I’m not a betting man. But I bet Sage Group (LSE:SGE) wouldn’t the first name on someone’s lips if I was to ask them to name great dividend shares.

This isn’t a poor reflection on Sage. Rather, it’s because growth-chasing stocks aren’t renowned for also being generous dividend payers. Any spare cash such companies have tends to be reinvested to generate more profit.

However, Sage — which develops accounting, payroll, and human resources software — is an exception to this rule. It’s committed to reliably raising shareholder payouts while still investing shedloads of capital into its operations.

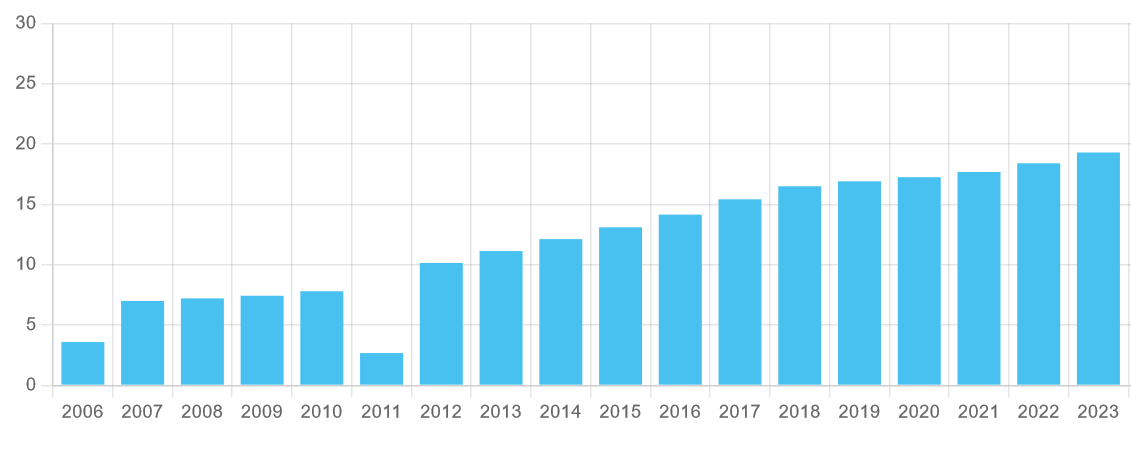

Indeed, dividends here have risen every year since 2012.

But what does the future hold for the FTSE 100 firm’s dividend policy? And should investors consider Sage shares for their portfolio?

Healthy forecasts

Keen followers of the stock may be unsurprised Sage’s dividends are tipped by City brokers to keep rising for the next two years, at least:

| Year | Dividend per share | Dividend growth | Dividend yield |

|---|---|---|---|

| September 2025 | 21.85p | 7% | 1.7% |

| September 2026 | 23.32p | 7% | 1.8% |

These forecasts are supported by expected earnings growth of 10% and 13% in fiscal 2025 and 2026 respectively. However, dividends are never, ever guaranteed. So how realistic are these estimates?

The first, and simplest thing, to consider is dividend cover. This gauges how well predicted payouts are covered by expected earnings.

I’m ideally looking for a reading of 2 times or above to provide a margin of safety. And on this front Sage shares score well, with dividend cover between 1.9 times and 2 times for the next two years.

On top of this, Sage has a rock-solid balance sheet it can use to support future payouts. The success of its subscription-based model means excellent cash generation, and free cash flow rose 30% last financial year to £524m.

The firm also has very little debt on its balance sheet it needs to worry about. A net-debt-to-EBITDA ratio of 1.2 times as of September was well inside its target range of 1 to 2 times.

Sage’s plans to repurchase another £400m worth of its shares, as announced in last week’s full-year results, underlines its robust financial foundations.

Are Sage shares worth a closer look?

All things considered, Sage looks in great shape to meet dividend forecasts for its shares. But as with any share, I need to think about more than just cash rewards when contemplating whether to invest.

I also need to ponder the possibility that the share price could stagnate or even fall. In this case, a sharp economic slowdown that cools business software demand could hit profits and cause a price reversal.

Having said that, Sage’s resilience encourages me to think this is a top stock to consider. Its focus on cloud and artificial intelligence (AI) systems is paying off handsomely, driving underlying revenues and operating profit 9% and 21% higher respectively in the last financial year.

There’s scope for a lot more growth too, as companies continue to digitalise their operations, and Sage develops new products to take advantage of this.

Its shares are up 16% in the last year, and I expect the firm to keep rising despite its forward price-to-earnings (P/E) ratio of 31 times.