Since 9 August, the Unilever (LSE:ULVR) share price has increased by 4% (at 30 August).

This is despite Trian Fund Management, the investment firm found by activist investor Nelson Peltz, offloading 3.82m shares in the company at a weighted average price of £47.33.

Peltz is also a director of Unilever.

The sale yielded £181m. But the fact that such a prominent figure has decided to reduce his holding doesn’t seem to have deterred others from buying.

| Date of sale | Number of shares sold | Average price (£) | Sales proceeds (£) |

|---|---|---|---|

| 9 August | 2,931,127 | 47.38 | 138,876,797 |

| 12 August | 738,471 | 47.19 | 34,848,446 |

| 13 August | 155,000 | 47.11 | 7,302,050 |

| Totals | 3,824,598 | 47.33 | 181,027,293 |

The announcement to the stock exchange didn’t provide any clues as to the reasons behind the sale. It vaguely refers to “portfolio management” as the primary motivation.

But as the saying goes, one person’s trash is another’s treasure. The company’s share price has been pushed higher as investors — not being put off by the sale — want a piece of the consumer goods giant.

A former shareholder

I used to have a stake in Unilever. But I got frustrated as the share price seemed unable to break through the £43-barrier.

Since then it’s risen by around 14%. Despite this, I don’t regret selling — I’ve done better elsewhere.

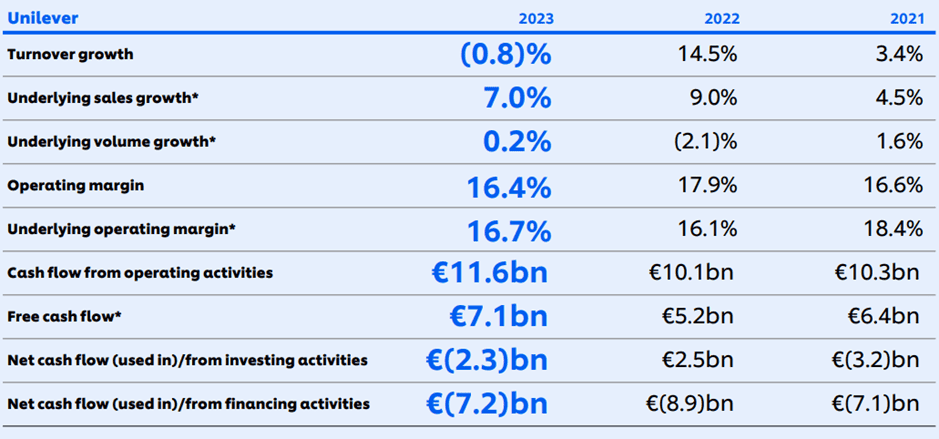

However, Unilever is a quality company with an impressive portfolio of household brands. It consistently generates €10bn-€11bn of cash from its operating activities.

Its results for the first six months of 2024 revealed sales growth, both in terms of price and volume. And its operating margin improved.

This success is attributed to focussing on the company’s top 30 brands, which account for approximately 75% of turnover.

The group’s continuing strong performance casts doubt on the idea that consumers are becoming increasingly price sensitive and swapping better-known names for cheaper alternatives.

But surely there’s got to come a point when it’s no longer possible to raise prices without damaging earnings?

I can’t believe how expensive some of Unilever’s products have become, especially when compared to many supermarket own-brands. Personally, I think we might be close to ‘peak prices’ for many of its products.

Too pricey

Similarly, I think the company’s shares are expensive.

Analysts are expecting underlying earnings per share of €2.76 (£2.33) for the year ending 31 December 2024. This implies a forward price-to-earnings ratio of around 21. This is on the high side, even for a member of the FTSE 100.

And it’s slightly above its five-year average.

Nor does the stock appear to offer good value when compared to that of, for example, Reckit Benckiser, which trades on a forward multiple of 13.7.

Underwhelming returns

Unilever’s dividend is also disappointing.

In 2023, the company paid 148.45p a share. If repeated this year, it implies a current yield of 3%. For an income investor like me, that’s not enough, especially from a company that’s something of a cash machine.

When I first bought the stock, it was yielding close to the Footsie average of 3.8%. For further comparison, Reckit Benckiser’s stock is currently offering a return of 4.4%.

It’s for these reasons — doubts over its ability to raise prices further, a toppy valuation, and a miserly dividend — that I don’t want to invest.