The Diageo (LSE:DGE) share price has fallen around 17% over the last five years. And it’s reached the point where I’ve been buying it for my portfolio.

While the stock’s at historically cheap levels, there’s nothing to say it can’t go further. So it’s worth looking at what the analysts are expecting from Diageo shares over the next 12 months.

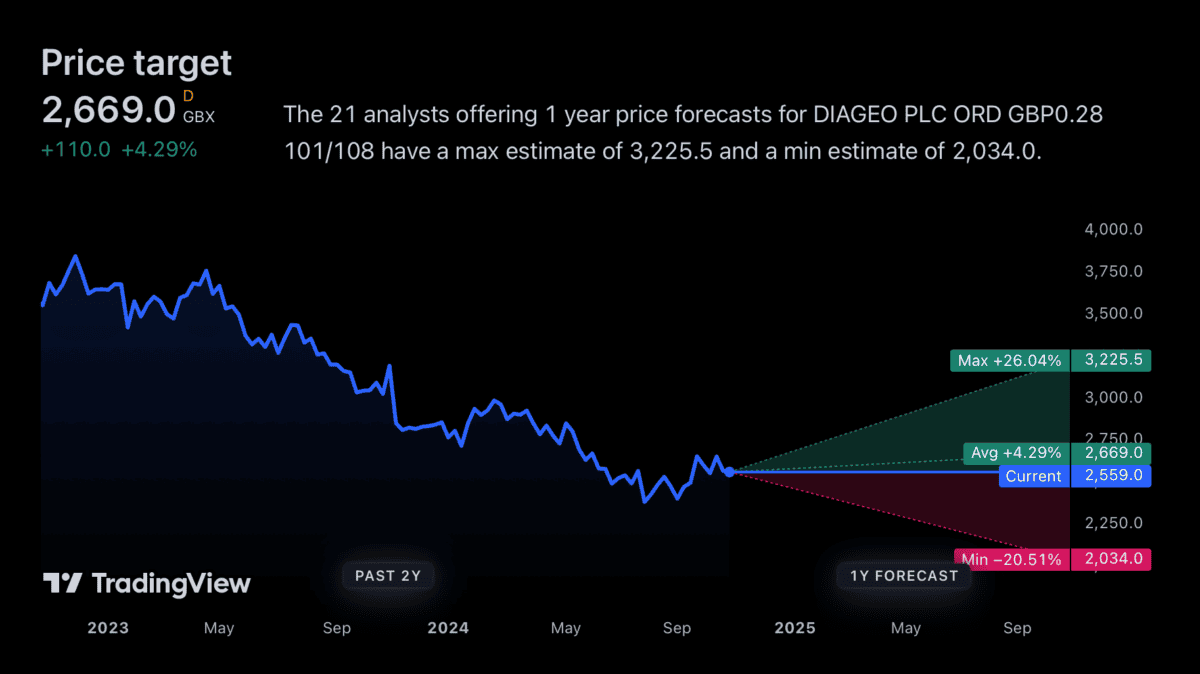

Price targets

Analysts think a big move for the Diageo share price over the next month is highly possible. But they don’t agree on which way it’s likely to go.

Source: TradingView

The highest price target I could find is 25% higher than the level the stock’s trading at right now, which is pretty optimistic. But at the other end, it’s 21% lower, reflecting some significant risks.

I actually think this makes a lot of sense. Diageo’s business is facing a number of actual and potential challenges that aren’t directly under its control.

If these either subside or amount to nothing, the company should do well and I expect the stock to rise. But if not, it’s entirely possible that the share price could fall further.

US tariffs

The US election’s a significant issue. The polls have Donald Trump ahead and Diageo’s on a list of 28 European equities Barclays thinks could be vulnerable if the Republicans win next week.

Back in May, the former President promised/threatened to introduce 20% tariffs on all US imports. And while politicians don’t always do exactly what they say, I think this is one to be taken seriously.

There are a couple of things worth noting though. The first – and most obvious – is that while Trump’s ahead in the polls, the result is by no means a foregone conclusion.

Another is that several of Diageo’s top US products are produced in countries such as Canada and Mexico, where the US has trade agreements. So the impact might not be as bad as it first seems.

What should investors do?

In this kind of situation, it can be difficult for investors to know what to do. And when there’s uncertainty around, the best thing to do can often be to stay out of the way.

With Diageo though, I have a different view. While there are some risks I’m unable to forecast accurately, I think the stock’s worth considering.

The reason is that I think a lot of the potential issues are reflected in the current share price. At a price-to-earnings (P/E) ratio of 18.5, it’s as cheap as it has been at any time in the last decade.

Diageo P/E ratio 2014-24

Created at TradingView

On top of this, the firm’s key advantages – the strength of its brand portfolio and the scale of its distribution – are firmly intact. And I think this is what will matter over the long term.

Could the stock keep falling?

It makes sense that the Diageo share price could be set for a big move in the next 12 months – either up or down. But I’m not looking to try and predict what’s going to happen here.

I’m looking to buy the stock at today’s prices. And if it falls further, I’ll likely try and take advantage of an even better opportunity in the future.