Bill Ackman is one of the sharpest investors on Wall Street, with a stellar track record of market-beating returns. The good news is that investors can put their money behind him through FTSE 100-listed Pershing Square Holdings (LSE: PSH).

This investment trust essentially serves as a vehicle for Pershing Square Capital Management, the hedge fund managed by the billionaire investor. The shares are up 139% in five years.

Typically, Ackman scoops up shares of industry-leading firms when they’ve hit a rocky patch. For example, he acquired a significant stake in Chipotle Mexican Grill in 2016 after food safety issues sparked a massive slump in the restaurant group’s share price.

Should you invest £1,000 in Pershing Square right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Pershing Square made the list?

He repeated the trick last year with Google parent Alphabet after a ChatGPT-triggered sell-off. Both positions have roughly doubled the S&P 500‘s gains since he first bought shares.

Interestingly, he slashed those holdings in the second quarter. But perhaps more eye-raising was the two stocks he bought, as this strongly suggests he thought they were on sale.

A new pair

The first stock Ackman snapped up was Brookfield Corporation. He bought just over 6.8m shares of the global asset manager for a value of $285m. This made it 2.7% of the overall portfolio.

The second stock was more interesting to me as this is one that I sold earlier this year! That’s sportswear giant Nike (NYSE: NKE). Ackman acquired just over 3m shares worth $229m, making it 2.2% of assets.

Back in June, the Nike share price cratered 20% in a single day, marking its worst ever session in its 44 years on the stock market. Thankfully, I got out before then.

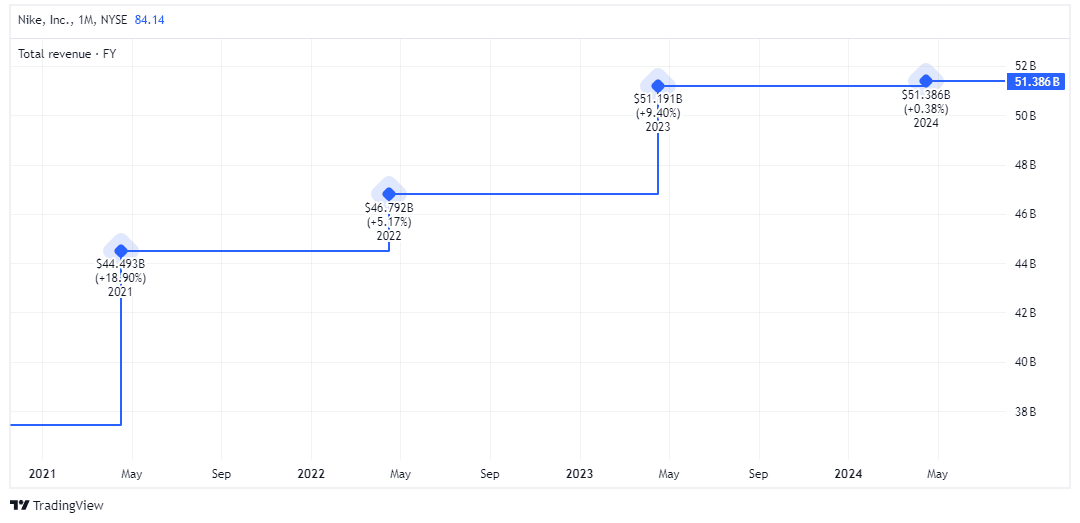

The company’s growth has stalled recently as cash-strapped consumers avoid discretionary purchases on things like branded sportswear. In FY24 (which ended on 31 May for Nike), the company’s year-on-year revenue was flat at $51.4bn.

This year (FY25) however, management expects revenue to be down by mid-single digits, worse than the drop pencilled in by Wall Street. This helps explains the huge decline in the share price (23% year to date).

Previous history with the firm

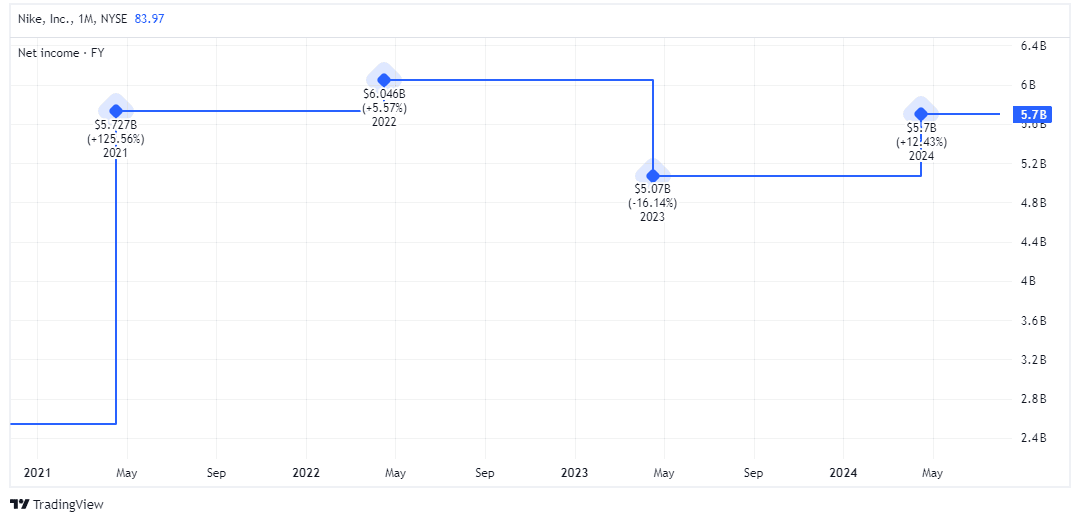

What might Ackman see here? Well, we know that he favours established firms that generate consistent profits. And despite its challenges, Nike’s net profit actually grew 12% last year as it reduced overheads.

Moreover, the last time Pershing Square invested in the firm back in 2017, it made a $100m profit. So he already knows the business inside out.

Happy shareholder

The stock’s trading at a multi-year low of 22 times earnings, making it a potential bargain. Yet I’m worried about increasing competition from the likes of Hoka and On Running. It’s also facing intense competition in China from domestic sportswear brands like Li-Ning.

However, as a shareholder in Pershing Square Holdings, I’m happy to let Ackman crack on and try extract market-beating gains from Nike stock.

As mentioned, his performance has been excellent. In the five years to June, the hedge fund roughly doubled the returns of the S&P 500.

I don’t expect that run to continue forever and there’s a risk the portfolio could decline in value if the US enters a recession. But long term, I’m expecting good things from this FTSE 100 stock.