The stock market offers a promising avenue for individuals seeking to generate a second income. Investing in companies listed on the UK stock market makes it possible to capitalise on the potential for growth and dividend payouts.

Dividend stocks are shares issued by companies that distribute a portion of their profits to shareholders. This distribution, known as a dividend, can be paid out in cash or additional shares. Dividend-paying companies often have stable business models in mature industries and track records of profitability.

Here’s a summary of the strategy I now use but wish I’d followed when starting out.

Selecting the right shares

When choosing stocks for an income portfolio, it’s essential to conduct thorough research and analysis. The four main factors I now consider are dividend yield, payout ratio, dividend growth and company health.

The dividend yield represents the annual dividend paid per share as a percentage of the stock’s current price. A higher yield indicates a more significant dividend payout relative to the stock’s value. The payout ratio measures the percentage of a company’s earnings that are distributed as dividends.

A sustainable payout ratio ensures that the company can continue paying dividends in the long term.

For growth, I check if the company has a history of increasing its dividends over time. This indicates a commitment to rewarding shareholders and suggests a healthy financial position. I then evaluate the overall health of the company by analysing its financial statements, market position, and competitive landscape.

Strong fundamentals contribute to a company’s ability to sustain dividend payments.

A stock that fits the bill

Here’s an example of how I now apply the above factors when picking a stock. Consider broadcaster and producer ITV. It’s a well-established company with a 6.3% yield and 46% payout ratio. That makes it seemingly reliable with a yield high enough to deliver decent returns.

However, its dividend history isn’t ideal, with many cuts and reductions in the past two decades. I hold the stock as I like its long-term prospects, but I think there are even better dividend options today.

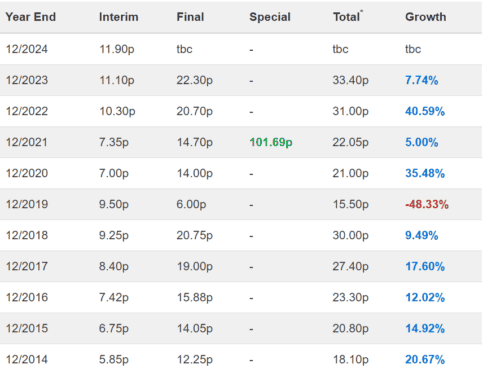

Insurance giant Aviva (LSE: AV.) may be a better option, with a 7.2% yield and 73% payout ratio. It’s also had a few reductions, but overall dividends have grown at a rate of 8.41% per year for the past decade.

However, insurance is a very competitive industry. Aviva risks losing its market share to other UK insurers if it can’t provide competitive pricing. Regulatory and legal changes are another ever-present risk that can affect its profitability. I also see that it tends to reduce dividends every five to six years. With five years of consecutive growth since 2019, a reduction may be on the horizon.

But for now, it looks stable. It has a solid balance sheet, with £6.3bn of debt and £9.46bn of equity. It also has strong cash flows and a sufficient interest coverage ratio of 6.9. Looking at growth prospects, its price-to-earnings (P/E) ratio is 9.9, below the industry average.

I don’t hold Aviva shares but it’s certainly an option I’ll strongly consider in my next buying round. In my opinion, it’s one of the most reliable stocks for passive income right now.