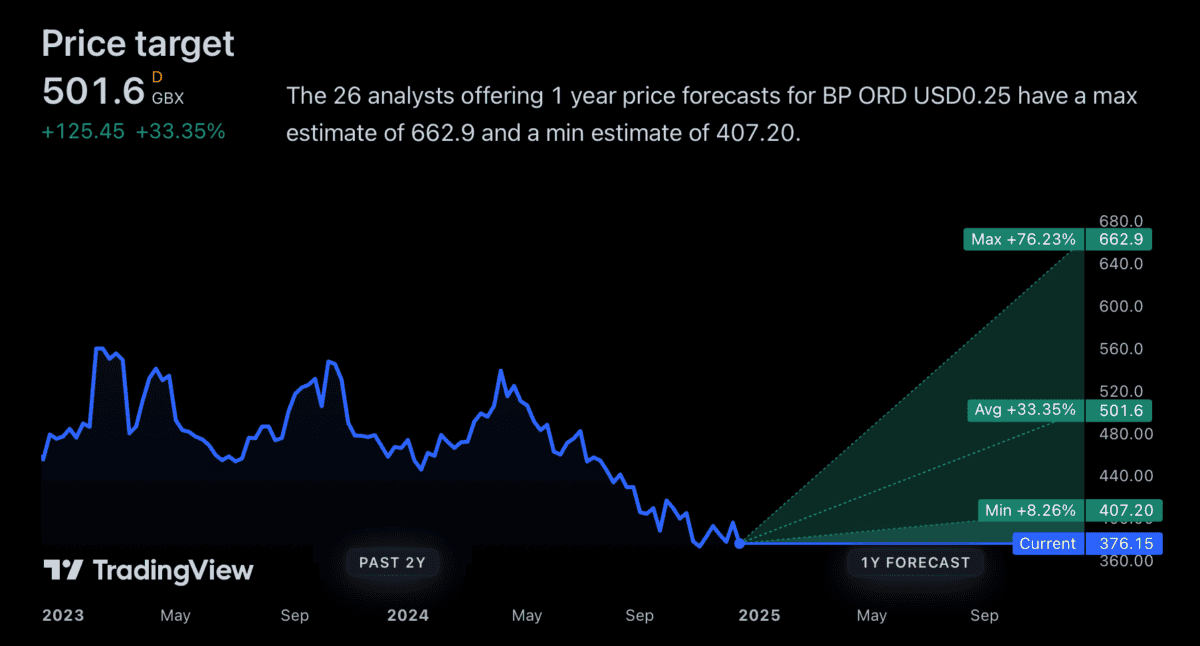

Analyst price targets for BP (LSE:BP) shares are pretty optimistic heading into 2025. The highest estimate I can find is £6.62.

Source: TradingView

That’s around 75% higher than the stock’s current level. So while 2024 hasn’t been a good year for the BP share price, could 2025 bring a dramatic turnaround?

Oil outlook

The most important thing for BP – as with any oil major – is the price of oil. But while I have a positive view on this over the long term, I’m not hugely optimistic for 2025.

A couple of things make me wary – both on the supply side of the equation. The first is the possibility of increased production coming from the US as lower taxes bring down costs across the Atlantic.

Furthermore, oil output in Saudi Arabia is currently near 2020 (i.e., pandemic) levels. With lower costs than the competition, I think it’s a matter of when – rather than if – production increases there.

Saudi Arabia oil production 2015-2024

Source: Trading Economics

For the oil price to stay at its current level, I think demand will need to increase. And outside of China – which is admittedly a huge factor – I’m not confident this will happen in the next 12 months.

Valuation

At the moment, BP shares trade at a significant discount to other oil majors. But by itself, this isn’t a strong reason for thinking the share price is going to rise next year.

One of the lessons I’ve learned in 2024 is that low prices can persist for a long time. And if it takes too long for the underlying value of the shares to be realised, this can make for a disappointing investment.

Importantly, though, management is taking advantage of the discounted valuation. It’s in the process of buying back shares, which will be more effective the longer the share price stays down.

Furthermore, there’s a dividend with a 6.31% yield on offer at the moment. This should go some way towards offsetting the opportunity cost of waiting for investors looking for a potential recovery.

Price targets

A 75% jump might seem like a lot – and it is. But it might not be implausible given the valuations – and dividend yields – on offer elsewhere in the sector.

If the BP share price reached £6.62, the dividend yield would fall to 3.63%. That’s towards the lower end of the range the other oil majors are trading in, but it wouldn’t make it a big outlier.

| Stock | Dividend yield |

|---|---|

| BP | 6.32% |

| Chevron | 4.62% |

| ConocoPhillips | 3.28% |

| ExxonMobil | 3.75% |

| Shell | 4.49% |

| TotalEnergies | 6.19% |

That goes a long way towards justifying a £6.62 price target for BP shares. Even at that level, the stock would still have a similar dividend yield to ExxonMobil.

Investors should keep in mind that US firms are set to benefit from tax cuts, while UK oil companies are facing windfall taxes. But even considering this risk, the valuation discount is very wide at the moment.

Opportunity?

As far as I can see, the best reason for thinking the BP share price might be about to climb 75% is that this would close the valuation gap to the other oil majors. And that isn’t a bad idea, by any means.

Investors need to consider how quickly this might happen. But with a substantial dividend in addition to ongoing share buybacks, there’s a chance the wait might be worth it.