Harbour Energy (LSE: HBR) is a FTSE 250 oil and gas company based in London. With a £4bn market cap, it’s not only the second-largest on the index but also currently larger than the 10 smallest on the FTSE 100. Consequently, it main rejoin the main index in the next reshuffle.

It got demoted from the FTSE 100 in late 2022 after its market cap collapsed below £3bn. However, it catapulted back above £4bn again in early September last year after finalising the acquisition of the upstream assets of German oil and gas producer Wintershall Dea.

The acquisition represents a significant expansion for the company, pushing production up to 475,000 barrels of oil equivalent per day (boepd). According to a press release, it’s now “one of the world’s largest and most geographically diverse independent oil and gas companies.”

Should you invest £1,000 in Harbour Energy Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Harbour Energy Plc made the list?

Assessing viability

Harbour certainly seems to be enthusiastically expanding its business but oil and gas is a tough industry. Prospecting for new wells can be expensive and at times, can yield no returns. Many independent companies experience long periods of losses and mounting debt with no guarantee of a recovery.

When assessing oil and gas companies, it’s important to consider how many years of reserves they hold. The potential value of an as-yet untapped reserve depends on its commercial viability.

Successful explorations amount to assets on the balance sheet and then slowly decrease as they are depleted. As incoming cash is used to fund new explorations, the company can quickly fall back into a low valuation.

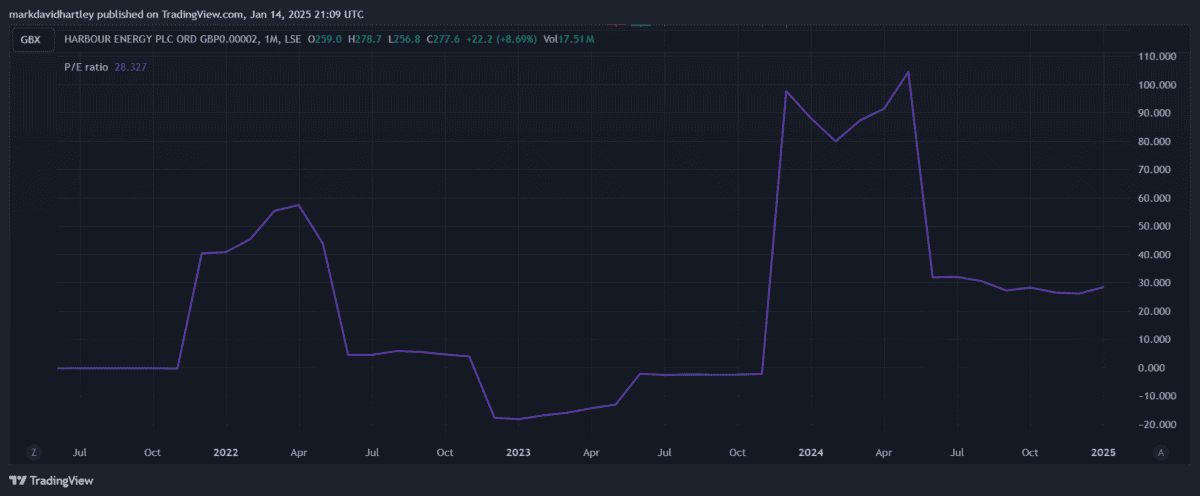

Thus, accurately assessing the investment viability of an oil and gas company can prove difficult. This is often made most evident by a wildly fluctuating price-to-earnings (P/E) ratio.

Value and dividends

In the graph above, we can see how Harbour’s trailing P/E ratio has moved in a range between -18 and +105 over the past few years.

Currently, it’s positive and sits around 28, which looks expensive for investors considering it now. But the recent boost in production means earnings are forecast to improve significantly, so it has a forward P/E ratio of only 10.

That means the current share price of 277p could be very cheap, prompting analysts to forecast an average 12-month price target of 370p — a 33% increase!

An extra 8% in dividends on top of that would be the cherry on top. But with almost no track record of payments, it’s impossible to say whether its dividends are reliable.

With no steady or consistent cash flow, energy companies can be unreliable when it comes to dividends. Last year, for instance, Diversified Energy Company slashed its dividend and the yield fell from 15% to 7.2%.

Subsequently, I wouldn’t factor in the dividend when assessing the long-term value of Harbour.

Further advancements

But in December 2024, Harbour enjoyed further good news. In cooperation with partner Ithaca Energy, it discovered hydrocarbons in the Jocelyn South prospect in the North Sea. Of course, while the discovery is promising, the commercial viability of it still needs to be evaluated. As ever, there’s a risk it could cost a lot and amount to little.

While Harbour’s developments seem promising, I don’t plan to buy it today. However, it may be worth considering for risk-tolerant investors keen on emerging energy stocks.