If someone offered to give you a pound coin and asked for a £20 note in return, that would sound like a terrible deal. Yet it would still be a better return than buying shares in Aston Martin (LSE: AML) when the luxury carmaker listed in 2018 and holding them until now.

During that time, the Aston Martin share price has fallen by 98%. Yet this is an iconic brand with a well-heeled customer base, desirable vehicles and strong pricing power. So might the share price bounce back – and should I invest in the hope it does?

A great business is not necessarily a great investment

While Aston Martin has a lot going for it, I think its predicament contains some powerful lessons for investors.

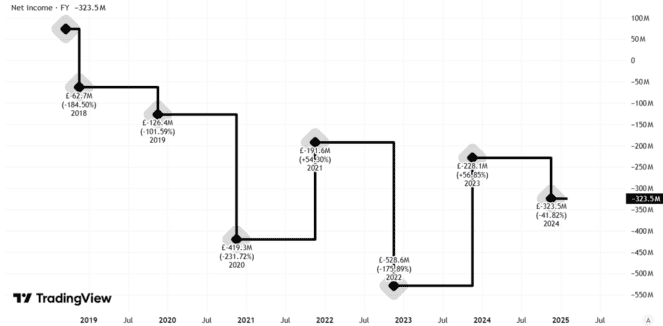

The first lesson is that having great assets does not necessarily equate to having a great business. Last year, for example, even though it generated revenue of £1.6bn, Aston Martin still recorded an operating loss of well over £1m a week.

Aston Martin cars are not cheap so it may seem odd that the business is losing money making and selling them. But the economics of a business matter. Selling just a few thousands cars a year can make it harder to swallow fixed costs than with much bigger volumes.

The second lesson is that a business’s balance sheet always needs to be considered alongside its operational performance. Aston Martin’s operating loss last year was £83m, but its overall loss for the year was £290m.

Created using TradingView

Where did that extra £200m+ of red ink come from? Non-operating costs.

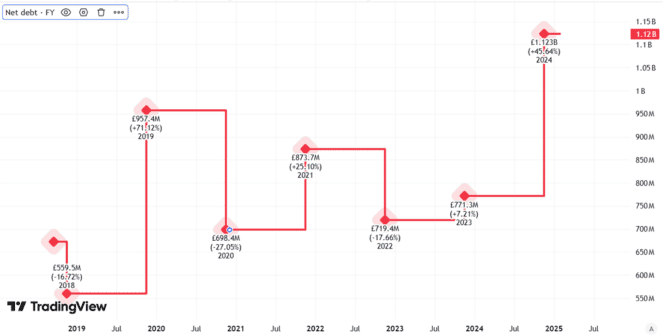

Specifically, the company had £180m of financing costs. That is what comes of having net debt of £1.2bn, as Aston Martin did at year end, especially when much of it is at a high interest rate. Aston Martin is paying 10% or more interest on some of its borrowings.

Created using TradingView

Much needs to go right for a share price revival

So could the Aston Martin share price ever bounce back? To do so, I think the business would first need to stop spilling red ink at the operating level and secondly sort out its finances by getting rid of most debt. That could involve issuing more shares, diluting existing shareholders.

While that is possible, for now I do not think the signs are encouraging. Revenues fell last year by 3% and wholesale sales volumes were down 9%. The fact that sales volumes fell more than revenues demonstrates positively that the company has pricing power, but neither trend is a positive one, in my view.

As the chief executive said this week as part of the annual results announcement: “We have all the vital ingredients for success”.

That is true, but it has long been true. Meanwhile, the Aston Martin share price has lurched from one disappointment to another. I have no plans to invest.