Insurance firms like Aviva (LSE:AV.) can be great shares to buy for passive income. They’re not without risk, as demand for their services can fall during economic downturns. However, steady premium collection means they can be better dividend payers than many other UK shares.

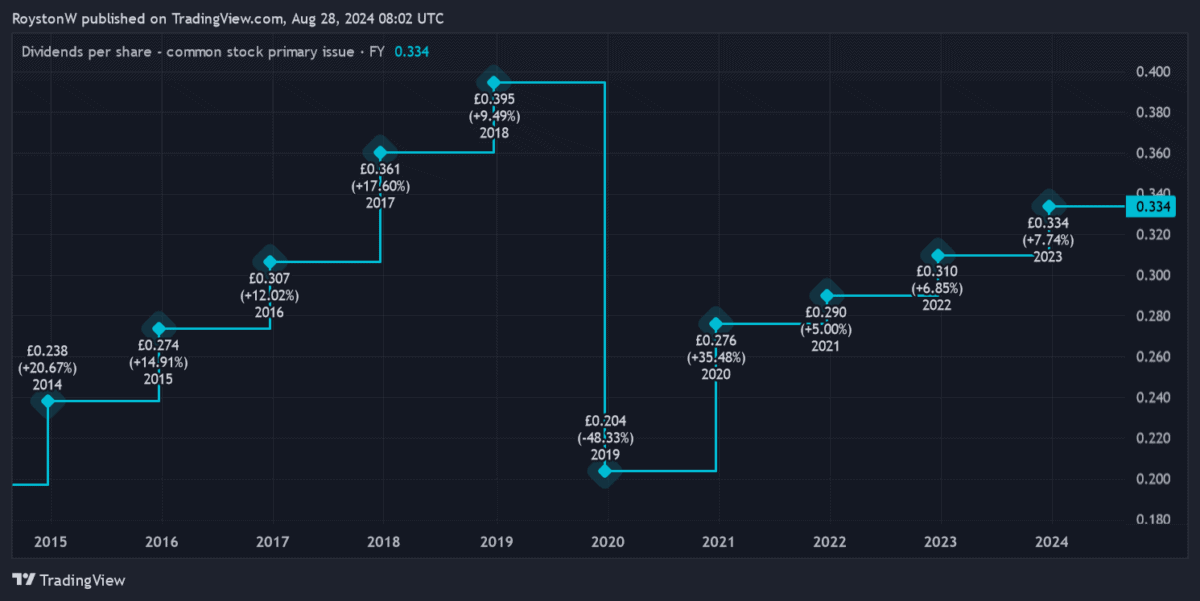

As we can see, the dividend on Aviva shares has risen regularly over the past decade. The only exception was in 2019. Back then, the business took the prudent decision to cut the full-year payout due to Covid-19-related uncertainty.

City analysts believe the company will continue growing dividends over the short-to-medium term at least too. This results in more FTSE 100-beating dividend yields, as the table below shows.

Should you invest £1,000 in Aviva right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Aviva made the list?

| Year | Dividend per share | Dividend growth | Dividend yield |

|---|---|---|---|

| 2024 | 35.40p | 6% | 7% |

| 2025 | 38.08p | 8% | 7.6% |

| 2026 | 40.80p | 7% | 8.1% |

However, dividends are never guaranteed. And Aviva’s strong dividend history may not necessarily be a reliable guide to future returns.

With this in mind, how realistic do these dividend projections appear? And should I buy this high-yielding stock for my portfolio?

Cash machine

The first thing to look at is how well forecast dividends are covered by expected earnings. This provides a good idea of how much scope a company has to meet broker estimates if profits disappoint.

Unfortunately Aviva doesn’t score well on this metric. For the three years to 2026, dividend cover ranges between 1.3 times and 1.4 times. As an investor, I’d be looking for a reading of 2 times and above.

This clearly isn’t ideal. But in the case of Aviva, I don’t think it’s a dealbreaker. This is because of the strength of its balance sheet.

The financial services giant generates huge amounts of cash that it’s committed to returning to shareholders. Earlier this year it launched a £300m share buyback to dish out some of its excess capital.

Today, Aviva’s Solvency II capital ratio stands at a reassuringly high 205%. And by targeting £1.8bn of own funds generation by 2026, Aviva’s taking steps to boost its financial foundations still further.

A top buy?

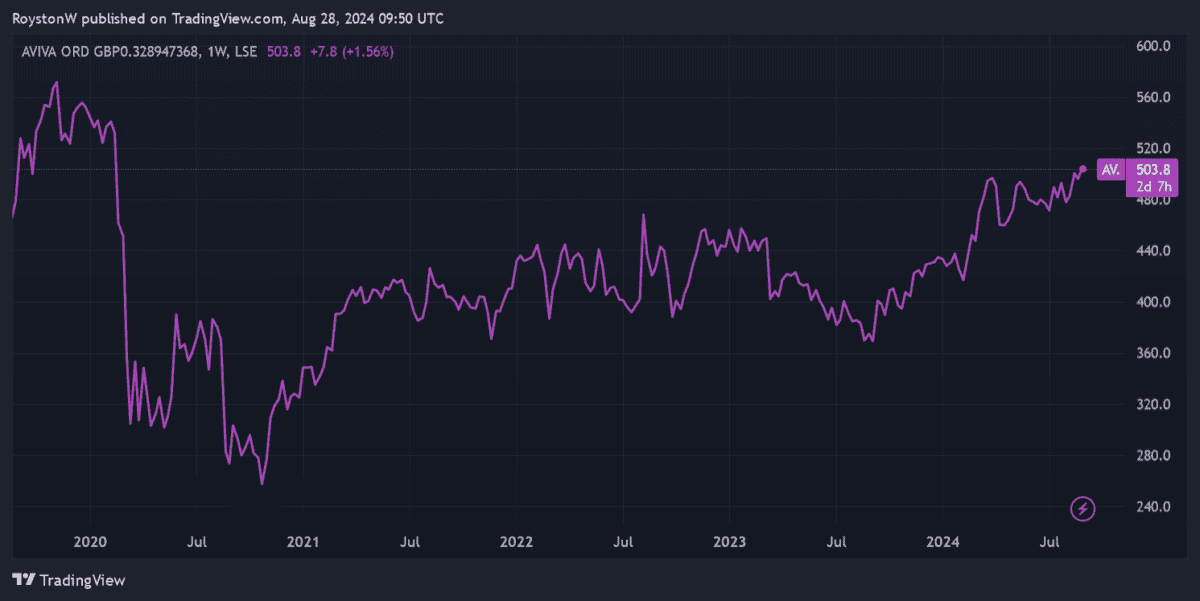

As I say, Aviva’s been a strong dividend payer in recent years. But its share price is yet to recover to pre-pandemic levels, as the chart above shows.

This underperformance reflects the impact that higher interest rates have had on its operations. Economic weakness in the UK and Ireland haven’t exactly helped matters either.

Would I be better off buying other dividend shares to make an all-round better return? Possibly. But I believe that Aviva’s recent share price recovery could accelerate as interest rate cuts heat up.

I certainly think its shares have considerable upside potential due to rapid demographic changes in its markets. In fact, I think the firm could be one of the Footsie’s biggest beneficiaries of the growing ‘silver economy’, thanks to its broad selection of retirement, insurance and wealth products.

With that strong balance sheet, Aviva has room for more shrewd acquisitions to harness this opportunity.

Given its bright dividend outlook and potential for share price gains, I think this is a top blue-chip share to consider today.