Looking for dividend growth stocks? These FTSE 100 stocks are expected to deliver strong payout growth over the next couple of years at least.

BAE Systems

Dividend yield: 2.5% for 2024, 2.7% for 2025

The stable nature of arms spending means defence tends to be a rock-solid sector for dividends. This is especially the case today, as fractures in the global order drive rapid rearmament in the West.

Should you invest £1,000 in HSBC right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if HSBC made the list?

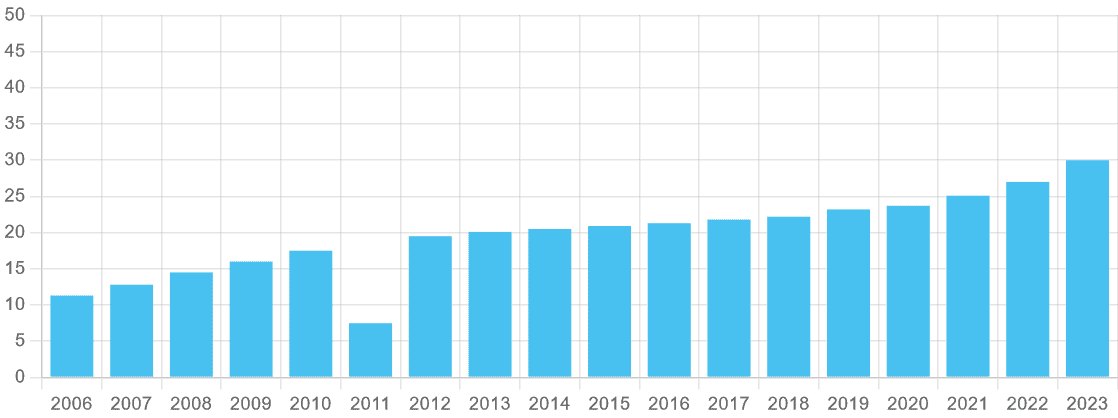

BAE Systems (LSE:BA.) is one contractor with a long record of distinguished dividend growth. It’s raised shareholder payouts every year since 2011. It’s a trend City analysts expect to continue, making it worth a close look in my opinion.

Payouts are expected to rise 8%, to 32.3p per share, this year. Dividend growth is expected to accelerate to 10% in 2025, resulting in a full-year payout of 35.5p.

Forecasts for next year are supported by expected profits rises of 7% and 12% in 2024 and 2025 respectively. As a consequence, estimated dividends for both years are covered 2.1 times by predicted earnings.

Both readings are above the safety benchmark of 2 times, providing dividends forecasts with additional steel.

BAE also has strong financial foundations to fund dividends in case earnings disappoint. Profits may fall short of estimates due to supply chain issues, for instance, a significant threat to defence firms’ annual earnings today.

The Footsie firm had £2.8bn of cash on the balance sheet as of June.

BAE Systems’ order backlog is surging, and it hit a record £74.1bn at the midpoint of 2025. It looks set to keep rising too, which bodes well for longer-term dividends.

Airtel Africa

Dividend yield: 5.4% for 2025, 5.5% for 2026

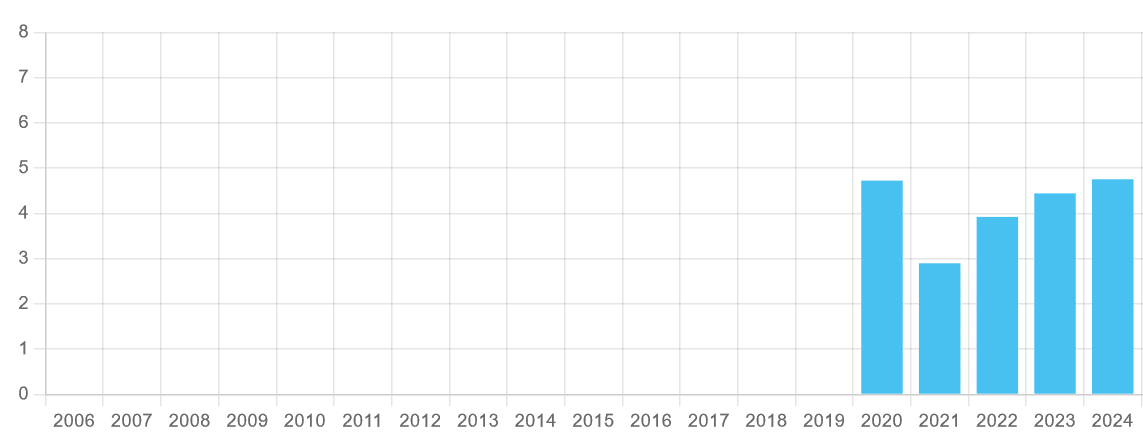

Telecoms provider Airtel Africa (LSE:AAF) doesn’t have a long record of dividend growth like BAE. It’s only been listed on the London Stock Exchange for five years. It also cut the annual payout in 2021 as it rebased dividends to cut debt.

However, cash payouts have surged since then, and by more than double-digit percentages on occasions. It’s a trend that City brokers expect to carry on.

For this financial year (to March 2025), a total dividend of 6.52 US cents per share is predicted, up 10% year on year. A further 3% rise is anticipated for financial 2026, to 6.70 cents.

However, I must warn that Airtel’s forecasts aren’t as robust as I’d ideally like.

Profits are skidding lower due to adverse currency movements (EBITDA dropped 16.5% between April and September). And leverage levels are sharply growing, with net-debt-to-EBITDA rising to 2.3 times as of September.

Falling earnings also mean dividend cover turns negative for this year, with predicted earnings of 46.7 US cents per share forecast. On the plus side, City analysts expect profits to rebound strongly in financial 2026, leaving robust dividend cover of 2.7 times.

Yet despite the uncertain near-term outlook, I still believe Airtel Africa shares are worth serious consideration by risk-tolerant investors.

What’s more, I believe the long-term picture here remains highly attractive. Telecoms demand for Africa continues to rocket, with Airtel’s customer base rising 6.1% year on year to 156.6m in September.