend growth stocks can offer more stability than shares with higher yields. They are often a signal of strong financial foundations. They provide inflation protection and they can provide superior overall returns through a combination of dividend income and capital appreciation.

Over the long term they can be far better ways for investors to grow their wealth.

A top dividend stock

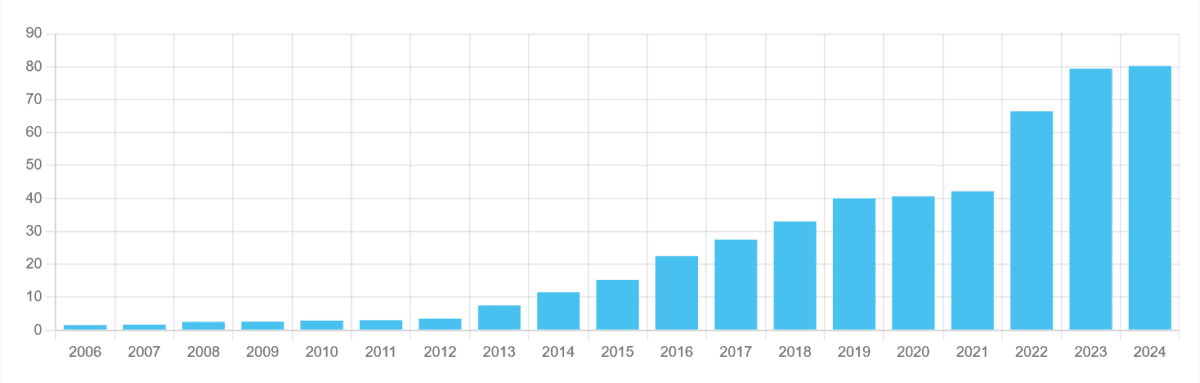

With this in mind, let me talk about one of my favourite Footsie dividend growth shares to consider right now: Ashtead Group (LSE:AHT). The rental equipment provider has one of the strongest dividend growth records on the FTSE 100, dating back well over a decade.

Supreme cash generation has allowed it to shower shareholders with cash, delivered through a blend of stock repurchases and annual payout increases:

Past performance isn’t always a reliable guide to the future however. Shell‘s shock dividend cut during the pandemic — the first such move since World War Two — illustrates how even the most reliable income stock can disappoint.

Yet barring some catastrophe, I’m expecting dividends on Ashtead shares to keep marching higher. Incidentally, it’s worth mentioning that dividends here continued to climb even during the Covid-19 crisis.

In good shape

Why am I so optimistic? While it’s suffering severe market challenges today, the increased earnings tipped for the next couple of years are well covered by expected earnings. This provides a cushion in case profits fall off a cliff.

For fiscal 2025 and 2026 respectively, dividend cover’s a sturdy 3.5 times and 3.5 times respectively. Any figure above 2 times is considered strong.

I’m also encouraged by the continued robustness of Ashtead’s balance sheet. Its net debt to adjusted EBITDA ratio fell to 1.7 times as of January from 1.9 times a year earlier. This pulled it further within the firm’s target range of 1 to 2 times.

A strong outlook

As I say, Ashtead isn’t having the best of times right now. Latest financials showed operating profit down 7% in the January quarter, reflecting lower equipment usage and higher costs. And conditions could remain tough in 2025 if economic uncertainty continues.

But I still believe the Footsie firm will remain a top share to consider for the long term. It’s well placed to capitalise on a spending boom on US infrastructure this decade. And supported by that strong balance sheet, it has considerable room to further grow its market share through acquisitions or organic investment.

Ashtead shares don’t have the largest dividend yields, at 1.8% and 2% for this year and next respectively. But on balance, it’s still a great passive income share, in my opinion.