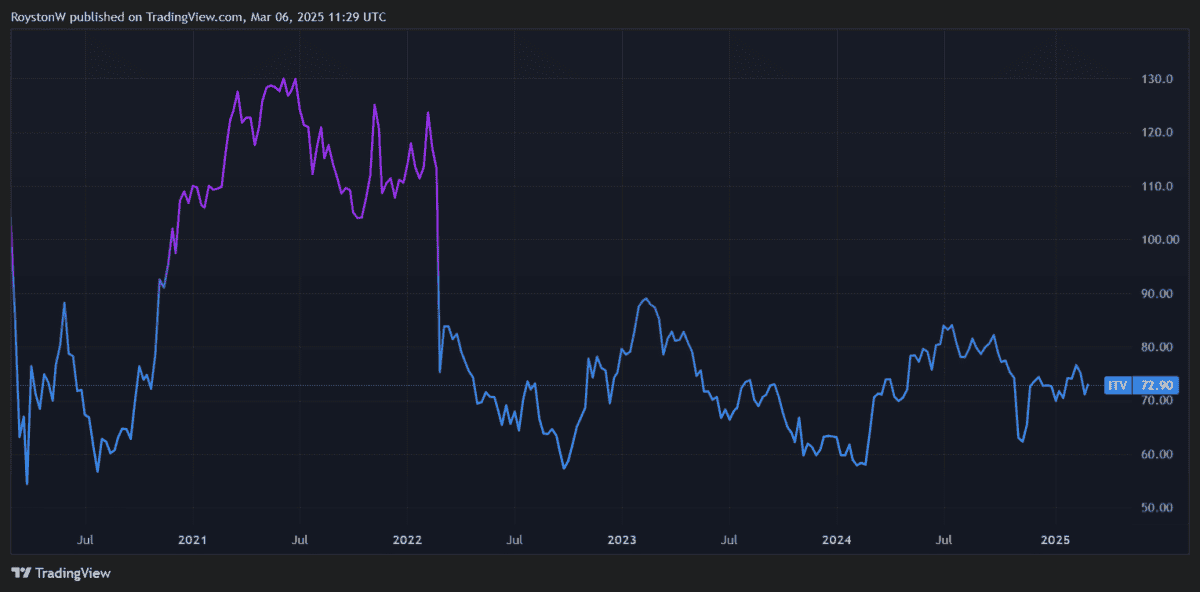

ITV (LSE:ITV) shares are rising strongly again following a bumpy few months. Problems at the broadcaster’s production division, mixed with concerns over the health of the UK economy and direction of interest rates, weighed on investor sentiment late last year.

But it’s on the front foot again Thursday (6 March) after a solid set of trading numbers for 2024. These showed adjusted pre-tax profits up 19%, at £472m.

At 72.90p per share, ITV’s share price was last around 5% higher on the day. And if broker forecasts prove correct, it will continue to rise during the next 12 months. But how realistic are the City’s estimates?

Another 17% rise?

As with any share, a wide range of opinions exist where ITV’s share price is heading. One particularly bleak forecast has the commercial broadcaster slumping 18% from current levels, to 60p per share. At the other end of the scale, the most bullish estimate has the FTSE 250 company leaping 58% to 115p.

Overall, City analysts are overwhelmingly positive on ITV shares for the next year. The average price target among eight brokers with ratings on the stock is 85.57p per share, marking a 17% premium to today’s price.

Still cheap

What suggests significant price rise potential from current levels? When combined with predicted dividends, a lump sum investment today could yield a significant total investor return. City analysts are expecting a 5.1p per share cash reward in 2025, resulting in a huge 6.9% dividend yield.

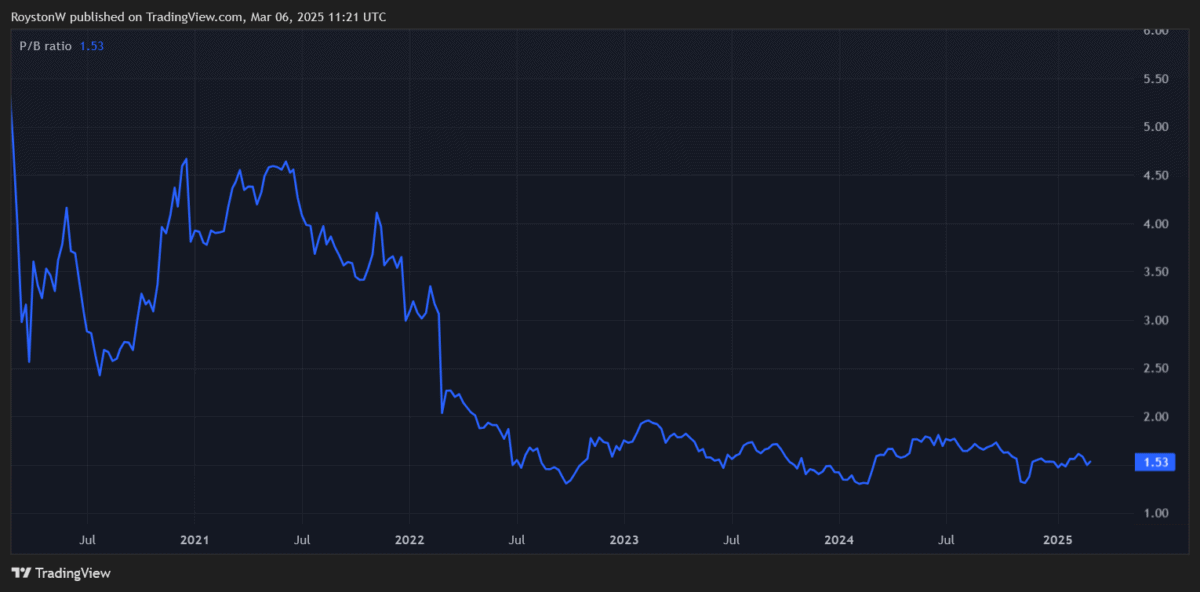

Encouragingly, ITV shares continue to trade at a decent discount to their long-term average. This theoretically provides added scope for the broadcaster to rise in value.

City analysts think annual earnings will increase 4% in 2025, to 8.99p per share. This leaves the firm with a price-to-earnings (P/E) ratio of 8.1 times, some way below the 10-year average of 9.9 times.

ITV’s price-to-book (P/B) ratio of 1.5 meanwhile, is also well below the long-term average (as the chart shows).

With its forward dividend yield also above the 5.5% average for the past decade, I think the business could continue attracting interest from value hunters.

Quietly confident?

Yet a further rise in ITV shares is by no means a done deal. Advertising revenues could crumble again if economic conditions worsen. Tighter marketing restrictions on unhealthier foods from October may also hit ad sales hard.

Intense competition from other broadcasters, not to mention US streaming giants like Netflix and Amazon‘s Prime service, could also weigh on performance.

But on the whole, I’m optimistic that ITV’s share price could continue rising. With demand for content steadily rising, and creative strikes in the US over, I believe ITV Studios can keep shining (profits here reached record highs in 2024).

I’m also encouraged by the breakneck momentum of ITVX. It’s been Britain’s fastest growing streaming platform during the past two years and drove ITV’s digital ad revenues 15% higher last year.

Finally, the firm’s cost-cutting programme also continues to surpass expectations. It delivered £60m of savings in 2024, beating estimates by a cool £10m. I think ITV shares are worth serious consideration today.