The SSE (LSE:SSE) share price has significantly outperformed the FTSE 100 over the past five years. Since October 2019, it’s risen by 46%, compared to 15% for the index as a whole.

Given that the company is a developer, builder and operator of electricity infrastructure assets this impressive performance isn’t surprising to me. In difficult times — remember, there’s been Brexit, a pandemic and rampant inflation during this period — risk-averse investors generally switch to defensive stocks, such as those operating in the regulated energy sector.

The transition to net zero

SSE likes to parade its green credentials.

In its annual report for the year ended 31 March 2024 (FY24), the word ‘renewable’ appears 556 times. And during that year, the company generated 11.2TwH of electricity using wind and hydro power. For context, it’s estimated that the UK’s annual consumption is currently 300TwH.

However, we‘re always being told that renewable energy is going to help drive down prices. Surely it doesn’t make sense to invest in a sector where the return on capital is expected to fall?

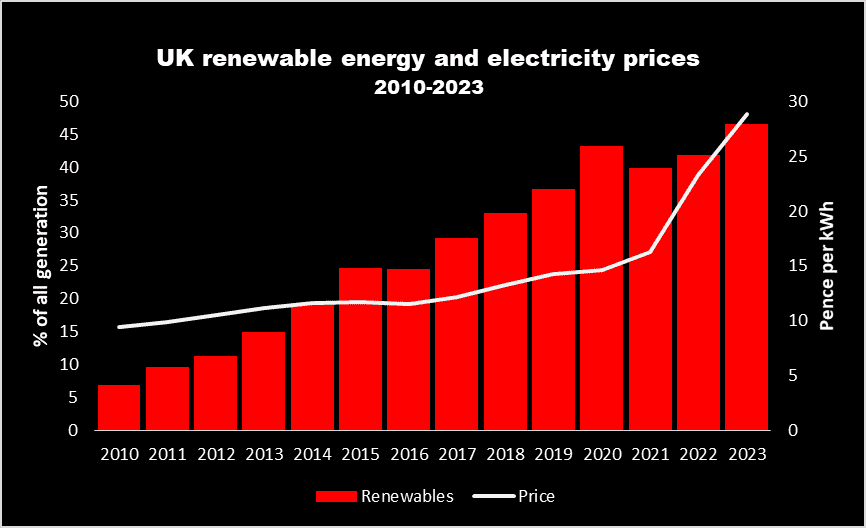

But as the chart below shows, since 2010, UK electricity prices have risen steadily even though an increasingly bigger proportion of the country’s energy requirements have been coming from renewable sources.

That’s because prices are still heavily influenced by the cost of wholesale gas, irrespective of how the energy is generated. Therefore, unless the market is fundamentally changed, SSE should continue to meet its target of delivering, for example, an 11% annual return on offshore wind.

Indeed, it has a target of increasing earnings per share by 13%-16% per annum over the next four years. If achieved, I’m sure this will help boost its share price.

And now could be a good time to consider adding SSE to my portfolio.

Based on a current (15 October) share price of 1,911p, the stock trades on a historical price-to-earnings (P/E) ratio of 12.1. Since 2020, its average has been around 17.

Blowing in the wind

But I have some concerns.

To demonstrate its commitment to clean energy, the government has created GB Energy. But its purpose — “to own, manage and operate clean power projects” — makes it sound like a state-owned replica of SSE.

Encouragingly, the company plans to grow its dividend per share from its FY24 level (60p) by 5%-10% a year, through until FY27. This sounds impressive. But even at the top end of this range, it would still be 17% lower than it was in FY23.

And its earnings can be volatile. The wind doesn’t always blow and with its income indirectly dependent upon gas prices, earnings per share have ranged between 78.4p and 166p over the past five financial years.

But the biggest concern I have is the company’s huge borrowings. Energy infrastructure doesn’t come cheap, which is why its ratio of net debt to EBITDA (earnings before interest, tax, depreciation and amortisation) is currently around 3. It has a target of 4.5, so SSE’s directors are probably not too concerned.

However, compare this to, for example, Centrica. It has a net debt target of just one times earnings. And its balance sheet is currently showing a net cash position.

Although I’m sure SSE will benefit from the green revolution, I believe there are less risky opportunities elsewhere.