Past returns are not always a reliable guide to the future. But if the historical performance of FTSE 250 stocks does continue, an investor could build a large shares portfolio with just a few pounds set aside each day.

Even those who reach middle age with £0 in savings could have a great chance of retiring in comfort. With a balanced portfolio of growth and dividend shares, investors have a chance to build a big retirement pot in under 30 years.

Here’s how.

Starting from zero

It’s a cliche, but it’s never too late to begin saving or investing for retirement. Even a small amount set aside each day can make a big difference to our post-work lifestyles. And as inflationary pressures recede, this should become possible for millions of people.

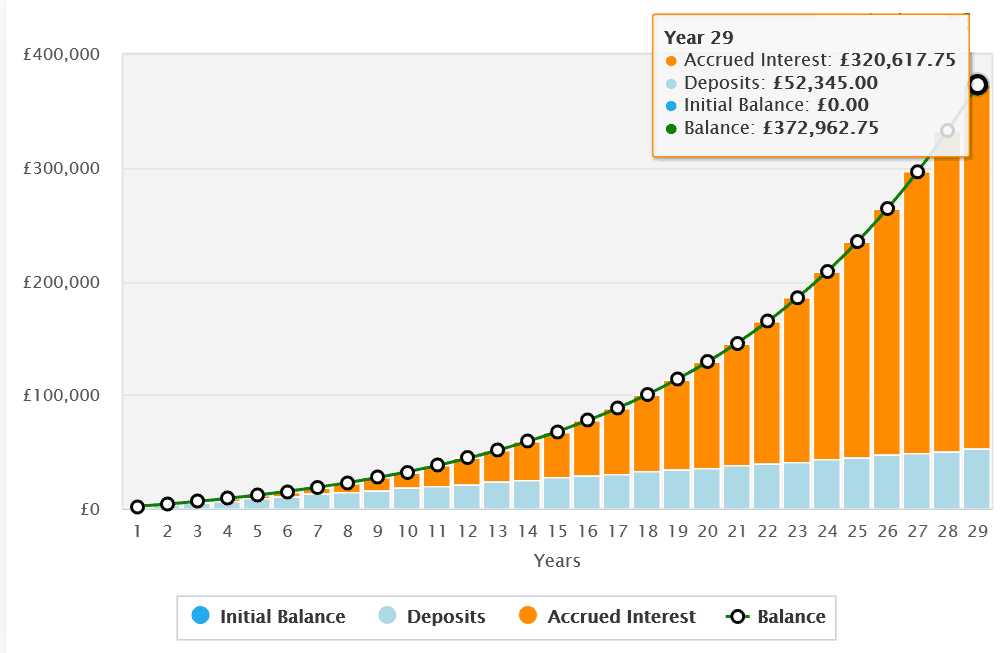

Let’s say someone has £5 in their pocket to invest a day. This could, if invested in a FTSE 250 index fund, create a portfolio worth more than £370k after just 29 years.

This seems like an extraordinary sum of money for such a small daily saving. So let me break this down to show you how it could work.

Building wealth

Investing that saved cash every day, week, or even month, could be a bad idea. This is because a large percentage of that money would be eaten up in trading fees.

Investing quarterly may be a better way to balance cost and reward. An investor who chose this path would have £451.25 every three months to put in that FTSE 250 fund if they used a broker who charged a fiver per trade (£456.25 – £5).

After 29 years, the mathematical miracle of compounding could turn that £5 saved each day into a portfolio worth £372,963.

That’s assuming that the FTSE 250 continues delivering its long-term average annual return of 11%.

It also supposing the investor uses a Stocks and Shares ISA to protect them from capital gains tax and dividend tax.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

A top FTSE 250 share

Combined with the State Pension, this £370k+ ISA could provide someone with a decent standard of living in retirement.

However, they could potentially have an even larger nest egg if they invested in individual shares rather than a FTSE 250 tracker fund. Software developer Kainos Group (LSE:KNOS) is one such stock on my watchlist.

Investing in individual shares carries more risk than buying a fund that hold hundreds of different companies or more. In this case, returns from Kainos could disappoint during economic downturns when companies scale back spending.

But the future is bright for Kainos, in my opinion, as private and public sector entities continue digitalising their operations. Since its IPO in 2015, the tech star has delivered an average annual return of 19.5%.

I’m especially excited by its growing position in artificial intelligence (AI). The firm’s executed more than 140 AI & Data projects so far, and racked up another 40 contracts here in the six months to September.

Robust cash generation gives Kainos the means to keep investing heavily in this growth area, too.