Terry Smith doesn’t tend to hold too many FTSE 100 shares in his £23.9bn Fundsmith Equity portfolio. He has even less now after disposing of his Diageo (LSE: DGE) holding last month.

By contrast, I added to my holding in August. Should I reverse that decision? Here are my thoughts.

Pick a reason

Now, the first thing to say is that we don’t know why Fundsmith sold the spirits giant. Its latest factsheet simply states: “We exited our position in Diageo during the month“.

But there isn’t any shortage of potential reasons. The share price is down 14.5% year to date and 39% since late 2021. It’s turned into a serial underperformer.

Last year (FY24), the company saw declining volumes, sales and earnings. There was an embarrassing buildup of unsold booze in Latin America, which raised questions about its inventory management.

Looking ahead, the firm has also warned that FY25 is going to be challenging. Its medium-term 5-7% annual organic growth target now seems to be on the rocks (or at least on ice).

I reckon there’s enough in all that to turn Smith bearish. But perhaps he also worries that Gen-Z is drinking less. Non-alcoholic cocktails are on the rise.

Meanwhile, there’s evidence that weight-loss drugs like Wegovy and Zepbound are reducing demand for spirits. According to research from Morgan Stanley, between 56% and 62% of alcohol consumers on these medications reported drinking less. Around 14% to 18% said they’d cut out booze altogether!

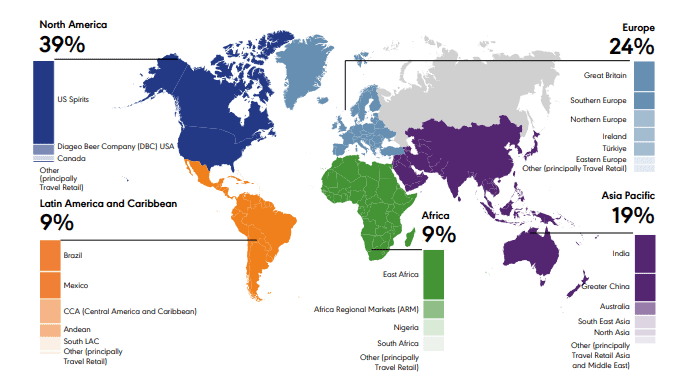

These trends are particularly pronounced in North America, where Diageo generates 39% of net sales.

Share of reported FY24 net sales by region (%)

I’m not selling yet

Writing all that, I feel like whipping out my phone and dumping my Diageo shares too!

The reason I won’t is because I believe Diageo’s current weakness is cyclical, not structural. In other words, I still anticipate significant future demand for the firm’s premium brands.

It has a boatload of these. In whisky, it owns Johnnie Walker, Crown Royal, Bulleit, and Buchanan’s. In vodka, Smirnoff, Cîroc, and Ketel One. In tequila, Don Julio and Casamigos.

Some of its brands, such as Guinness and Baileys, are essentially in a category of their own.

Plus, despite its annus horribilis, the firm still managed to make nearly $6bn in operating profit. And it generated $2.6bn of free cash flow, up $400m on the previous year. I’ve seen far worse from struggling businesses recently.

There’s also a dividend that now yields 3.4% on a forward-looking basis. Nothing’s certain with dividends, but I think the payout could continue rising steadily for decades to come.

Finally, the shares are currently valued on 17.7 prospective earnings. I believe that’s a pretty attractive valuation, which is why I recently added a few more shares to my portfolio.

Some things change slowly

Despite what I occasionally read, I’m skeptical that certain things — cigarettes, oil, fast food, booze — are facing imminent existential threats.

The world population is growing rapidly and many people are going to get a lot richer in future. Whether in hotels, restaurants, cocktail bars or airports, Diageo’s timeless brands will still be there waiting for them.