After sprinting 2,200% higher in five years, Nvidia (NASDAQ: NVDA) stock has paused for a breather. It’s basically flat over the past nine months. Where it heads in future will ultimately come down to demand for its latest AI-focused chips.

Earlier this week, Nvidia held its flagship annual GTC event. Here, I’ll touch on three things that we learned.

Restless innovation

The first thing that struck me was just the relentless innovation still going on at Nvidia. My email inbox was inundated by a flurry of press releases from the event.

Here are some of them:

- Partnered with telecom giants to build AI-native 6G networks, integrating AI into wireless architecture.

- Unveiled Blackwell Ultra, a powerful AI factory platform built for reasoning, agentic, and physical AI.

- Partnered with Google to use AI and simulation to develop robots with grasping skills, reimagine drug discovery, and optimise energy grids.

- Will build a quantum computing research centre to accelerate quantum supercomputing.

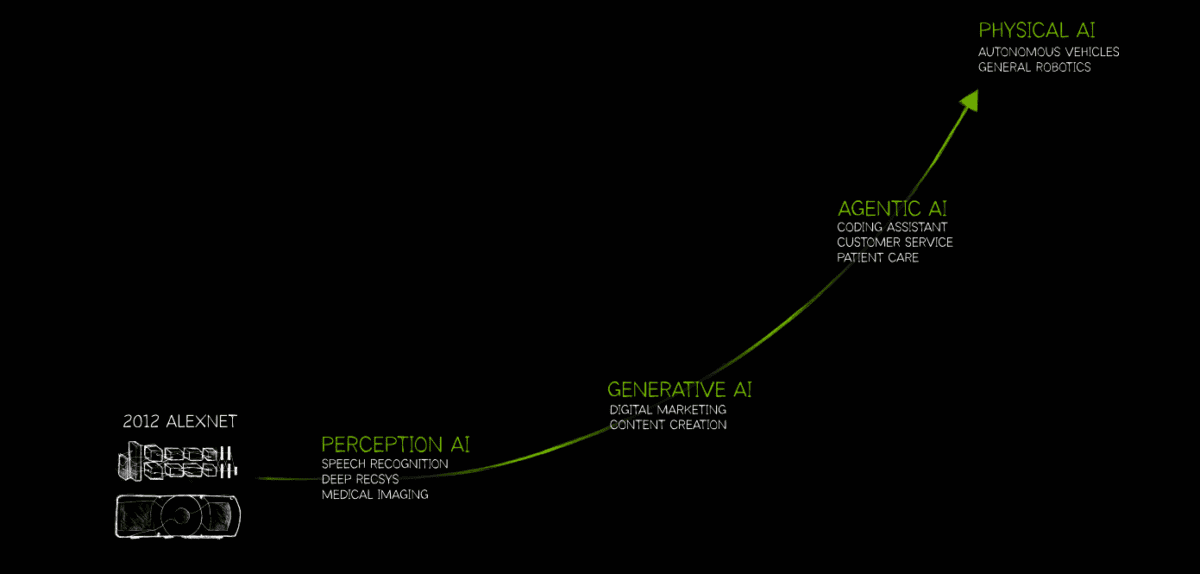

This shows how the company is looking well beyond generative AI towards quantum computing and physical AI (particularly self-driving vehicles and robots). Nvidia certainly isn’t resting on its laurels.

This level of innovation and drive to stay ahead of rivals is a key competitive strength. Indeed, I would argue that Nvidia carries more key person risk in the form of founder-CEO Jensen Huang than any other company. Without his vision and leadership, I would think twice about investing in the company.

