Scottish Mortgage Investment Trust (LSE: SMT) prides itself on finding the next big-winner growth stock. But this approach comes with a fair amount of volatility.

For proof, look at the Scottish Mortgage share price, which has risen 41% over the past 18 months but still remains 37% lower than its 2021 peak.

When the S&P 500 and Nasdaq are both surging to new heights on an almost daily basis, that’s been a bit frustrating for many shareholders (myself included).

Granular data

Perhaps that’s why there’s been a noticeable effort from the managers to increase engagement with shareholders. More interviews, webinars, updates, insights, that type of thing.

There was even an October lunch interview with lead manager Tom Slater in The Times, where we learned that he likes aubergine involtini and uses a smart mattress to track his sleep.

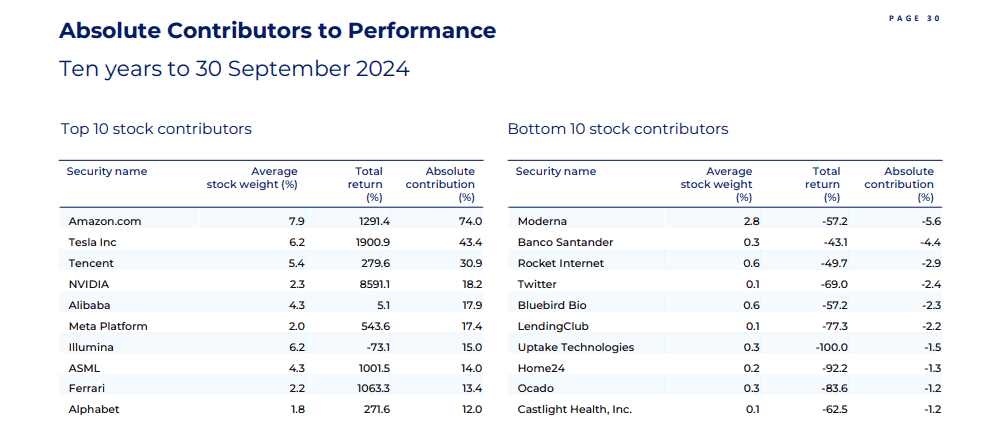

Recently, Scottish Mortgage also released a quarterly data pack, which gave shareholders an under-the-bonnet peak at the portfolio returns. There was some interesting info in there, I think, that proves the power of long-term investing.

A FTSE flop

Just 3% of the trust’s assets are currently in UK stocks. One of them is Ocado (LSE: OCDO), the online grocery/robotics company.

According to the Q3 data pack, the trust’s investment in it had fallen by 83.6% in the five years to 30 September. Ouch.

With the benefit of hindsight, we can see that investing in Ocado in 2020 during the peak of the pandemic-driven online grocery boom was folly. It’s been downhill ever since, with post-Covid conditions normalising, along with Ocado’s growth rates.

The firm has even been demoted from the blue-chip FTSE 100 after its spectacular fall. The problem comes down to profits, or lack of them. In H1 2024, it reported a pre-tax loss of £154m.

I had a brief encounter with the stock a year ago, opening a small position then running for the hills when the CFO said it would be up to another “six years” (!) before the firm expected to make a pre-tax profit.

One risk here is that Ocado needs to tap shareholders for more money at some point. After all, the high-tech robotic warehouses it builds in partnership with leading global grocers aren’t cheap.

That said, Ocado’s been the UK’s fastest-growing grocer in recent months, while its robotics business still has exciting potential. However, I won’t invest, preferring instead to gain exposure through Scottish Mortgage’s stake (what’s left of it).

Asymmetry in action

For every handful of Ocados that drop 80%+, the trust has hit the jackpot with a huge winner.

We saw this in the data pack, which confirmed that its stakes in Nvidia and Tesla had returned 2,475% and 1,415%, respectively, over five years. Nice.

Across 10 years, the asymmetric returns were even more pronounced. The trust was sitting on five ’10-baggers’ (10x returns). These were Nvidia (actually an 85-bagger!), Tesla, Amazon, ASML, and Ferrari.

It’s these outliers that have helped Scottish Mortgage deliver a 347% return over the past decade, thrashing the 211% produced by the FTSE All-World index.

The risk is that the managers fail to identify the next generation of massive stock market winners. But looking the portfolio today, I’m optimistic that they’re in there somewhere, ready to drive more gains.