Based on payouts over the past 12 months, Harbour Energy (LSE:HBR) is one of the best dividend shares on the FTSE 250. Due to its generous yield, it sits comfortably within the top 10% of stocks in the UK’s second tier of listed companies.

And following the acquisition of assets previously owned by Wintershall Dea, it’s now the largest oil and gas producer in the North Sea. This transformational deal, which was completed in September 2024, means the group now has the financial firepower to further increase its dividend.

Indeed, the company intends to pay $380m to legacy shareholders over the next 12 months. At current (9 January) exchange rates, this equates to 21.5p (26.4 cents) a share. At the time of writing, Harbour Energy’s shares are changing hands for around 265p. This implies a yield of 8.1%, more than twice the FTSE 250 average.

But returns to shareholders are never guaranteed, particularly in the oil and gas sector. Earnings can be volatile, which means dividends can fluctuate significantly from one period to another.

However, in it’s short existence as a listed company, Harbour has an impressive record of steadily increasing its payout (see table below).

| Financial year | Dividend type | Dividend per share ($) |

|---|---|---|

| 2021 | Final | 0.11 |

| 2022 | Interim | 0.11 |

| 2022 | Final | 0.12 |

| 2023 | Interim | 0.12 |

| 2023 | Final | 0.13 |

| 2024 | Interim | 0.13 |

Excess profits

Undoubtedly, this has been made possible by spikes in wholesale oil and gas prices, particularly in 2021 and 2022.

But this is a double-edged sword.

In response to public pressure, the previous government introduced a ‘windfall tax’, officially known as the Energy Profits Levy (EPL). Not surprisingly, the company’s share price has been steadily declining since the May 2022 announcement.

Subsequent increases mean the group now faces an effective corporation tax rate of 78% on its profits derived from the UK Continental Shelf.

In part, this explains the acquisition of Wintershall Dea’s oil and gas fields. None of these are in UK waters, therefore the EPL doesn’t apply. And as a result of the deal, the group is now producing 90% more than previously. This gives me some confidence that it can continue to grow its dividend.

Commodity prices

Current legislation means the EPL will remain until 31 March 2030. But there are provisions for it to be scrapped.

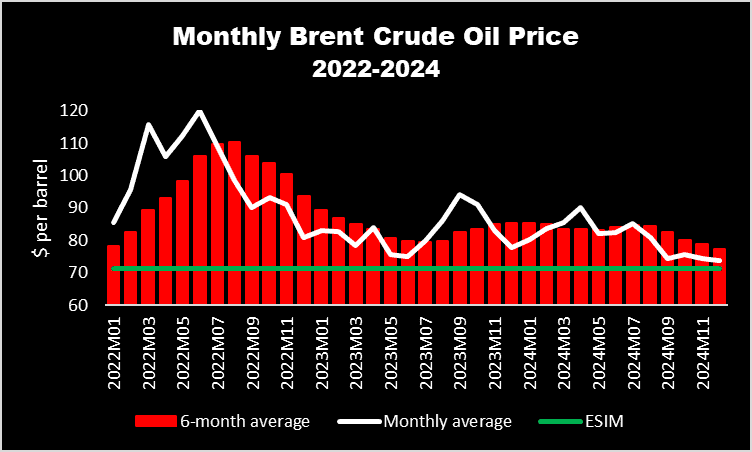

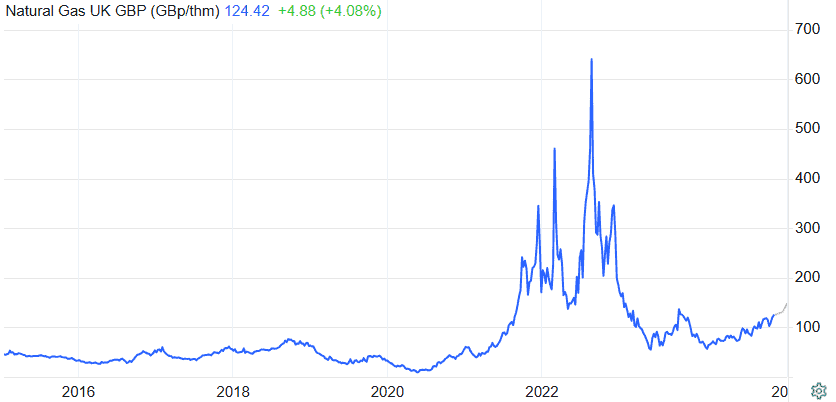

On the one hand, a falling oil and gas price would damage revenue. However, if (for six consecutive months) the average monthly oil price falls below $71.40 — and the gas price goes under 54p a therm — the ‘windfall tax’ will be abolished.

But this appears unlikely to happen any time soon.

Although Brent crude is falling, it still remains above the price floor.

And I wonder if gas prices will ever drop below 54p again.

In my opinion, it looks as though the EPL is here to stay.

My opinion

Despite this, I plan to keep my Harbour Energy shares.

That’s because I think diversifying away from the UK is a good move.

And although it’s impossible to accurately predict future energy prices, the additional profits earned outside of Britain’s waters should help ensure that the group is able to — at least — maintain (in cash terms) its generous dividend.