It might surprise people to learn that the seven best performing stocks on the FTSE 100 have done better, since September 2023, than the Magnificent Seven.

Who’d have thought that an aerospace engineer, two investment firms, a retailer famous for selling knickers, a cardboard box maker, a builder and a bank could outperform the best that Silicon Valley has to offer?

Well, they have. Their share prices have increased by an average of 71%. The mean for the seven tech giants is 48%.

| Stock | Share price performance since 18.9.23 (%) |

|---|---|

| Rolls-Royce Holdings | +122 |

| Intermediate Capital Group | +77 |

| Marks & Spencer | +67 |

| DS Smith Group | +64 |

| Persimmon | +62 |

| 3i Group | +57 |

| NatWest Group | +48 |

| Average | +71 |

Catching my eye

Of the UK seven, the one that I follow most closely is Persimmon (LSE:PSN). That’s because I own shares in the housebuilder. However, I have to admit, it hasn’t been my best investment.

There are signs that the housing market’s slowly starting to recover after the double whammy of the pandemic and soaring inflation caused by Russia’s invasion of Ukraine. Interest rates in the UK are starting to fall and mortgages are becoming more affordable.

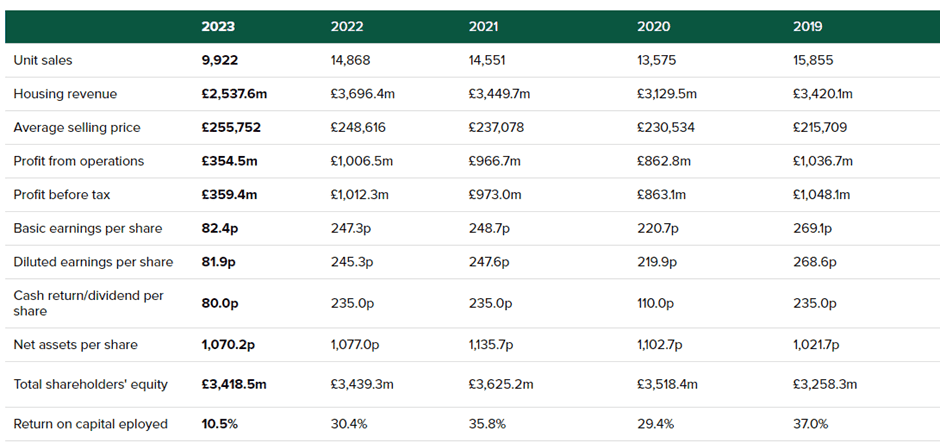

But I’m still sitting on a large paper loss. And when I first purchased the stock, it was paying a dividend of 235p a share. This year, its payout’s expected to be 60p.

Those who bought after me are doing better. Its shares are up 62% since September 2023. Investors appear to think the worst is over.

That could be because the company expects to build 10,500 homes in 2024. However, although an improvement on 2023, it’s 28.6% below its 2019-2022 average of 14,712.

Encouragingly, the average selling price (ASP) of Persimmon’s properties for the first six months of 2024 is £263,288. That’s 22% higher than in 2019 — its record-breaking year when it made a profit before tax of £1.048bn.

Chalk and cheese

But the world is a different place now. Over the past couple of years, building cost inflation has decimated housebuilders’ margins. For example, in 2019, the company recorded a profit before tax per completion of around £66k. During the first half of 2024, it made just under £33k per house.

It’s going to take a long while for the company to recoup these additional costs by raising its ASP. At the moment, I suspect the market isn’t in a strong enough position to absorb much more of a price increase.

Shareholders (like me) will therefore have to accept a new reality. At least in the short term, margins are going to be significantly worse than they were. And even if completions return to their pre-pandemic levels, earnings are going to be lower than before.

Of course, there’s no guarantee the housing market will continue to recover. The UK economy’s struggling to grow and the government’s suggesting that October’s budget is going to be painful.

But the company has no debt on its balance sheet and owns 38,067 plots with detailed planning consent. With a huge factory due to be completed in 2025, it’s also looking to build more modular homes, which are quicker and cheaper to construct.

I have to admit that Persimmon and the Magnificent Seven are at opposite ends of the spectrum when it comes to technological innovation. But I reckon the housebuilder has more chance of doubling its profits over the next few years than any of the famous American seven.

How magnificent is that?