I had never come across US used car sales platform Carvana (NYSE: CVNA) until several years ago when someone told a story about selling an old secondhand car for more than they had bought it for. That struck me as odd and so I looked into the growth stock and its business model.

Clearly, I was not the only one who struggled with the commercial logic. Between August 2021 and December 2022, Carvana stock lost 99% of its value.

At that point, I am sure a lot of investors must have wondered if things were over. Far from it. In little over two years, the growth stock has soared 6,398%.

What on earth’s going on with this valuation?

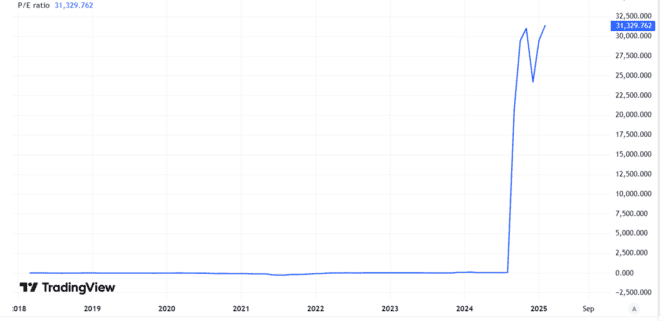

That means Carvana is now trading on a price-to-earnings (P/E) ratio of over 28,000. Yes, you read that correctly.

Created using TradingView

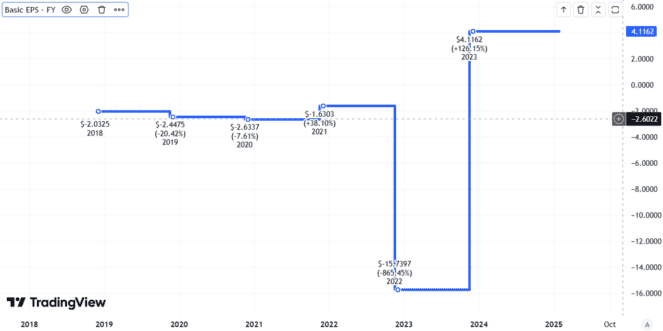

Still, at least it made a profit last year. That came after many years of losses.

Created using TradingView

But… a P/E ratio in tens of thousands? Has the US market gone totally mad?

Not necessarily. Carvana has a market capitalisation of $55bn. Clearly there is some serious money invested here.

The company has developed an innovative business model at scale. In its most recently reported quarter, it sold 109,000 cars and generated revenue of $3.7bn.

When the growth stock crashed that reflected a number of risks: volatile pricing in the second hand car market, concerns about the quality of Carvana’s loan book, its ability to keep servicing it, and the company’s losses at that point.

Now, investors seem to be looking from the other side of the lens. Carvana is profitable and growing fast. It has economies of scale that in a platform model like this can be a virtuous circle.

The more buyers and sellers it serves, the better it understands the market and the stronger its offering for consumers becomes. (Although the business model is different, this sort of platform-based virtuous circle can be seen on this side of the pond at Auto Trader).

I’m not going anywhere near this

However, while the 99% crash now looks overdone in retrospect, I also am sceptical that the 6,398% share price growth is reasonable.

Although Carvana is profitable, that is on an accounting basis. It was still lossmaking at the operational level in its most recent full-year results.

Seeing this purely as a car trading platform (similar to, say, eBay) misses a large part of what attracts investors – and also what I think is a key risk.

Carvana’s model is as much (or more) about being a financing company as it is about buying cars, reconditioning them and selling them on.

That large book of auto loans concerns me. Carvana has been heavily reliant on reselling them to one buyer (Ally Financial). That causes a big concentration risk, should the relationship between Carvana and Ally sour.

Even beyond that though, US car loans historically have higher default rates than some other types of borrowing like home mortgages.

In a weak economy I expect used car loan default rates could grow, making it harder for Carvana to offload its loans onto Ally (or anyone else) at an attractive price.

The risks here are well above my comfort level, even for a US growth stock. I have no plans to invest.