Compared to overseas equities, the returns on UK shares have broadly underwhelmed over the past decade. A blend of low economic growth and extreme political turbulence have limited share price gains as investors have prioritised buying foreign stocks.

Yet there have been some spectacular performances from particular British shares over this time. Take these two FTSE 100 blue-chips, for instance:

| Stock | Average annual return since 2014 |

|---|---|

| JD Sports (LSE:JD.) | 17.5% |

| Scottish Mortgage Investment Trust (LSE:SMT) | 14.9% |

To put their robust performances into context, the annual returns of FTSE 100 and S&P 500 over the same timeframe sit way back, at 6.1% and 12.7%, respectively.

Should you invest £1,000 in JD Sports right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if JD Sports made the list?

I’m optimistic that they may continue to outperform these heavyweight indexes for the next decade too. Here’s why.

Tech trust

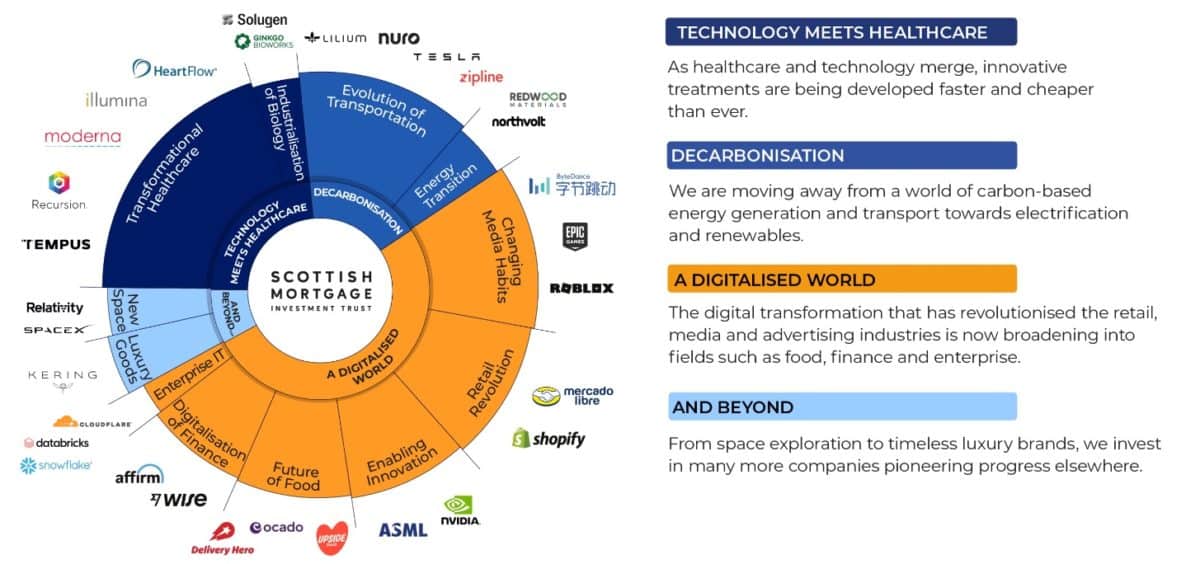

Surging demand for tech stocks has underpinned the S&P‘s strong gains of the past decade. So it’s not tough to see why Scottish Mortgage Investment Trust — which provides targeted exposure to online retailers, software developers and the like — has delivered superior returns.

Holdings like Amazon, Tesla and Apple mean the trust has capitalised on hot trends like e-commerce growth, electric vehicle (EV) adoption and soaring smartphone sales. Today it has stakes in 95 different companies, giving it exposure to a multitude of white-hot growth sectors for the next decade.

All this being said, the risks of owning Scottish Mortgage are growing. I’m worried that an escalating tech trade war between the US and China could dampen annual returns over the next 10 years.

In December, the US slapped fresh restrictions on advanced microchip shipments to China. Within days, Beijing said it was investigating Nvidia on the grounds of breaking local anti-monopoly laws.

These tit-for-tat actions could intensify further once tariff fan and China critic Donald Trump returns to the White House this month. But despite this, there’s a good chance in my opinion that Scottish Mortgage will deliver another decade of market-beating returns.

Global digitalisation is poised to continue at rapid pace, providing the trust with terrific profit potential. Fields like artificial intelligence (AI) and robotics in particular have significant scope for growth.

Sports star

JD Sports had a poor 2024 as inflationary pressures and higher interest rates squeezed consumer spending. These remain dangers across the sportswear retailer’s US, UK and European markets in the New Year and potentially beyond.

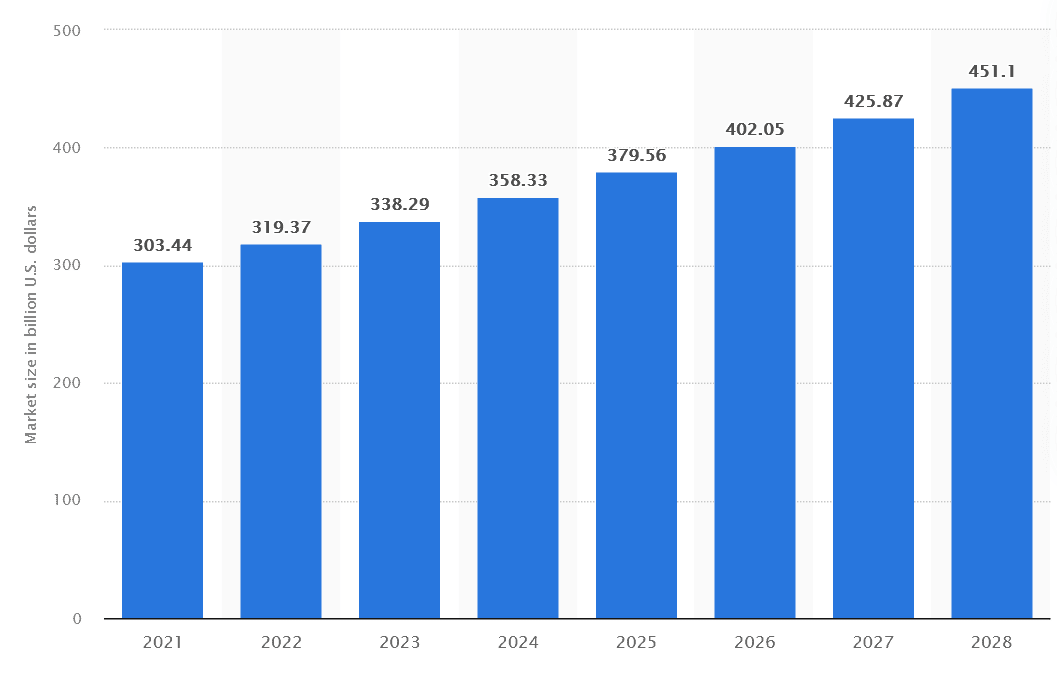

But as with Scottish Mortgage, I think the potential long-term rewards here make it worthy of consideration. The global activewear (or athleisure) market is tipped to continue taking off, as the chart from Statista below shows.

As we saw during the last decade, JD should be in good shape to capitalise on this opportunity. Under its long-running expansion scheme, it plans to open between 250 and 350 stores each year through to around 2028.

A strong balance sheet also gives the Footsie firm scope to make more earnings-boosting acquisitions. Its most recent acquisition was France’s Courir, whose completion in December boosts JD’s presence in Europe’s largest sneaker market.

I also like JD’s leading position in the premium athleisure market where growth is especially strong. Given its low price-to-earnings (P/E) ratio of 7.5 times, I think it has significant room for a share price recovery.