One of the arguments for investing in FTSE 250 shares is that the smaller- and medium-sized companies in the index may have better long-term growth prospects than the often mature firms of the flagship FTSE 100 index.

In practice, I think the reality can be more nuanced. Over the past five years, the FTSE 250 has grown just 2%, while the bigger index is up 11% on that timeframe.

That reflects the languishing or even falling price of some growth shares in the FTSE 250. One that has caught my eye lately is trading at its cheapest level in years.

Sharp fall puts the price at multi-year low

The company in question is software specialist Kainos Group (LSE: KNOS). The share price is 23% below where it was at the start of 2024.

That is still an impressive 92% higher than five years ago.

With a 3.3% yield now, if I had bought five years ago I would have benefitted from the price growth and would now be earning a yield of over 6%.

So could this growth share currently be a bargain from a long-term perspective?

Past model for growth still has potential

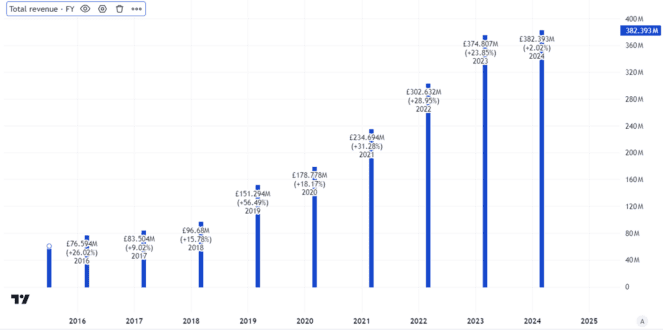

With specialist expertise in Workday software as well as a large footprint in government, Kainos has seen revenues soar over the past decade.

Created using TradingVIew

But while last year still saw growth, it was in low single digits. That disappointed the City, after Kainos had delivered double digit annual revenue growth for many years.

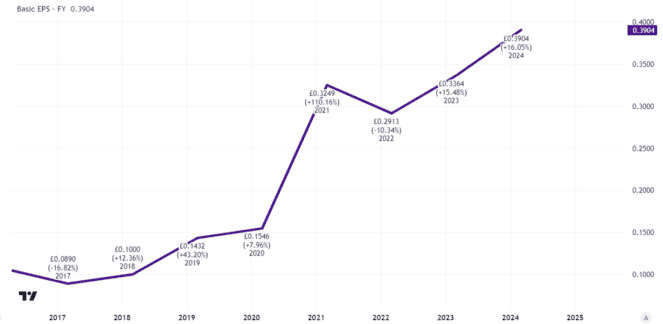

A larger revenue base has enabled the company to grow profits, as this chart depicting annual basic earnings per share demonstrates.

Created using TradingVIew

The company had posted a mixed outlook for revenue this year due to weakness in it commercial digital services customer base, although it is rosier about the medium-term outlook. Meanwhile, an operational focus led the company to forecast strong profit margin and cash generation growth in 2024.

Last week though, it issued a warning that it would undershoot market expectations for revenue. Still, it expects at least some full-year revenue growth.

With high long-term demand and a proven business model, I think Kainos could continue to perform strongly as a business.

Why I’m not buying yet

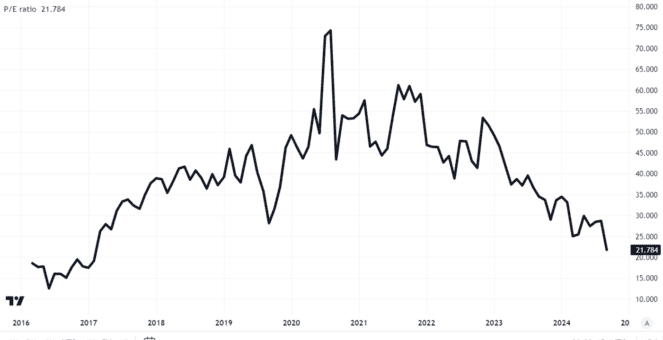

Those years of double-digit growth propelled the FTSE 250 share price fast. So even after the steep fall seen this year, the price-to-earnings ratio is still 21. That is the lowest it has been for many years. That may suggest the current share price is a possible bargain.

Created using TradingVIew

For me though, it still does not look cheap. After all, we do not know whether the challenges Kainos has faced with its commercial clients is a sign of problems with its offering or pricing that might end up hurting public sector demand too. The revenue warning is an alarm bell.

Meanwhile, the success of the Workday partnership is great on one hand, but the flipside is that Kainos’ heavy dependence on the relationship is a risk.

So Kainos is on my FTSE 250 watchlist, but the share is not yet attractively priced enough for me to buy it.