Looking for the best cheap UK growth shares to buy for the New Year? Here are two of my favourites.

Marston’s

Trading conditions are becoming increasingly difficult for the traditional public house. Changing consumer habits, cheap supermarket booze, and soaring costs have all smashed profitability acros the sector.

Combined, these pressures have seen 2,000 pubs close their doors for good since the start of 2020, according to Altus Group.

But City analysts don’t hold any fears for Marston’s (LSE:MARS). They expect strong earnings growth all the way through to financial 2027, as the table below shows.

| Financial year ending 30 September | Predicted growth |

|---|---|

| 2025 | 56% |

| 2026 | 15% |

| 2027 | 12% |

Marston’s isn’t immune to broader pressures in the pub sector. But its sales are outperforming the broad industry thanks to its diversified estate. Its portfolio includes an even spread of differentiated venues from your local traditional pub to sports pubs, adult dining pubs, and family pubs.

It’s a recipe that’s proving to be a winner. Reported and like-for-like revenues were up 3% and 4.8% in the last fiscal year, pushing underlying operating profit 17.9% higher.

Market-beating sales aren’t the only impressive thing at Marston’s. Margins are booming thanks to initiatives like cutting labour and energy costs, changing pub menus, and improving revenue per customer.

Last year, the underlying EBITDA margin leapt 190 basis points to 21.4%. And Marston’s is targeting margin expansion “of 200-300 basis points” from this point on as its efficiency strategy rolls on.

I’m still a bit concerned about the high levels of debt the pub operator’s servicing. This has dropped significantly, but net-debt-to-EBITDA was still high at 6.5 times as of September.

But the cheapness of Marston’s shares still makes it worth a very close look, in my opinion. Its forward price-to-earnings (P/E) ratio is 5.4 times, while its price-to-earnings growth (PEG) multiple is just 0.1.

Any reading below one implies that a stock is undervalued.

TBC Bank

Political uncertainty in Georgia makes investing in its local companies higher risk than usual. The economic impact of whether the country chooses closer ties to Russia or the EU will be significant.

Yet some Georgian shares are so cheap they’re still worth a close look, in my view. TBC Bank (LSE:TBCG), for instance, has a forward P/E ratio of 3.9 times and a PEG ratio of 0.2.

A low valuation isn’t the only attractive thing that TBC Bank shares with Marston’s. As the table shows, earnings here are also tipped to continue taking off:

| Financial year ending 31 December | Predicted growth |

|---|---|

| 2025 | 20% |

| 2026 | 19% |

This isn’t a surprise (to me at least) given the ongoing strength of Georgia’s economy. Latest data showed GDP expand a whopping 11% in quarter three, the sort of figure the UK — and with it domestic banks like Lloyds — can only dream of.

Cyclical shares like TBC Bank are reaping the rewards of this breakneck growth. Thanks to soaring loan demand, TBC’s pre-tax profit leapt 19.1% in the three months to September.

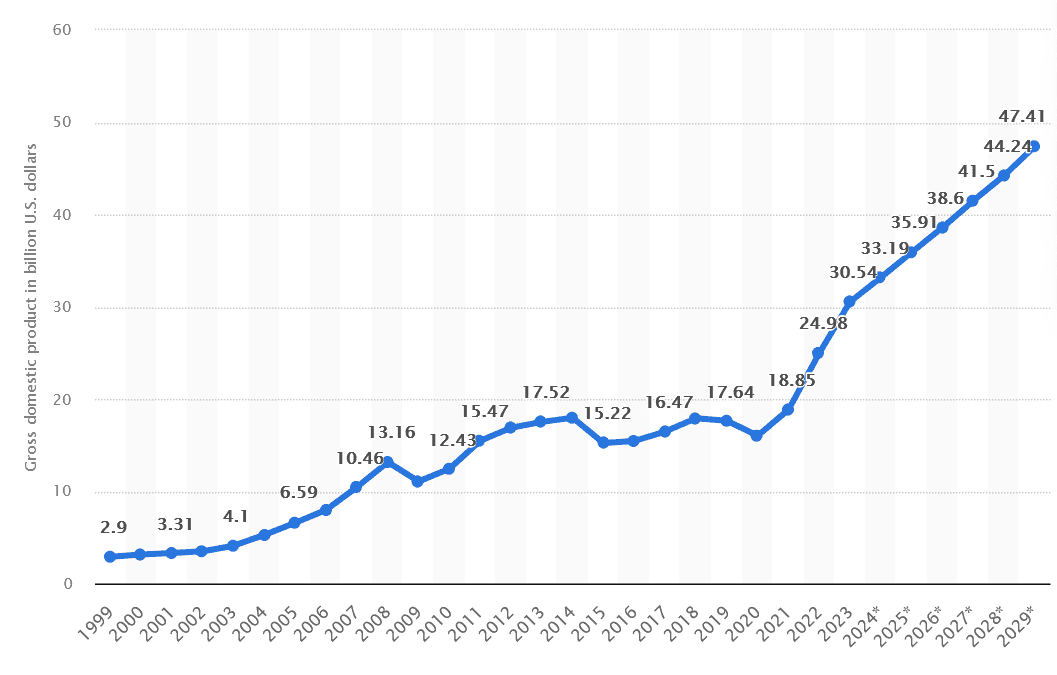

WIth low banking product penetration persisting, I’m expecting the bank to continue enjoying staggering earnings growth as the economy grows. Analysts at Statista are expecting supportive GDP growth to continue to 2029 at least, as shown below:

It’s not without risk, as I mention. But the possibility for further substantial profits and share price growth makes TBC a growth share to consider.