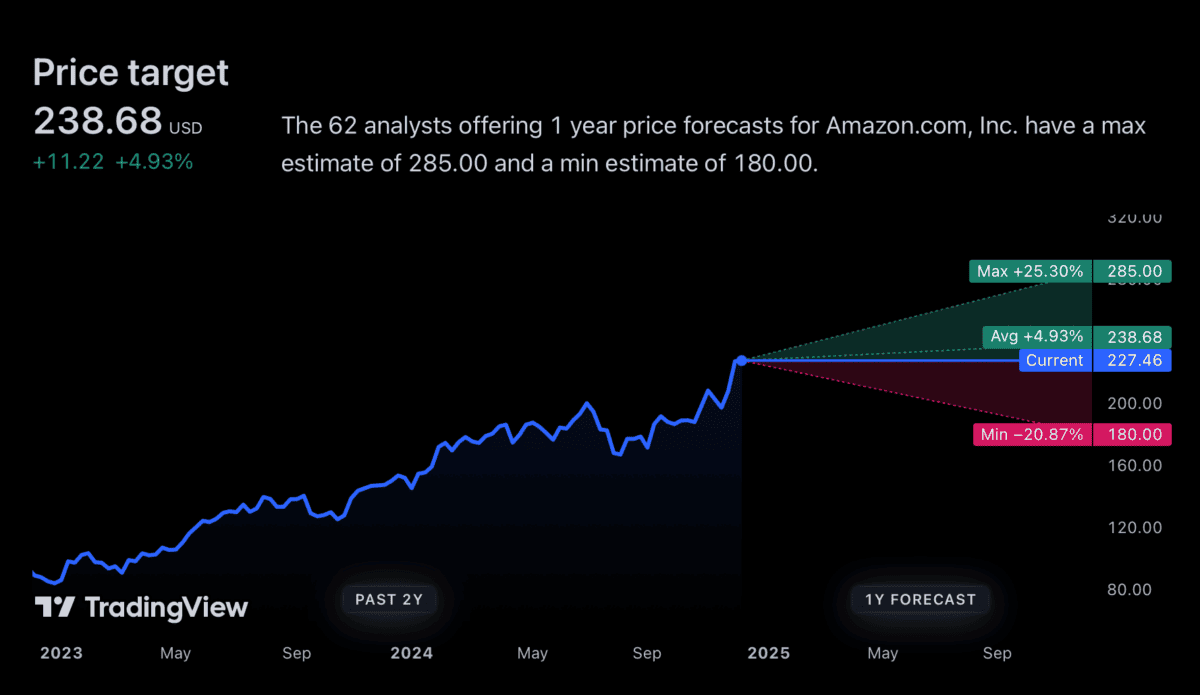

The Amazon.com (NASDAQ:AMZN) share price has comfortably outperformed the S&P 500 this year. But analysts are expecting a more subdued performance in 2025.

The average price target for Amazon over the next year is 5% higher than the current level – below expectations for the index. But I think the company’s latest innovation could give the stock a boost and that makes it worth considering for investors looking for stocks to buy.

Source: TradingView

Selling cars

There are only a few things people can’t buy on Amazon. Until recently, that included cars, but the company has recently expanded into allowing people to buy vehicles through its platform.

So far, the only manufacturer on the platform is Hyundai, but more companies are expected to join in 2025. And there are potential benefits for both sides. Listing through Amazon might help sellers access a bigger customer base. And for the marketplace, it could generate revenues with very little by way of associated costs.

So far, so good. But selling cars online has been tried before and the dealership model has proven hard to disrupt. So is there any reason to think it’s going to succeed this time?

Scale

Success isn’t guaranteed, but it doesn’t cost Amazon much to try the idea out and it does have a good start in terms of what could potentially be the biggest obstacle. The challenge is scale.

The operation needs both buyers and sellers, but attracting one without the other’s hard. Vendors are unlikely to list in places people don’t look and buyers won’t search in places that don’t have many cars.

Amazon though, has an advantage here. Its marketplace already attracts a significant number of users and it might be able to use this to help it convince manufacturers to list on its platform.

If it can do this, having more buyers should bring more sellers and the cycle continues. So as an Amazon shareholder, I think there are reason to believe this is at least worth exploring.

Risks

It might turn out that even the mighty Amazon can’t disrupt the existing way of buying and selling cars. But even if it fails, I’m not expecting a significant hit in terms of returns.

In terms of investment risks, I’m much more focused on the possibility of the company attracting antitrust attention. This has been an issue for Alphabet this year and I think the risk is real.

Amazon works so well because the various bits of its network support each other. The marketplace attracts users to other services, which are the main profit engines for the business.

Either one without the other would be a much weaker – and a much less attractive investment. So this is where I think the real threat to Amazon is over the coming year.

Worth a look?

I think the move into selling cars is something of a shot to nothing. I don’t anticipate a significant problem if it fails and if it succeeds it could be a very nice addition.

In my view, the company’s in a better position than anyone else to make selling cars online work. And I think it could boost the Amazon share price in 2025.