Investing in the S&P 500 has provided exceptional returns over the long run. During the 10 years to November 2014, the benchmark US share index provided an average annual total return of 12.7%.

Past performance isn’t always a reliable guide to future returns. But based on the last decade or so, how much could a 40-year-old investing £500 monthly in the S&P 500 make by the time they retire?

Talking tech

The S&P 500‘s remarkable performance can in part be attributed to strong growth in the US economy, which has boosted profits of local shares and confidence in the stock market.

The index’s large contingent of multinational companies that dominate overseas markets also helps. This provides additional opportunities to grow earnings and a chance to harness global economic expansion.

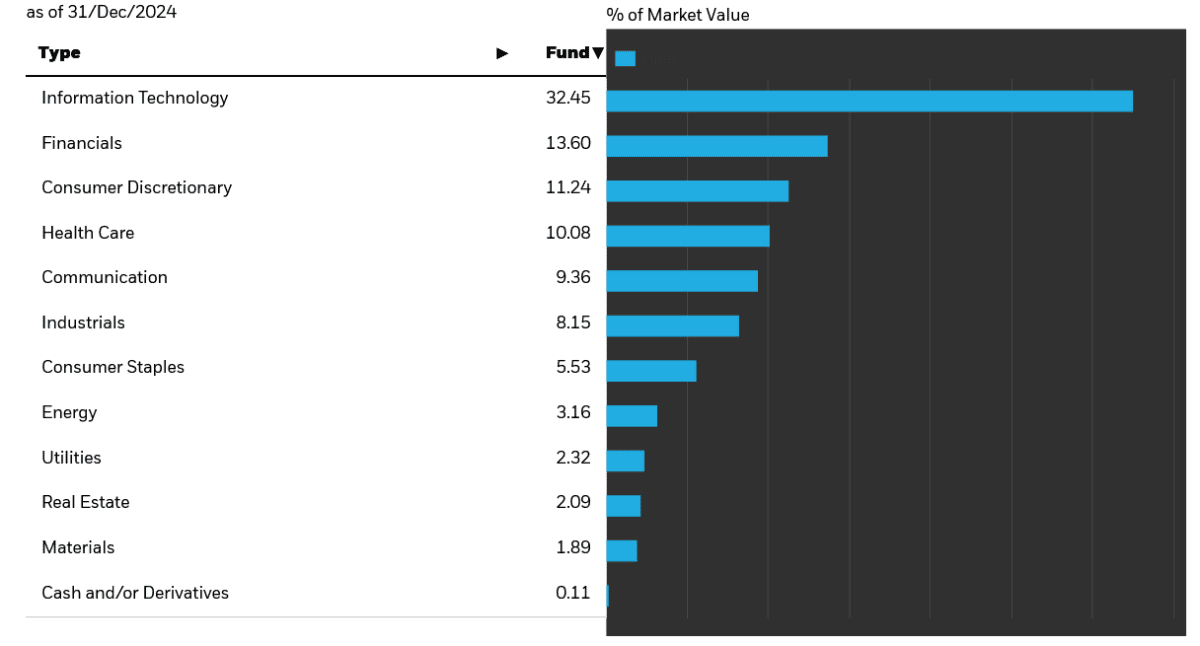

That being said, the S&P 500’s high weighting of fast-growing technology shares has been its biggest driver this century. Just under a third of the index consists of information technology firms like semiconductor manufacturers (like Nvidia), hardware producers (Apple) and software developers (Microsoft).

Other major tech names can be found under non-IT categories as well. Amazon and Tesla sit inside the consumer discretionary bracket, while Meta and Alphabet are classified under communications.

As this list shows, the S&P 500 is home to companies that are pioneering the digital economy. And they have the scale and the know-how to continue innovating, which could lead to further sustained growth and high returns.

Building a £1m portfolio

Looking ahead, many S&P 500 shares face challenges that could damage the index’s overall performance.

These include a new era of trade wars during Donald Trump’s second US Presidency. This could damage profits at multinational businesses, and especially those across the critical technology sector.

Other risks include sustained economic weakness in China, persistent inflationary pressures, and rising conflict in Europe and the Middle East.

But the S&P 500 has previously overcome many macroeconomic and geopolitical challenges to deliver mammoth returns. And I’m optimistic it can do so again.

If the S&P 500 maintains the 12.7% annual average return of the past decade, a 40-year-old investing £500 monthly in a index tracker fund from today could — 25 years from now — have a portfolio worth more than a million pounds (or £1,064,454, to be exact). That’s excluding broker-related fees and foreign exchange movements.

Targeting larger returns

That’s a pretty good return. But they could target an even larger retirement pot by purchasing an exchange-traded fund (ETF) that’s focused on the high-growth tech sector.

The SPDR S&P US Technology Select Sector ETF (LSE:GXLK) is one such fund that could create substantial wealth. With an ongoing charge of 0.15%, it is also one of the most cost-effective funds out there.

Since its inception in July 2015, this SPDR fund has delivered an average annual return of 21.3%. If this continues, someone who invested £500 a month here could have £5,493,940 in 25 years. Again, this excludes broker costs and currency movements.

The fund’s cyclical nature means performance will lag during economic downturns. However, over the long term, I’m optimistic it could deliver whopping returns given the massive growth potential of artificial intelligence (AI) and other emerging technologies.