Savings levels in the UK have hit record highs above £2bn in 2024. But could prioritising saving instead of buying UK shares be costing individuals a lot of cash?

I think so. And fresh research from Janus Henderson Investment Trusts supports that view. It shows that cash savings “returned less than a third of that returned by stocks and shares” in the nine months to September.

It means that Britons have literally missed out on tens of billions of pounds.

A £165bn black hole

According to Janus Henderson, savers earned £58.6bn worth of interest between January and September, equivalent to an average interest rate of 2.93%.

By comparison, the FTSE All-Share Index returned 9.9% through a blend of capital gains and dividend income. Meanwhile, the MSCI World Index provided an even-higher return of 13.4%.

The result in real terms is jaw-dropping. Using Janus Henderson’s calculations, “savers have missed out on £165bn of returns… by comparing cash interest and the return on global equities.”

The report adds that “savers have missed out on £110bn of returns this year compared to investing in UK equities.” Both calculations even allow for three months’ household income being held in a savings account.

Long-term trend

This stunning difference isn’t just a temporary development either. And it’s even more depressing for cash savers when we factor in the eroding impact of inflation.

Janus Henderson says that “£100 saved in cash has lagged behind rising prices by 3.4% over the last 30 years, meaning it buys less today, even with all the interest income earned since, than it did in 1994.”

Conversely, that £100 invested in global shares would have beaten inflation almost seven-fold, or four-fold if spent on UK shares.

A top fund

Past performance is no guarantee of future success. But the resilience and wealth-creating power of the stock market is why the lion’s share of my money is tied up in shares, funds and trusts.

I only hold some money in a savings account to manage risk, and give me cash to draw on in the event of a rainy day. While this is a riskier strategy, I can take steps to reduce the danger by diversifying my holdings.

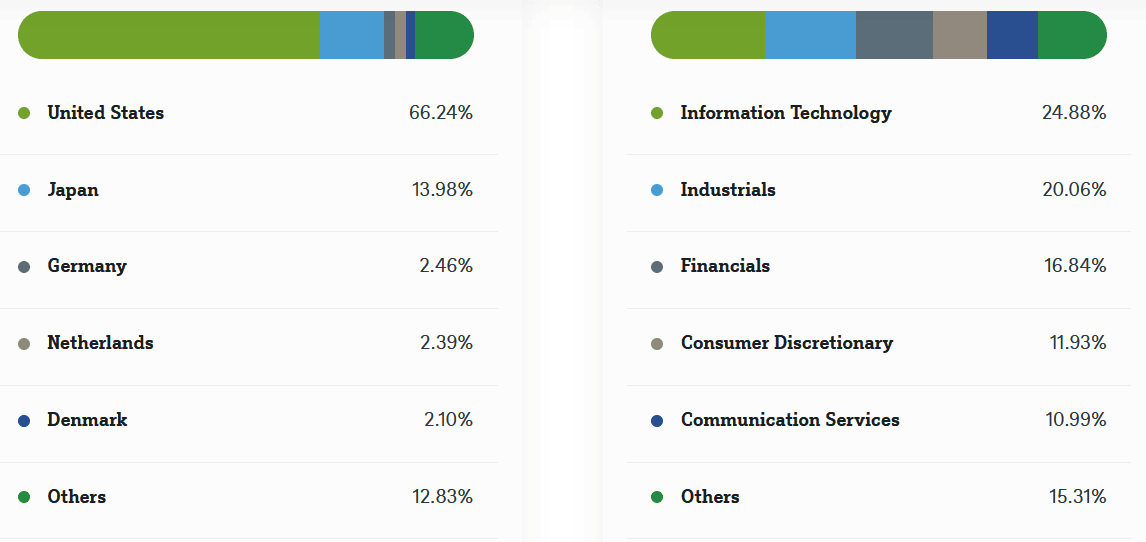

One strategy I use is to invest some of my capital in exchange-traded funds (ETFs) like the Xtrackers MSCI World Momentum UCITS ETF (LSE:XDEM).

As the name implies, this fund invests in shares from across the globe, 350 in total. And so it allows me to spread risk across a variety of regions — including the UK — as well as a multitude of sectors.

I like the decent exposure to tech stocks including Nvidia, Apple and Meta. This gives me an opportunity to profit from fast-growing tech phenomena including artificial intelligence (AI), robotics and quantum computing. But I’m aware that shares like this could deliver disappointing returns during economic downturns.

Since 2014, this fund has delivered an average annual return of 11.9%. If this continues, a £10,000 investment today would become £348,975 after 30 years.

That’s far better than the £24,568 I could have made by parking £10k in a 3%-yielding savings account.

Shares and funds can rise and fall in price. But returns like this suggest my current strategy is the correct one for me.