Legal & General (LSE: LGEN) shares have enjoyed a nice little spell recently. As I write, the FTSE 100 financial stock is up 7.6% in just over a month.

Over five years though, L&G shares have fallen around 24.3%. That’s obviously not great.

But the income…

The silver lining to that subdued share price is that the dividend yield now stands at a delicious 8.9%. That’s among the highest around in the UK market (or anywhere else).

Better still, analysts expect the insurance and asset management firm to pay out 21.8p per share in dividends in 2025. With the current share price at 231p, that puts the forward-looking yield at 9.4%!

It means £10,640 invested in the shares would generate me £1,000 a year in annual passive income.

Naturally, dividends aren’t guaranteed, and the share price could continue underperforming (reducing the total return). But as a shareholder myself, I do like the look of the income potential here.

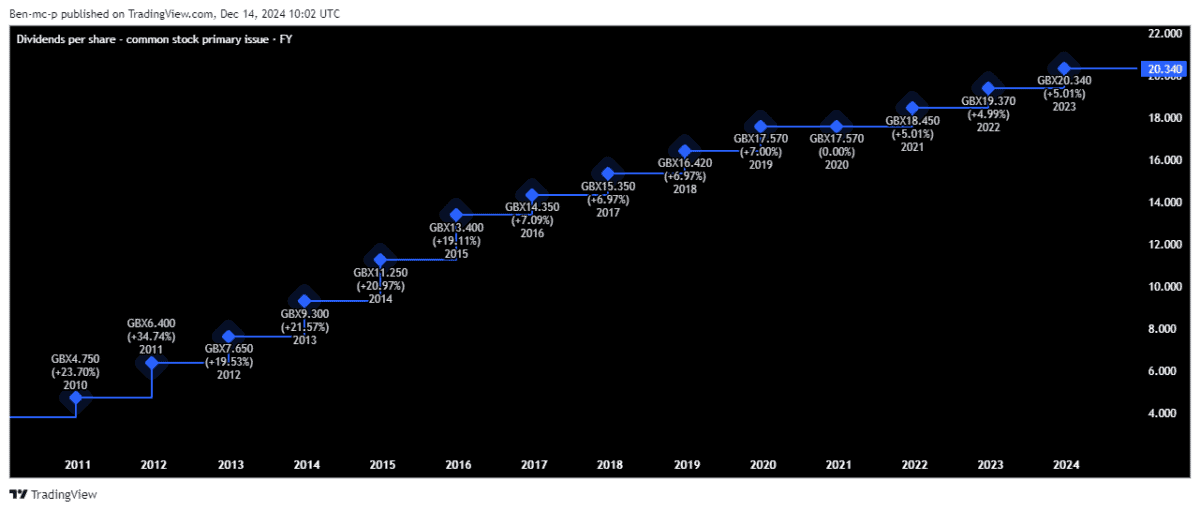

Additionally, I love its tremendous long-term dividend growth record.

But should I buy more shares?

I have some reservations

Admittedly, if it wasn’t for the clockwork-like dividends and monster yield, there wouldn’t be much to get excited about. Legal & General’s growth has been sluggish, with the firm operating in steady but mature markets.

Plus, while boasting a strong brand and vast experience, the firm also faces quite a bit of competition in the UK. This is something to consider.

Meanwhile, it also operates in a heavily regulated industry. This partly explains why international investors haven’t been keen to snap up UK financial stocks since the 2007/08 financial crisis.

With Donald Trump back in the White House aiming to deregulate and unleash animal spirits, it’s possible that the stock continues to meander in the wilderness for the next five years. Or perhaps the opposite might be true.

Interest rate cuts could help, potentially leading to a re-rating of the stock. However, inflation crept back up in October, to 2.3%, above the Bank of England’s 2% target and the sharpest rise in a while. So rate cuts aren’t now a shoo-in over the coming months.

Steady away

Looking at the business, it appears to be solid, with trading currently in line with expectations.

Between 2024 and 2027, L&G anticipates core operating earnings per share increasing at a compound annual growth rate (CAGR) of between 6% and 9%.

In early December, management also suggested that shareholder returns could be higher than previously outlined. As a reminder, it had committed to a modest £200m share buyback and a 2% rise in the annual dividend, following a 5% hike this year.

This news is what perked up the share price recently.

I’ll keep reinvesting

On balance, I still rate this as one of the best high-yield dividend stocks around. I’d like to see a bit better share price performance, but the 9%+ yield makes up for this.

I’ll invest more money in the stock during 2025, though not £10,640 as that would be a big chunk of my ISA allowance used up on a single share.

What I will do however is reinvest any dividends I get to fuel the compounding process. Even if the annual yield remains steady at 9.4%, simply reinvesting those payouts could grow £3k to £10k inside 14 years.