Investing in high-yield FTSE 100 dividend stocks can create a substantial passive income. Thankfully, years of underperformance mean that many UK blue-chip shares offer truly mighty dividend yields.

Buying high-yielding shares can be risky however. A large dividend yield can be a sign of a distressed company whose share price has sunk. It may struggle to meet brokers’ payout forecasts and pay decent dividends further down the line.

As a result, share pickers should concentrate on robust companies that reliably grow earnings over time. We’re talking about businesses with market-leading positions in mature markets and strong balance sheets, for instance.

With this in mind, here are two big-paying FTSE dividend stocks to consider right now.

Legal & General Group

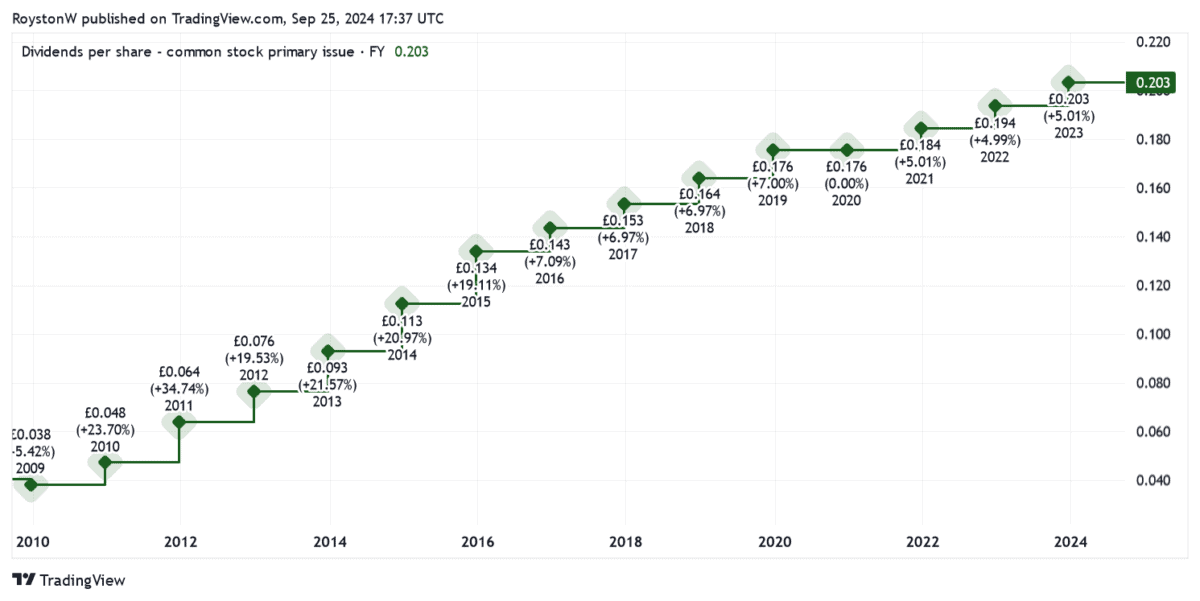

Put simply, Legal & General‘s (LSE:LGEN) a cash machine. It has a long record of delivering dividend increases, which it maintained even during the Covid-19 crisis when many other UK blue-chips were suspending, reducing, or axing shareholder rewards.

The company’s pledged to keep raising annual dividends over the next few years too, albeit by a slower rate of 3%. And I’ve no reason to doubt its ability to meet this objective.

Its financial foundations are rock solid, and its Solvency II capital ratio was 223% as of June. Last month, it sold its Cala housebuilding unit for £1.35bn too, to give its balance sheet extra clout.

City analysts are expecting dividends to keep rising through the next few years. And so L&G’s dividend yield stands at a whopping 9.4% for 2024, eventually rising to 10% by 2026.

The ultra-competitive nature of its industry poses a threat to future shareholder returns. But I’m confident Legal & General will continue to thrive as a growing elderly population drives demand for its retirement and wealth products.

M&G Group

At 9.6%, M&G‘s (LSE:MNG) forward dividend yield’s one of the biggest on the FTSE 100 today. Compare that to the index’s broader forward average which sits way back at 3.5%.

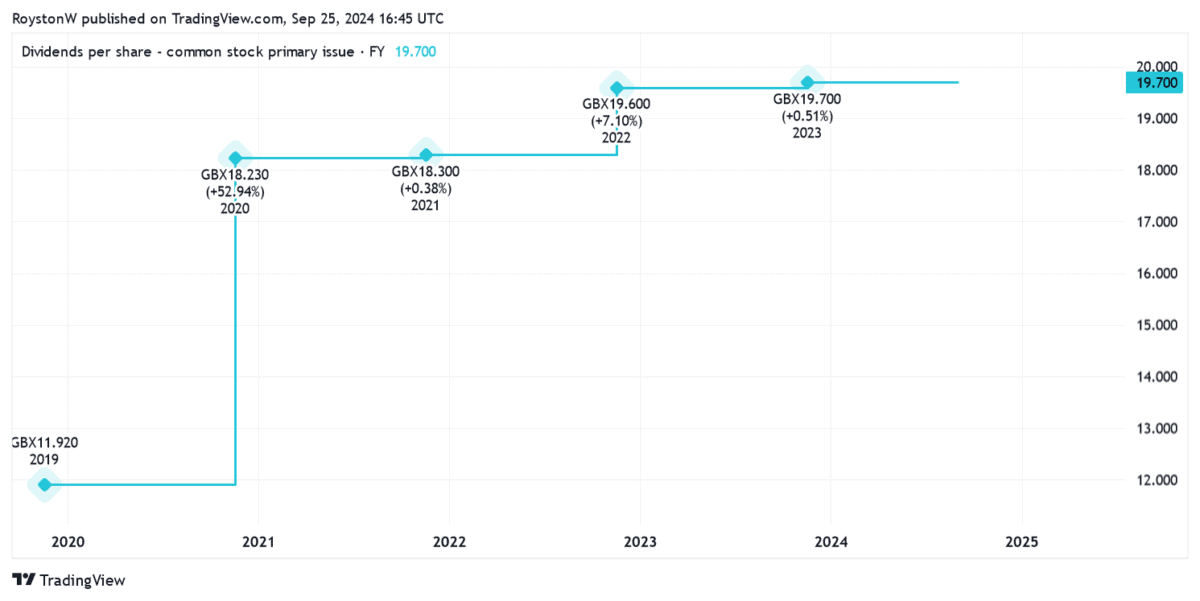

The financial services provider doesn’t have the long record of dividend growth of Legal & General. But that’s because it was only spun out of Prudential back in 2019.

Still, as the chart above shows, shareholder payouts have risen strongly over the period. And City brokers think the shareholder payout to keep rising through the next few years too, resulting in that mammoth yield for 2024, and which eventually rises to 10.2% by 2026.

Like Legal & General, M&G’s formidable cash generation has formed the bedrock of its expansive dividend policy. And going by latest financials, it looks in great shape to continue handsomely rewarding shareholders.

At the end of June, its Solvency II ratio was 200%, up from 203% from the same point in 2023.

As with the broader sector, profits at M&G are sensitive to volatility in financial markets, interest rates, currencies and inflation, to name just a few. This in turn could impact its share price.

However, over the long term, I’m optimistic the FTSE firm will deliver excellent returns, driven by those same demographic drivers benefitting Legal & General.