Blackwell ramp up

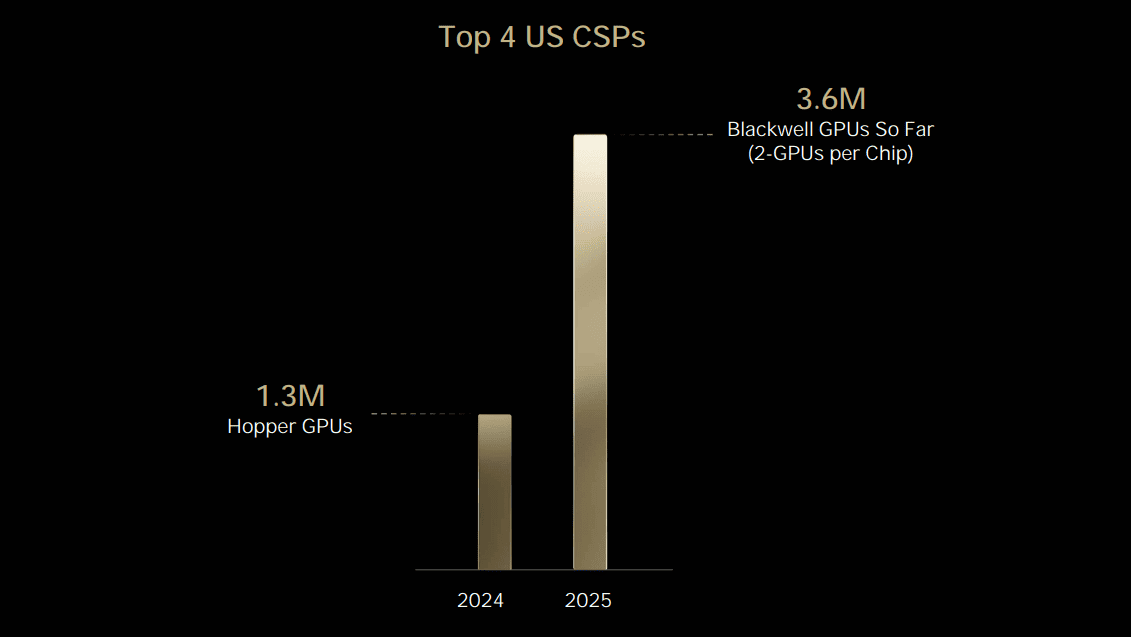

Next, we got some news about demand for the firm’s latest Blackwell chips. In a nutshell, it’s very strong.

Nvidia said that demand from the top four US cloud service providers (CSPs) is significantly higher than when the Hopper chip was released in 2024. In other words, it has been the fastest ramp up of a product in the company’s history.

Product roadmap

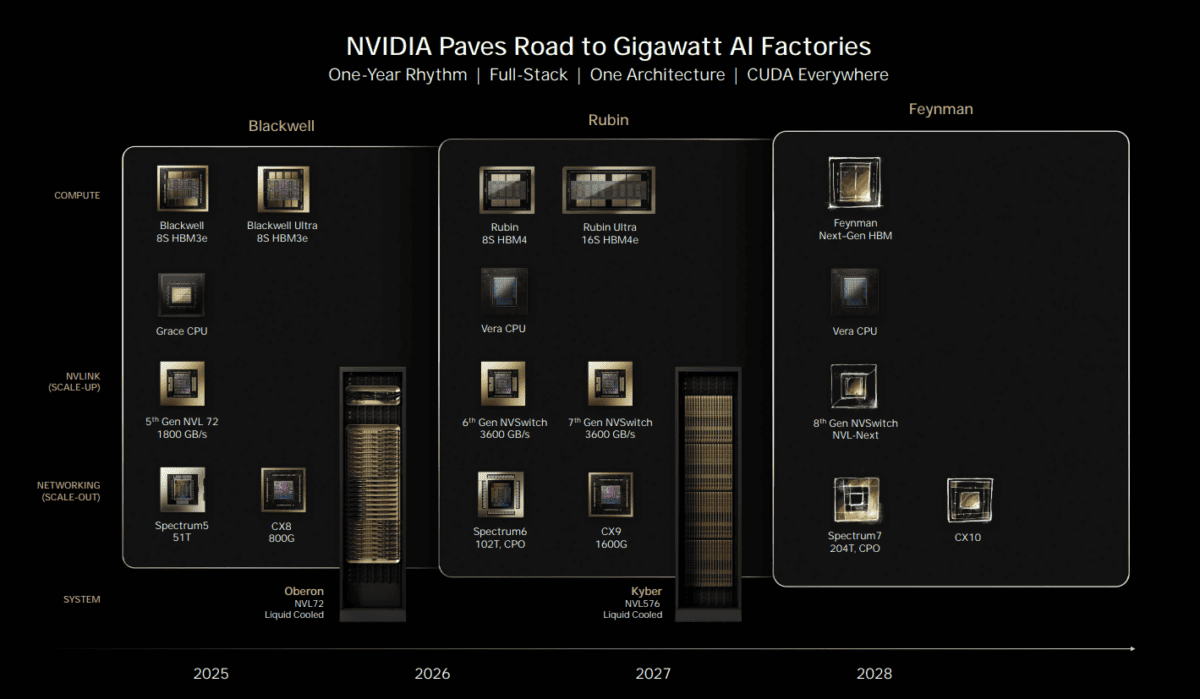

Finally, Nvidia gave us a display of its product roadmap through to 2028. The key takeaway is that there will be a new annual release cadence rather than every other year.

A family of Blackwell Ultra chips will start shipping in the second half of this year, while the next-generation Vera Rubin chip is expected to reach customers in 2026.

Beyond that is Feynman, though whether those chips will have enough additional performance and efficiency to convince the cloud giants to keep forking out for them is anyone’s guess. That adds a bit of uncertainty in the mid-term here.

What about the stock?

It’s hard not to be bullish on the company’s growth in the near term. Longer term, it sees a multi-trillion dollar market opportunity in robots. There are a number of companies working on humanoid robots, including Tesla. Nvidia is positioning its chips to be at the centre of it all.

Looking at valuation, the stock appears attractively priced at 26 times forward earnings. That’s not a high multiple for a company like this.

Of course, there are big risks here if AI infrastructure spending unexpectedly cools. Meanwhile, Nvidia is spending heavily to shift its supply chain from Asia as President Trump’s policies have their affect.

On balance though, I think the stock is worth considering at $116 for long-term investors.