Shares in Dividend Aristocrat Rio Tinto (LSE:RIO) have been falling. But a smart acquisition this week has caught my attention.

The firm has announced an agreement to buy Arcadium Lithium – one of the world’s largest lithium mining producers. That’s put it on my list of stocks to buy.

Renewable energy

Like a lot of mining companies, Rio Tinto’s looking to focus on metals that will be important for the transition to renewable energy. The most obvious are copper and lithium.

Rio Tinto does have copper operations. But its output in 2023 was lower than the likes of Anglo-American, Antofagasta, or Glencore and only made up 12% of the firm’s overall sales.

The acquisition of Arcadium Lithium – one of the world’s largest lithium producers – adds another dimension to the company’s portfolio. And it’s arguably coming at a very good time.

Rio Tinto’s set to pay $5.85 per share – a 90% premium to the price the stock was trading at when the deal was agreed. That seems like a lot, but investors should look closer.

A smart acquisition?

Rio Tinto’s CEO Jakob Stausholm said of the agreement:

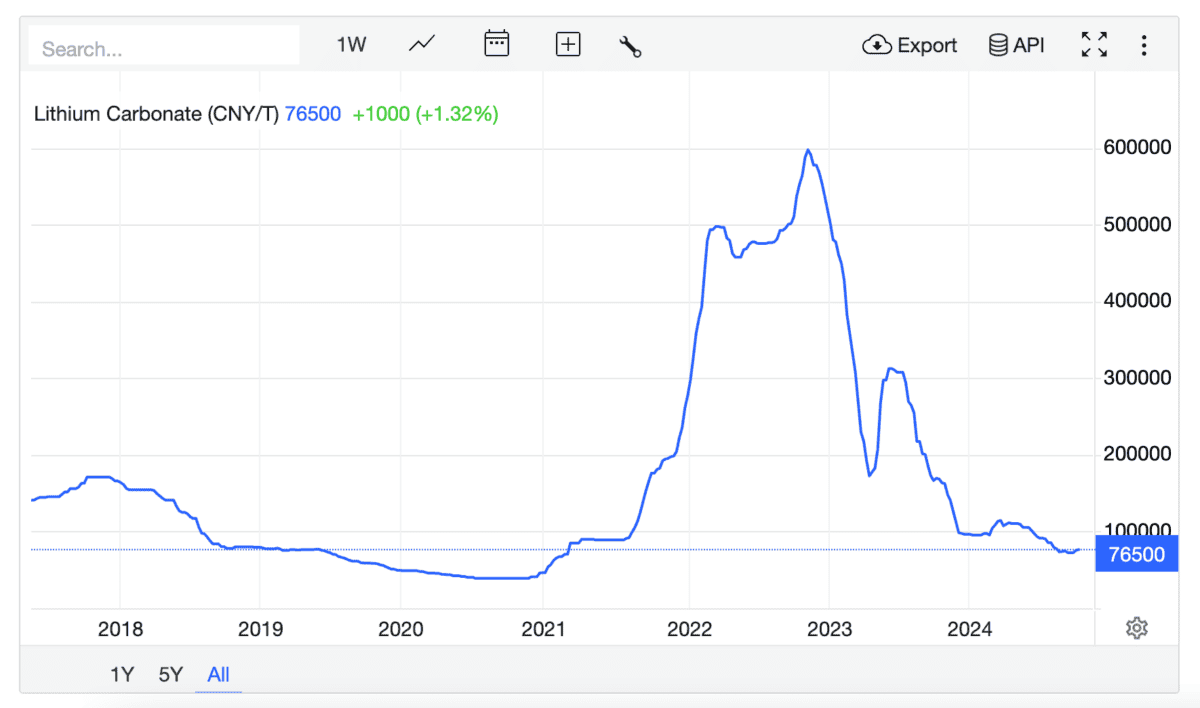

This is a counter-cyclical expansion aligned with our disciplined capital allocation framework, increasing our exposure to a high-growth, attractive market at the right point in the cycle.

In other words, it’s looking to take advantage of lithium prices being below their pre-pandemic levels to acquire a lithium miner while its stock is unusually cheap.

Lithium Carbonate Price 2017-24

Source: Trading Economics

Arcadium was only formed at the start of 2024, but the stock began trading at $6.81 per share. That means Rio Tinto’s deal represents a 15% discount to where the stock was in January.

I think it’s hard not to be impressed with the move from the FTSE 100 miner, which is paying cash for the transaction. In a cyclical industry, it’s very much the definition of buying low.

Risks and opportunities

Exactly how well the deal works out over the long term will depend on the price of lithium. And while there are reasons for optimism, it’s also worth noting why this collapsed lately.

One reason is that electric vehicles (EVs) have been slower to take market share than expected. This is partly to do with concerns about range and the lack of charging infrastructure.

Another issue is oversupply from China. Earlier this week, US officials reported concerns that this is a move to try and force the price down in the short term to eliminate competitors.

Both of these are challenges for lithium producers. But I think with the price Rio Tinto has paid for the acquisition, the odds are in its favour over the long term.

Dividend income

Rio Tinto has an excellent record of increasing its shareholder distributions over time and I expect this to continue. And the dividend yield‘s currently an attractive 6.75%.

There are never any guarantees when it comes to dividends. And investors should note that 60% of its revenues currently come from China, where industrial output looks weak.

Nonetheless, with the share price at £50.15, I think there could be an opportunity here. If I had £1,000 to invest right now, 19 shares in Rio Tinto would be my choice.