Since October 2019, the boohoo (LSE:BOO) share price has slumped nearly 90%.

It’s a sad decline for the online fashion retailer that was one of the few beneficiaries of the pandemic. During the year ended 28 February 2021 (FY21), the company reported revenue of £1.75bn, and a post-tax profit of £124.7m.

For FY24, turnover was 16% lower and a loss before tax (and exceptional items) of £56.9m was recorded.

And comparing the end of these two financial years, the company moved from a net cash to a net debt position.

How times have changed.

Unhappy owners

Not surprisingly, this hasn’t gone down well with stakeholders.

Frasers Group, which is the retailer’s largest shareholder, has written to the board demanding that Mike Ashley be appointed as chief executive.

The open letter also refers to boohoo’s “abysmal” trading performance. And complains about a declining gross profit margin and a failure to cut costs. It goes on to describe the company’s new debt facility as a “step backwards” and an “appalling outcome”.

Ashley can point to his record at Frasers as evidence of his ability to build a successful business. In October 2022, when he stood down as chief executive, the group was valued at just under £3bn. Not bad considering he opened his first ski and sports shop in 1982.

Over the past five years, of all the current members of the FTSE 100, its share price performance has been the fourth best.

But if Mike Ashley gets his way, I think he’s going to have his work cut out.

Gathering headwinds

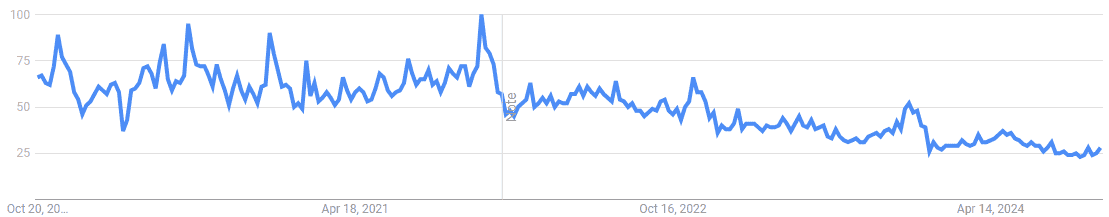

My pessimism is based on some evidence that I’ve found suggesting that the brand’s popularity is continuing to decline.

For an exclusively online business, a good guide to its success is the number of internet searches. And according to Google Trends, over the past two or three years, those searching for ‘boohoo’ has been falling. This isn’t surprising given the slump in sales. However, of more concern, the downward trend appears to be continuing.

I suspect that’s because competition in the fast fashion sector is fierce, particularly from overseas rivals. However, they’ve a far lower cost base meaning they can sell more for less.

Shein isn’t a listed company but its accounts show that its 2023 gross profit margin was 2.6%. Despite its problems, boohoo’s was 51.8% (FY24). To put this in context, if it matched the margin of its Chinese competitor, its loss would have been £718m higher!

I’m sure Ashley would see overheads savings as another way of improving profitability. But boohoo announced £125m of cuts last year. In FY24, administrative costs were £441.3m. Reducing these by 10% wouldn’t be enough to make the group profitable.

In my opinion, the company has limited room for manoeuvre.

My thoughts

I’ve no idea whether appointing Ashley as boohoo’s boss is going to solve the group’s problems. But his track record at Frasers is impressive. And I’m sure he’d give it his best shot.

He also has more skin in the game than most. Given that he owns 73% of Frasers which, in turn, has a 27% stake in boohoo, he’s a vested interested in turning things round.

It’s hard to believe that things can get any worse. Therefore — if I was a shareholder — I’d welcome his appointment.