Back in September, writers at The Motley Fool were speculating on whether Rolls-Royce (LSE: RR) shares could possibly break through the 500p mark. The rest, as they say, is history. The Rolls-Royce share price is currently at 809p, bringing the three-year return close to 800%!

Next stop £10? I wouldn’t rule it out after reading through the FTSE 100 company’s full-year earnings call on 27 February.

Here are two interesting takeaways from the call for Rolls-Royce investors like myself.

Upgraded mid-term guidance

In its 2023 annual report, Rolls-Royce set out ambitious mid-term guidance (defined as 2027). This was for operating profit between £2.5bn and £2.8bn, operating margins of 13%-15%, and free cash flow between £2.8bn and £3.1bn.

In its 2024 report, the company significantly upgraded its medium-term guidance (2028). It’s now targeting underlying operating profit of £3.6bn to £3.9bn, a 15%-17% operating margin, and £4.2bn to £4.5bn in free cash flow.

The largest improvement will come from civil aerospace where we target an 18% to 20% margin in the mid-term.

CEO Tufan Erginbilgiç

In the earnings call, the chief executive set out a number of factors that will drive higher operating profit in its key civil aerospace division.

First, Rolls-Royce has been optimising long-term service agreements (LTSAs) by renegotiating contracts. This is boosting aftermarket margins.

Next, it aims to make Trent XWB widebody engine sales break even or even profitable by the mid-term. These engines power the Airbus A350 family. This is a shift from historically selling at a loss to secure LTSAs.

Crucially, Rolls-Royce is significantly extending time on wing — the period engines operate and generate revenue before requiring maintenance — through design improvements and data-driven optimisations. It’s spending £1bn by the end of 2027 to improve time on wing. Ultimately, this will reduce shop visits and boost margins.

Meanwhile, business aviation is set for double-digit growth, led by Pearl engines, and outpacing the wider market. Finally, more contract renegotiations will conclude by 2026.

In the call, Erginbilgiç also said: “We see the potential for this [civil aerospace] business to deliver a higher than 20% margin beyond the mid-term.”

Mini-nukes

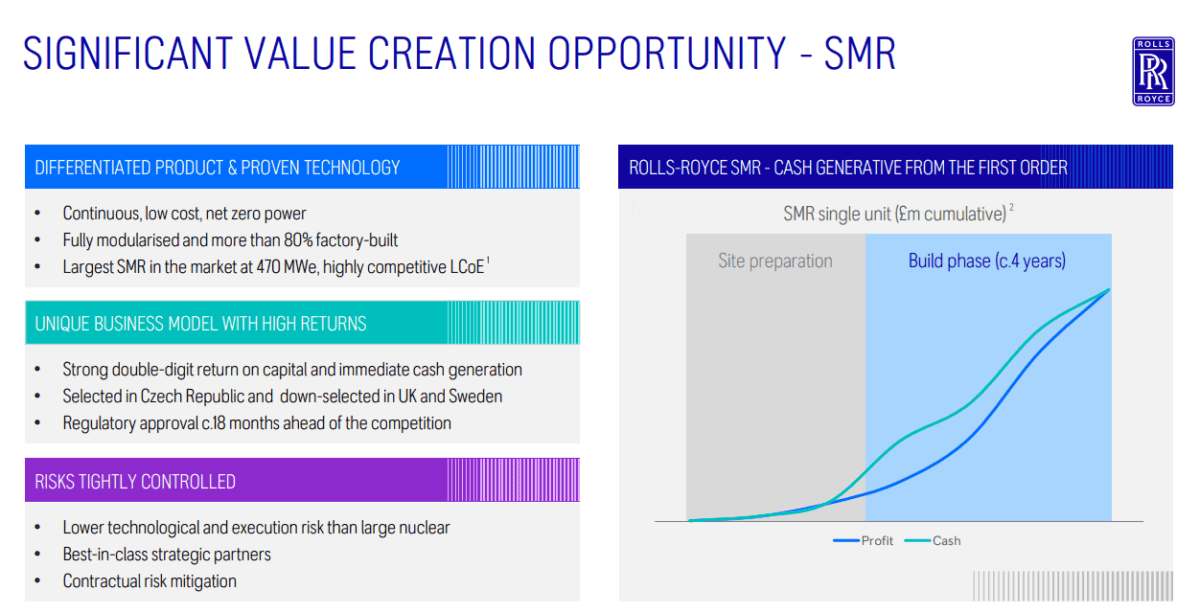

Next, the company gave investors more details on small modular reactors (SMRs), or ‘mini-nukes’.

We are uniquely placed to win in this large and growing [SMR] market and create significant value.

CEO Tufan Erginbilgiç

Rolls-Royce has been selected to deliver up to six SMRs in the Czech Republic and shortlisted for projects in the UK and Sweden. However, there’s a risk that it doesn’t make the cut, which would be a significant setback. Missing out in the UK could undermine its success in securing contracts with overseas governments.

Importantly though, advanced payments from customers will ensure that SMR contracts are “immediately cash-flow generative”. In other words, margin protection is built into the initial contracts, allowing Rolls to achieve positive margins on the very first SMR.

Consequently, Erginbilgiç confirmed: “We expect to generate a strong double-digit return on capital from SMRs.”

Each unit could cost around £2bn. Based on International Energy Agency forecasts for 2050, management estimates a total addressable market of around 400 of its 470-megawatt SMRs. This highlights the massive long-term opportunity.

Rolls-Royce stock is pricey at 30 times next year’s forecast earnings. But I think it would be worth considering on any significant dip.