Most of us will be aware that the FTSE 100‘s up and trading near all time highs — albeit not adjusted for inflation — but these two beast of the index are sinking. Diageo (LSE:DGE) and Rio Tinto (LSE:RIO) are stalwarts of the blue-chip index, but both stocks are trading just above their 52-week lows.

A discounted share price creates buying opportunities, potentially propelling a portfolio to new heights. However, some stocks are cheaper for a reason. So are we looking at bargains or value traps?

Diageo

Diageo’s a global leader in premium alcoholic beverages, with a portfolio stacked full of iconic brands including Johnnie Walker, Smirnoff, and Guinness. Founded in 1997, Diageo’s grown to become one of the world’s largest spirits and beer companies, with operations in over 180 countries.

However, despite its strong market position, the company reported a 0.6% decline in organic net sales for fiscal 2024, primarily reflecting weakness in Latin America and the Caribbean.

This has been compounded by inflationary pressures in recent years. In fact, running a soft drinks brand — Sumacqua — myself, I’ve seen this inflation first hand — extract costs surged 40% between recent batches.

Back to Diageo, there’s reason for optimism. The London-based company continues to benefit from premiumisation trends in the beverage sector, with its premium-plus brands growing 4% in the latest fiscal year.

Coupled with strong presence in emerging markets, particularly India and China, Diageo’s long-term growth potential remains intact.

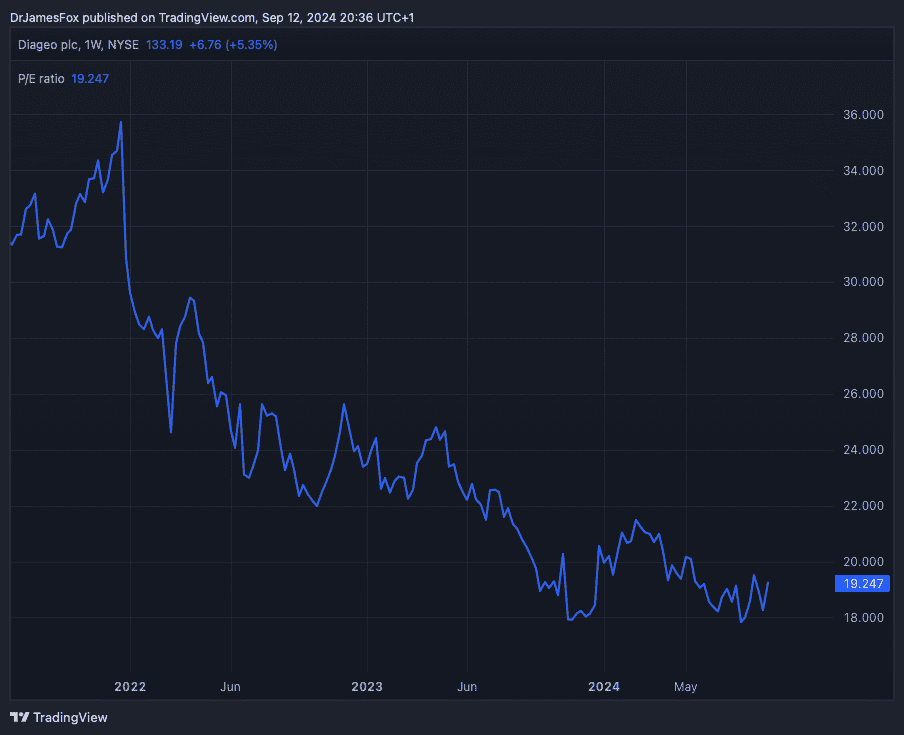

As for valuation, with a forward price-to-earnings (P/E) ratio of 19.6 times and a price-to-earnings-to-growth (PEG) ratio of 7.4, it doesn’t scream value. However, this P/E ratio is lower than its been in recent years and the dividend yield has grown to 3.2%.

Finally, the average share price target is £27.66, representing a modest premium to the current price.

Rio Tinto

Rio Tinto’s one of the world’s largest mining companies, with a portfolio of assets focus on iron ore, aluminium, copper, and other minerals.

Rio Tinto’s falling share price primarily reflects falling iron ore prices and demand uncertainty, especially from China. However, the company’s diversification into aluminium and copper offers growth potential, given the expected shift towards renewable energy.

While Chinese iron ore demand may have peaked, Rio Tinto’s well-positioned for future demand shifts noting its high-grade ore assets, especially its upcoming Simandou mine.

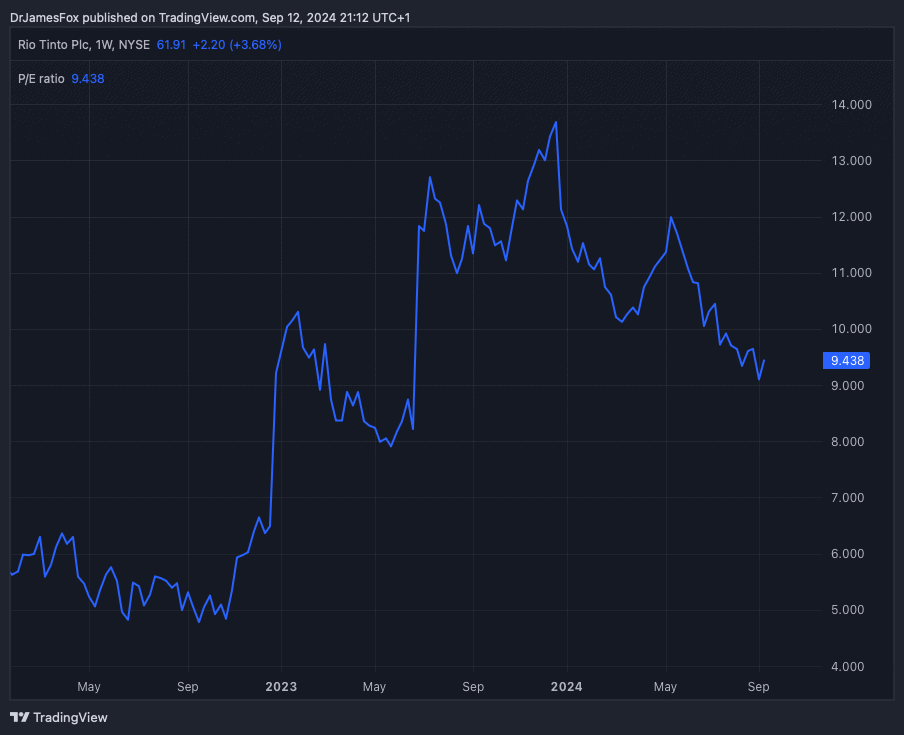

It’s not dirt cheap compared to its peers, trading at 8.2 times forward earnings. However, it’s a cyclical stock and the earnings forecast can change dramatically, and quickly.

And the average share price target’s £62.25, representing a 31% premium to the current share price. Coupled with a 7.3% dividend yield, it could be an interesting investment opportunity.

The bottom line

So where do I stand on these two stocks? I think Diageo’s still a bit pricey but I’d expect it to bounce back eventually on long-term growth prospects.

And Rio? Well, it may be like trying to catch a falling knife. The stock clearly could recover, as it has previously. But there’s always a risk that this downward cycle will be worse than the last.

Personally, I’m not rushing into either of these stocks, but I’ll certainly keep a close eye on both.