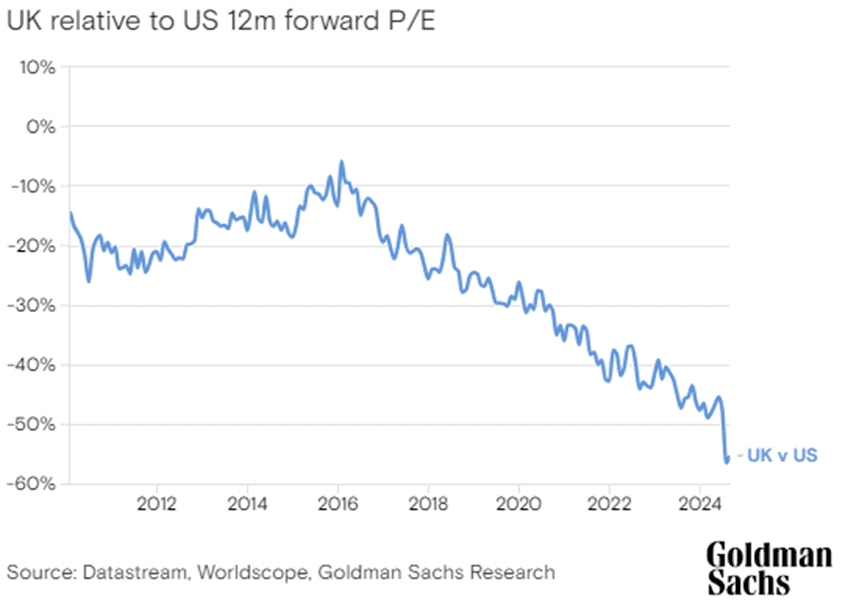

According to Goldman Sachs, UK stocks currently look cheap. The investment bank says a lack of “home-grown equity investing” has caused significant price differentials between domestic stocks and those, for example, in the US.

It notes that the only major domestic buyers of UK shares have been companies themselves through buybacks.

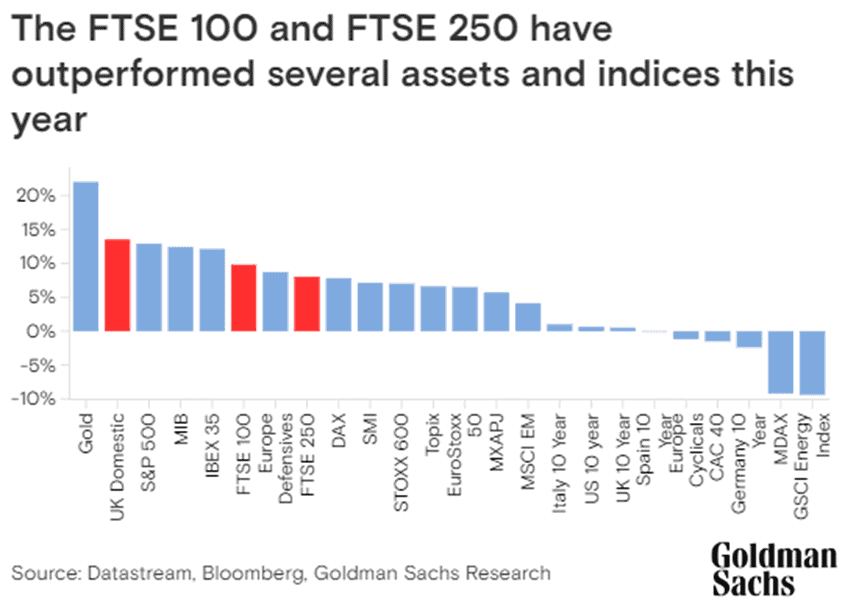

However, in 2024, Goldman Sachs says things have started to change. To the beginning of September, UK domestic equities as a whole have outperformed most stock markets around the world. And the FTSE 250 and FTSE 100 aren’t too far behind.

A case in point

I believe there’s one member of the FTSE 250 that perfectly illustrates the different attitudes that investors appear to have towards UK and overseas stocks.

On 3 September, Harbour Energy (LSE:HBR) was valued at £2.2bn. The oil and gas producer’s the largest operator in the North Sea. In 2023, it extracted 186 kboepd (thousand barrels of oil equivalent per day).

At the time of writing — 11 trading days later — the company’s valued at £3.8bn. The increase can be explained by the completion of a deal that saw it acquire the upstream assets of Wintershall Dea, a group with fields in Norway, Argentina, North Africa and Germany.

The combined group’s now worth 72% more than when its members were operating as standalone companies.

A different scale

However, in my opinion, this doesn’t accurately reflect the fact that Harbour Energy’s production is now expected to be around 500 kboepd. In other words, a 269% increase in output has seen ‘only’ a 72% boost to the group’s market-cap.

And margins should also increase post-transaction. That’s because operating costs are expected to fall to $13-$14 boe from $16, in 2023.

Overseas comparison

I suspect if the company wasn’t based in the UK, it would achieve a higher valuation.

Aker BP (420-440 kboepd) and Diamondback Energy (462-470 kboepd) are similar in size to Harbour Energy. But their current stock market valuations are much bigger — €12.1bn (£10.2bn) and $32bn (£24.2bn) respectively.

Of course, there are many other factors that play a part here which means a direct comparison could be misleading. Operating margins, gearing and the level of reserves are just three.

The location of production’s another. The UK government’s decision to tax North Sea profits at 75% (likely to be increased to 78% in October) has clearly weighed heavily on Harbour Energy’s share price.

But I suspect much of this price differential is due to the stock markets on which they’re listed.

However, if I wasn’t already a shareholder in Harbour Energy, I’d be strongly tempted to take a position.

I’m aware of the risks of investing in the sector. Energy prices and therefore earnings can be volatile. And it’s one of the most dangerous industries in which to operate. However, I think the company’s healthy dividend — its current yield is 7.6% — is high enough to compensate for the risk.

I also think there are many other examples of UK companies being valued less favourably than their overseas peers.

That’s one of the reasons why Goldman Sachs is predicting the FTSE 100 will break through the 8,800-barrier before September 2025.

As a UK equity investor, I hope they’re right.